As tensions escalate in the Middle East and South China Sea, more than half the world’s population heads to the polls, and the US and Europe seek to bring supply chains closer to home, geopolitics will have a significant impact on a multitude of asset classes this year. Investors are also grappling with the end of free money, the rise of artificial intelligence and decarbonisation.

Janus Henderson Investors’ absolute return team is preparing for tail risks by writing ‘blueprints’ listing trades they would do if an event occurred. Portfolio manager Luke Newman said the team is preparing a Taiwan blockade blueprint and working on the US election, including its impact on renewable energy incentives and project finance.

Another blueprint involves rebuilding Ukraine, looking at construction businesses and how much of the work goes to China.

“We stay very liquid, we stay in large-cap equities, so we can react,” Newman said. “We also steal a march by planning ahead.”

For Jenna Barnard, co-head of global fixed income at Janus Henderson, the greatest risk would be if tensions in the Middle East and the Red Sea caused inflation to rise to such an extent that central banks contemplate further rate hikes. “If terminal rates are not in, in that case we’ve got a big problem,” she said.

On the other hand, the quest for energy security and data security should yield a wealth of investment opportunities, according to Alison Porter, a portfolio manager in Janus Henderson’s global technology leaders team. There is a record amount of government stimulus in the US and Europe for chips manufacturers and semi-conductor companies, she said.

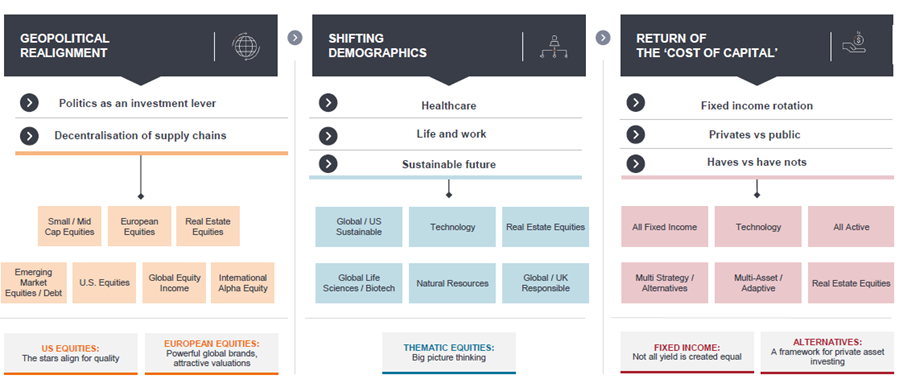

Ali Dibadj, chief executive officer of Janus Henderson, added that “global supply chains are breaking down” and onshoring has the upper hand, which will favour European equities, as the graphic below shows. Real estate investors, meanwhile, should look at where the next warehouse or distribution centre will be located.

Asset classes and sectors that should benefit from megatrends

Source: Janus Henderson Investors

The increased cost of capital

Beyond geopolitics, investors are realigning their portfolios to cope with the increased cost of capital, which favours fixed income and alternative investments, as well as stock pickers who can “separate the wheat from the chaff,” Dibadj explained.

Newman said equity markets have entered a new regime due to higher borrowing costs, where companies that can generate the cashflow they need to grow will outperform new entrants who can no longer borrow cheaply.

The risk on/risk off environment of the past couple of years, dominated by interest rates and with a wave of free money lifting all boats, is over. Newman relishes the return of rational, fundamental valuations and bottom-up research.

This is also a good environment for bonds. Barnard said that after a couple of tough years for fixed income investors, “macro fundamentals finally solidified in a supportive way in the fourth quarter [of 2023]. From here it looks really quite lovely for bond markets.”

Barnard does not think that the US Federal Reserve’s ‘dot plot’ – a chart showing Fed officials’ projections for the federal funds rate – looks aggressive, even if there is a soft landing. “If there’s any hint of a hard landing then bonds will be off to the races,” she added.

Against this backdrop, Barnard said US agency mortgage-backed securities look compelling. This is a $12trn government-backed asset class that is closely correlated to rates volatility, which is still quite high, she explained.

Shifting demographics

Dibadj’s third mega force (as pictured above) is ‘shifting demographics’ – a broad church that encompasses ageing populations in the West (invest in healthcare), sustainable investments that meet societal and environmental challenges, and technological advancement.

Porter said most economists fail to factor in the influence of technology cycles on labour markets, the economy and inflation.

Artificial intelligence (AI) will impact a wide range of industries from healthcare to transport, where it will enhance profitability for some companies, make goods and services cheaper, and bring disruption.

The ‘Magnificent Seven’ tech giants performed well this year because they have strong balance sheets and cost discipline, so they are relatively uncorrelated to bond markets, Porter said. Going forward, she thinks the gap will narrow between the magnificent seven and the rest of the market.

Over the next four to five years, Porter expects a shift from the enablers of AI to the adopters. New business models will emerge, although they will run on infrastructure provided by Google and Microsoft, which should continue to do well.

Porter also said that initial public offerings and merger and acquisition activity often pick up again about 30-36 months after that previous peak in deal making. We are now 34 months past the most recent peak, so she expects IPOs and M&A to gather pace sometime this year, providing a tailwind for the broader equity market.