The war between Israel and Hamas has been devastating, with more than 4,000 people estimated to have died since the conflict began on 7 October.

While the human impact is most important, JP Morgan global investment strategist Madison Faller said it is her job to measure “what impact the conflict might have on the global economy and financial markets”.

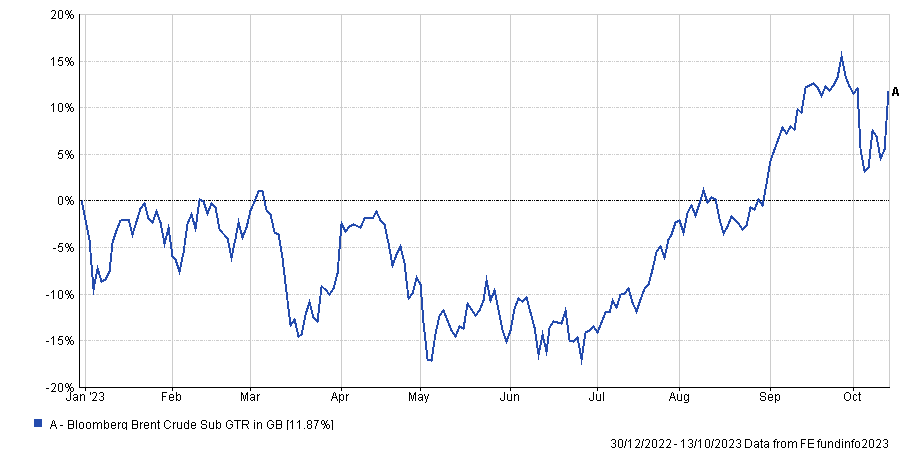

Higher oil prices have been the most notable financial consequence of the war, rising 8% since fighting started, but with neither side being key oil players Faller said that the conflict “does not meaningfully impact oil production or supply”.

Looking back over the past year, she highlighted that the recent spike in oil prices is well below the highs it reached in September.

Brent crude oil prices in 2023

Source: FE Analytics

These “muted moves” are largely because global oil supply and demand are “pretty balanced” today compared to when Russia invaded Ukraine last year.

It may be contained for now, but Faller warned that further escalation in the conflict could have a much larger impact on the global economy.

“The situation is incredibly fluid, but it’s worth noting the geopolitical web is a complex one and stretches beyond the two sides involved,” she added.

“To gauge any investment impact, we are closely watching the potential for escalation and the follow-through effect on natural resources given it seems like the clearest link to corporate profits, inflation and consumer sentiment.”

If Iran – the third-largest natural gas producer in the world and holder of 24% of the oil reserves in the Middle East – becomes directly involved in the conflict, investors could expect to see larger knock-on effects in global markets.

Iran is reported to have backed Hamas with funding, training and equipment while the country’s Supreme Leader Ayatollah Ali Khamenei praised Hamas’ 7 October attack on Israel.

Faller said that disruptions along major shipping routes such as the Strait of Hormuz, which traffics about 20% of global oil consumption, would be “much harder to digest” than the impacts so far.

She reminded investors that it wouldn’t be the first time this had happened – the Yom Kippur War in 1973 between Israel and a coalition of Arab states sent oil prices rising by more than 300%, triggering a period of high inflation and recession around the globe.

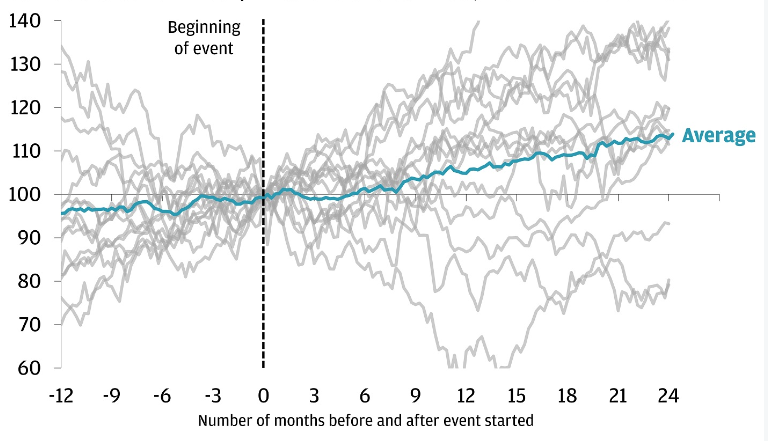

While escalation would make the situation worse, Faller told investors that the impact of geopolitical conflicts on global markets tend to be short-lived, so large portfolio changes aren’t needed for the time being.

Performance of S&P 500 around military conflicts since 1950

Source: JP Morgan

“There may be volatility as investors wait to learn more but in the long run geopolitical events generally haven't had a lasting impact on markets,” she said.

“The first thing to do is remember that staying invested in a diversified, goals-aligned portfolio has paid off through countless geopolitical crises, wars, pandemics and recessions and will likely continue to do so. This is not the first time geopolitical turmoil has been the catalyst of market turbulence.”

Kathleen Brooks, founder of Minerva Analysis, agreed that now is not the time for investors to make sweeping changes to their portfolios.

“While it’s important to be cautious around major global events, that doesn’t mean making big knee-jerk changes to your portfolio,” she explained. “Make sure you’re happy with how much risk you’re taking and that your portfolio is well-diversified.”

However, she warned that “the second-round effects of geopolitical crises can be profound” on countries not directly involved. If the situation escalates and oil prices rise further, it could put more pressure on already-high inflation.

Brooks added: “With the Israeli prime minister stating that the campaign against Gaza is only just getting started, the rise in the oil price could be permanent. This could well feed into higher inflation.

“If the oil price continues to rise, then the impact of these attacks could show up in consumer inflation expectations in the west in the coming months. This could then impact interest rate expectations and investor sentiment.”

Likewise, investors may not be able to rely on fixed income assets as the ‘safe haven’ they are typically used as after geopolitical crises.

Brooks said the growing US deficit – as well as dropping bond prices after the US economy proved more resilient than expected – could “threaten the US position at the centre of the financial system”.

“If we see the US get dragged into the latest conflict in the Middle East, it could also impact US assets’ claim to be safe havens,” she added.