This year is likely to be turbulent, with elections across the world and a still uncertain macroeconomic environment. Some 2 billion people across 50 countries will go to the polls in 2024, while markets are attempting to forecast when (and whether) central banks will cut rates and to assess the extent of the global growth slowdown.

Below, Lindsay James, investment strategist at Quilter Investors, outlines 10 events that are likely to dominate headlines in 2024 and explains their implications for investors.

US election

The upcoming US presidential election tops James’s list of the events to watch in 2024, as she sees it as potentially more “consequential” and “important” than previous US elections.

She said: “The spectre of Donald Trump looms large in this one, and if, as he is expected to do, he runs again, the divisiveness in the United States will be ratcheted up another level.

“Given the events that surrounded his departure in early 2021, it is not hyperbolic to say that US democracy could be put under severe pressure and markets may not like that outcome.”

US economy

With the presidential election around the corner, James expects incumbent president Joe Biden and his administration to do all they can to make people feel better off, in particular in the so-called ‘swing states’ where manufacturing depends on low energy costs and government investment.

As for the Federal Reserve, it is likely to try to appear impartial in the election but it may harbour concerns on what a Trump administration could mean for bureaucrats.

James said: “Don’t be surprised to see the US economy remain robust as government spending continues its support in 2024.”

UK election

British citizens might also vote in 2024 and this general election could herald the first non-Conservative government since 2010.

According to a poll from Ipsos, the Labour party is heading for a majority election victory, but the market seems comfortable with this potential outcome.

James said: “The Labour party has shifted to the centre ground and readied themselves for power with a costed and detailed industrial strategy that sets them apart from the Corbyn-era.”

She added that a change in government could positively impact UK companies and lead to a new wave of investment due to the prominence in environmental policies from the Labour party and its attempts to woo business leaders.

A new AI boom

The artificial intelligence (AI) boom last year may well continue in 2024. James believes it will likely be driven by the impact on companies and people as this technology becomes more integrated.

She said: “With AI becoming ever more closely integrated with computer software and readily available on our phones, companies already seeing pressures from rising wages and skill shortages will be keen to consider new ways of driving productivity and we may see adoption happen a lot more quickly than expected. We are entering uncharted territory here and regulation is unlikely to keep pace for now.”

Path of interest rates

After two years of aggressive interest rate hikes in developed markets, it appears central banks are now looking to cut rates. Therefore, the debate has shifted to ‘when’ and ‘by how much’.

The Fed in the US has already signalled it is considering three quarter-point rate cuts but the Bank of England and the European Central Bank haven’t given any indication on their next move so far.

James said: “History tells us that market performance is often strongest in the early part of the rate cutting cycle, so investors will need to make sure they are ready to participate in any market rally.”

Recession still a possibility

Recession is not off-the-table, with the Organisation for Economic Co-operation and Development (OECD) recently stressing that economic growth is being seriously challenged, while it is grinding to a halt completely in some regions.

James explained that interest rates and fiscal pressures mean countries may struggle to maintain their current services and warned that a soft landing may quickly turn into a crash landing.

She added: “Recession has been avoided for now, but how sustainable that is in Europe and the UK remains to be seen.”

The rebirth of fixed income

The result of the interest rate hiking cycle is an environment where fixed income becomes investible again. James believes this story will continue in 2024 as central banks start to cut rates and economic growth continues to be challenged.

She said: “Bonds are acting as a proper diversifier for investors again and this will likely only become stronger over the course of the year as volatility strikes.”

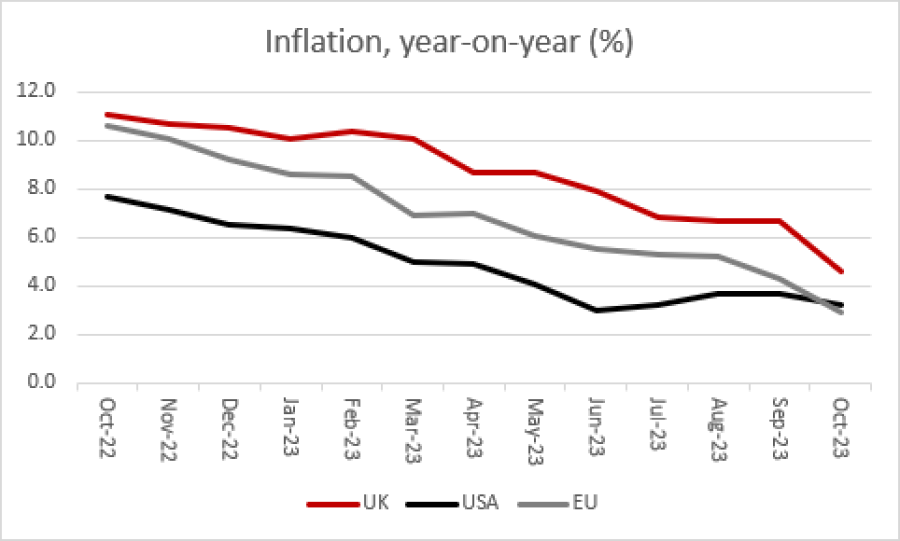

Inflation targets

Although inflation has been tamed and price rises are likely to continue to soften, it may not reach the 2% target this year.

In fact, inflation may remain structurally higher than in previous cycles. Therefore, James does not exclude that central banks start debating around the appropriateness of the 2% target.

She said: ”We would not be surprised to see at least one central bank look to shift the goalposts and move to more long-term average targets, rather than the nominal 2%.”

Source: Office for National Statistics, US Bureau of Labor Statistics, European Central Bank. US and UK based on consumer price index, EU on Harmonised Index of Consumer Prices, AJ Bell

The Olympics

The Summer Olympics being held in Paris will likely provide Europe with a short-term boost, but James believes attention should rather be focused on the Middle East and Saudi Arabia in particular.

She explained: “While it has so far signed numerous sporting stars for hundreds of millions of pounds apiece, cutting a swathe through golf and football, it is hoping to continue its rise in economic might and become a major player on the global stage.

“With the 2034 Football World Cup secured its use of soft power to advance its economic interests is unmatched in the region and shows no sign of stopping in 2024.”

Return of Russia

The conflict between Ukraine and Russia drastically escalated in 2022 when Russia started the invasion of its Western neighbour.

Yet, James warned that there could be further escalation as Vladimir Putin is attempting to outspend Western democracies in Ukraine. Russia has committed 6% of its GDP to its 2024 defence budget in an effort to push for victory, while Ukraine’s funding is beginning to hit obstacles. Moreover, a Trump administration could potentially align more closely with Putin.

James concluded: “It is not unfeasible that peace talks begin and the end to this war moves into sight. What that means for Europe and the world order is very much up in the air given all the moving parts.”