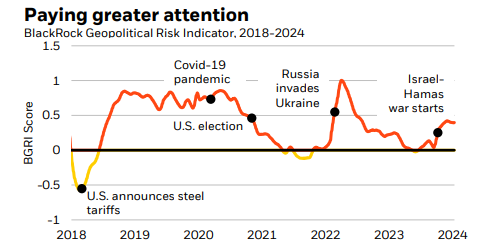

The pace of geopolitical fragmentation is accelerating rapidly and bringing with it long-term consequences for inflation and global markets, BlackRock strategists have warned.

In its latest market commentary, the BlackRock Investment Institute pointed to recent events in Asia and the Middle East as key indicators of this trend.

The recent attacks by Yemen’s Houthi militants on Red Sea shipping are a case in point, illustrating how such conflicts can impact global supply chains and inflate production costs. BlackRock sees geopolitical tensions as a significant factor in keeping policy rates above pre-Covid levels, with implications for global markets and investment strategies.

Source: BlackRock Investment Institute

Catherine Kress, head of geopolitical research at the BlackRock Investment Institute, said: “Geopolitics has become a persistent and structural market risk over the last half decade, in our view. The world has faced cascading crises – from the US trade wars to the Covid-19 pandemic, Russia’s invasion of Ukraine and now war in the Middle East.

“These developments have accelerated global fragmentation and the emergence of competing geopolitical and economic blocs. And the openness of countries to trade with each other has stalled, based on world trade as a share of global GDP. This is a marked departure from the globalisation and geopolitical moderation of the post-Cold War period.”

On the individual geopolitical situations, BlackRock has its highest-level tensions rating in the Middle East given the ongoing Israel-Hamas war. It warned the risk of escalation is high with the rise in attacks by Iranian-backed groups, as well as the recent disruption of Red Sea shipping.

Meanwhile, the firm is keeping its US-China strategic competition risk rating at a high level. While the meeting between the US and Chinese presidents in November set a more positive tone for ongoing relations, Taiwan remains “a significant flashpoint”.

However, Kress added that there are some beneficiaries to increased geopolitical fragmentation.

Countries like Mexico and Vietnam, seen as “connector” countries, may benefit from this “rewiring” of the global order as they act as intermediaries between different geopolitical blocs.

However, Kress cautions that this fragmentation will require significant investment in critical infrastructure for these benefits to be fully realised.

Strategic sectors such as technology, clean energy and defence may also see gains from this realignment, as will those benefitting from “robust industrial policies” such as the US Inflation Reduction Act and the CHIPS and Science Act.

“Fragmentation’s economic and market impact will depend, in part, on if changes to the global order are managed or disorderly. Greater geopolitical volatility – and the rising number of violent conflicts worldwide – increase the risk of a more disorderly and less predictable path,” she finished.

“Yet as broad stocks and other assets move on quickly from geopolitical events, we worry they may not be appreciating that we have entered a new geopolitical regime. The old playbook no longer applies, in our view.”

Geopolitical fragmentation is one of five mega forces being tracked by BlackRock, alongside demographic divergence (the world being spilt between ageing and younger economies), digital disruption (the potential of technologies such as artificial intelligence to boost productivity), the future of finance (changes in how households and companies use cash, borrow, transact and seek returns) and low-carbon transition (the reallocation of capital as energy systems are rewired).