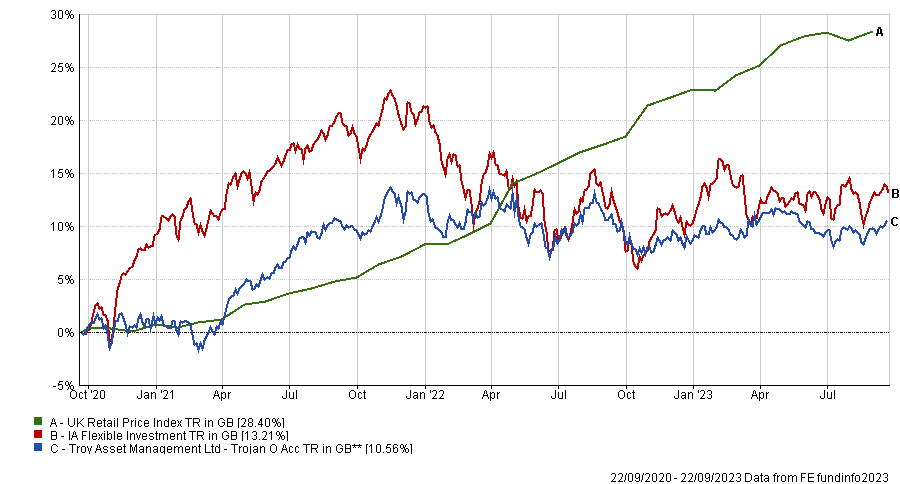

Sometimes funds that lag behind their peers are still a good buying opportunity in certain circumstances. That’s what experts thought of Troy Trojan, the popular £6bn strategy led by FE fundinfo Alpha Manager Sebastian Lyon which became popular a few years ago but lagged its peers more recently, as highlighted in the charts below.

Performance was lacklustre in the past year too, when it returned 0.9% against a sector’s average of 2.4%, but the specialists we asked highlighted that its own sector, the IA Flexible Investment, might not be relevant for a fair comparison.

The fund is a defensive play with a high-quality bias and high bond exposure – which is why it struggled in 2022, according to Rob Morgan, chief analyst at Charles Stanley.

“Last year presented difficult conditions for the fund but pleasingly it was characteristically resilient thanks to the decision to run plenty of US dollar exposure rather than hedging it all back to sterling,” said Morgan.

Performance of fund vs sector and index over 3yrs

Source: FE Analytics

Today, it remains “very defensively” positioned, reflecting the managers’ nervousness about the medium-term prospects for risk assets, with the team buying up short-dated UK and US government debt towards the end of 2022.

There is also a significant exposure to gold, while the equity weight is relatively low at 25% and is allocated to large consumer staples businesses and other high-quality areas that should exhibit resilience.

“This mix makes the fund a good core position for a portfolio that is likely to protect capital in more troubled times, but with the ability for the manager to up the level of risk as deemed appropriate when opportunities arise,” said Morgan.

“For me this is a buy. Although it has been an unspectacular performer recently, Troy Trojan has largely met its objective of protecting and increasing the value of shareholders' investments over the long term. Lyon views risk not as volatility but as the potential for permanent capital loss, something that chimes with many investors.”

The strategy also chimes with Peter Sleep, senior portfolio manager at 7IM, who recommends it to his conservative customers where capital preservation is important.

Because it has about 25% at the present time invested in equities, Sleep prefers comparing it to the IA 20%-60% sector instead of its own IA Flexible Investment sector, whose members don’t have equity allocation constraints.

Against this alternative benchmark, the fund beat the average peer over the past three, five, 10 and 20 years despite being less risky.

“One of the ways it’s done so is by preserving capital in the big equity crashes in 2008 and in 2020. A key reason behind this is the funds’ holdings in steady, non-cyclical stocks that tend to do well at all stages of the economic cycle, for example Microsoft, Nestle, Visa or Unilever,” said Sleep.

“Capital preservation is a key tenet for the team at Troy. This is not surprising given Troy’s origins as an office to invest the wealth of a large UK family. More than 30 years later the family is still invested in Troy, just that now any investor can invest alongside them.”

Performance of fund vs alternative sector and index over 3yrs

Source: FE Analytics

Jason Hollands, managing director of Bestinvest, agreed with Sleep.

“I wouldn’t pay any attention to how the Trojan fund ranks relative to the IA Flexible Sector. This sector is a catch-all dumping ground for a very wide range of strategies,” he said.

“This fund will lag more aggressively positioned funds in bull markets but enable investors to sleep easy at night and provide considerable downside protection in tougher times. For investors who are risk averse this remains a fund worth considering.”

Troy Trojan and its investment trust cousin, Personal Assets Trust, are both funds on the Bestinvest “Best Funds List” and are praised for their “very distinctive and well-articulated” mandates.

As Hollands highlighted, the fund also achieved inflation-beating returns over five-to-seven years.

It was also a buy for Ben Yearsley, director at Fairview Investing, who is “a big fan” of Troy's approach and recommended the fund for investors with a long-term investment horizon, which will allow them not to experience its out-of-favour quality-growth style as an issue.

“For this fund particularly I've always thought it is good either for novice investors or more experienced. It’s a good first-time fund as well as a portfolio anchor,” he said.