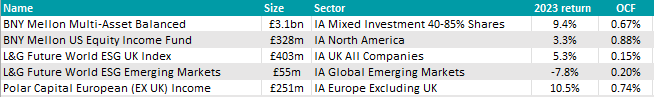

Legal & General Investment Management and BNY Mellon Investment Management were popular amongst Hargreaves Lansdown’s analysts last year. Four of the five new entrants to Hargreaves Lansdown’s Wealth Shortlist in 2023 belonged to these two houses.

Income funds and environmental, sustainability and governance (ESG) strategies were areas of focus for Emma Wall, head of investment analysis and research, and her team.

Below, Trustnet analyses Hargreaves Lansdown’s fund picks, their investment strategies and their recent performance.

Sustainable UK equities and European income

For sustainable UK equity exposure, Wall and her team chose Legal & General Future World ESG UK Index, which offers “an attractive blend” of responsible and passive investing.

“We think this fund is a good option for broad exposure to the UK stock market and could be a great low-cost starting point for a portfolio aiming to deliver long-term growth in a responsible way,” Wall said. The fund’s ongoing charge is a mere 0.15%.

Since it was added to the list in mid-February, however, it has fallen 5%, with its ESG overlays probably penalising it amid negative sentiment for the asset class.

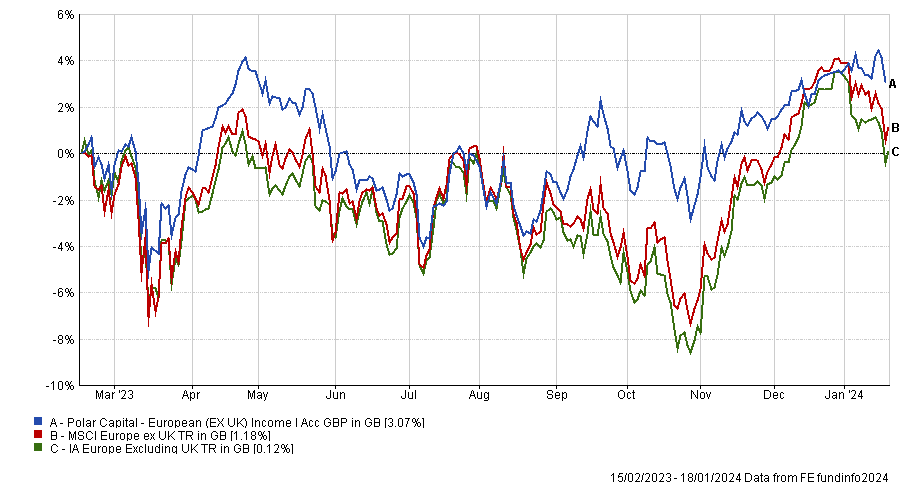

Investors would have had more luck with another new entrant, Polar Capital European ex-UK Income, which made 3.1% over the same timeframe, as shown in the chart below.

Performance of fund vs sector and index since February 2024

Source: FE Analytics

Manager Nick Davis has built a "strong" track record investing for income in larger European companies that are undervalued but have the potential to bounce back.

For the manager, the key to long-term success is compounding (making extra returns on previous returns).

Historically, the fund paid investors a 3.86% dividend, which is “attractive” and above the one produced by the market, Wall said.

“We'd expect the fund to lag a rising market but to hold up better when markets are falling,” said Wall. “It compares favourably against value and income focused peers.”

ESG in emerging markets

Two months later in April 2024 the second Legal & General strategy, Future World ESG Emerging Markets, was added to the shortlist, taking the total number of ranked Legal & General portfolios to 10.

The emerging market strategy only launched in April 2022, but throughout its life, “has tracked its index well”, Wall said.

The fund has a greater weighting to the technology and financial sectors versus the non-ESG FTSE emerging markets index, noted Wall, with another differentiator being its allocation to South Korea, which is not available in the FTSE Emerging Markets index, though it is in other non-ESG emerging indices.

BNY Mellon’s multi-asset and US equity income funds

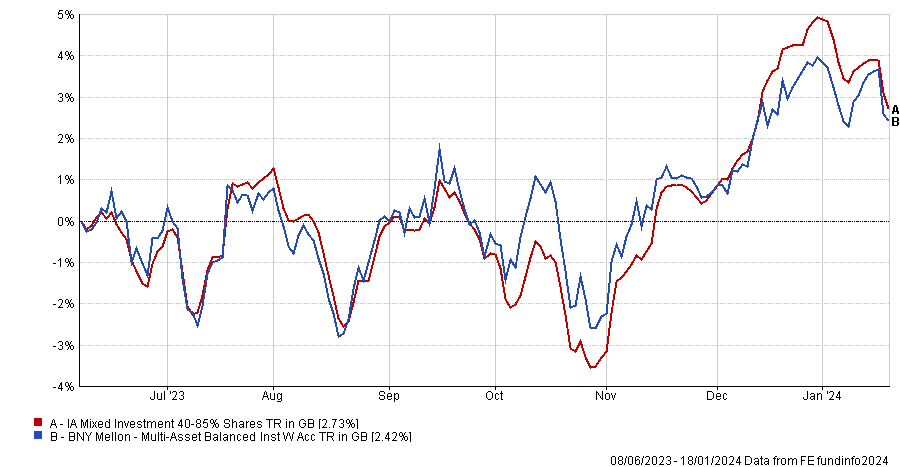

Finally, BNY Mellon Multi-Asset Balanced and BNY Mellon US Equity Income convinced Wall’s team in June and September 2023, respectively. Since their addition, the strategies have returned 2.4% and -1.8%.

The mixed-asset portfolio is led by Simon Nichols, who is “a naturally conservative investor”, despite typically keeping a high proportion invested in shares of companies with good long-term prospects from across the globe (the current equity weighting is 81.9%).

Performance of fund vs sector since June 2023

Source: FE Analytics

“Since Nichols has taken over managing this fund, he's managed to keep pace during market rallies, although it would be reasonable to expect this fund to lag the wider market during strongly rising markets,” Wall said.

“Nichols' multi-asset funds have typically experienced lower volatility than company shares over time and usually lower than multi-asset peers too. We think he has the experience and resources to do a good job for patient investors over the long term.”

While the US is usually synonymous with growth, for the benefit of diversification, Wall and her team picked a different strategy for their last addition of 2023.

BNY Mellon US Equity Income invests in large companies that trade at attractive valuations and provide a balance of income today and dividend growth potential for the future, making it “a good way to add US exposure to a global portfolio or for sitting alongside other US funds focused on more growth-style companies”.

Wall stressed that investors need patience with this fund.

“Over his career stretching back to 2005, manager John Bailer has consistently added value through stock selection, delivering good returns to patient investors,” she said.

“He has built a strong track record in US income investing and the fund offers something quite different to some of its peers in the IA North America sector. Bailer is well supported and resourced for the task at hand, and this gives us confidence in the fund’s long-term prospects.”

Source: FE Analytics