Some funds bounced back from a difficult year in 2022 and delivered strong relative performance in the different market environment that came with 2023, Trustnet analysis shows.

The past two years have brought challenging conditions for investors to navigate, with sharply rising interest rates spooking markets in 2022 before a renewed tech rally lifted stocks last year. This has caused some big reversals in fund performance.

In a previous article, Trustnet revealed that just 18% of the funds that were top-quartile in 2022 held onto this position in 2023 while 61.7% dropped into their sector’s third or fourth quartile.

However, the picture is more positive when we flip this on its head and look at the funds that made bottom-quartile returns in 2022. While 24.4% of those remained in the bottom quartile last year, 37% went into the top quartile and another 21.7% moved into the second quartile.

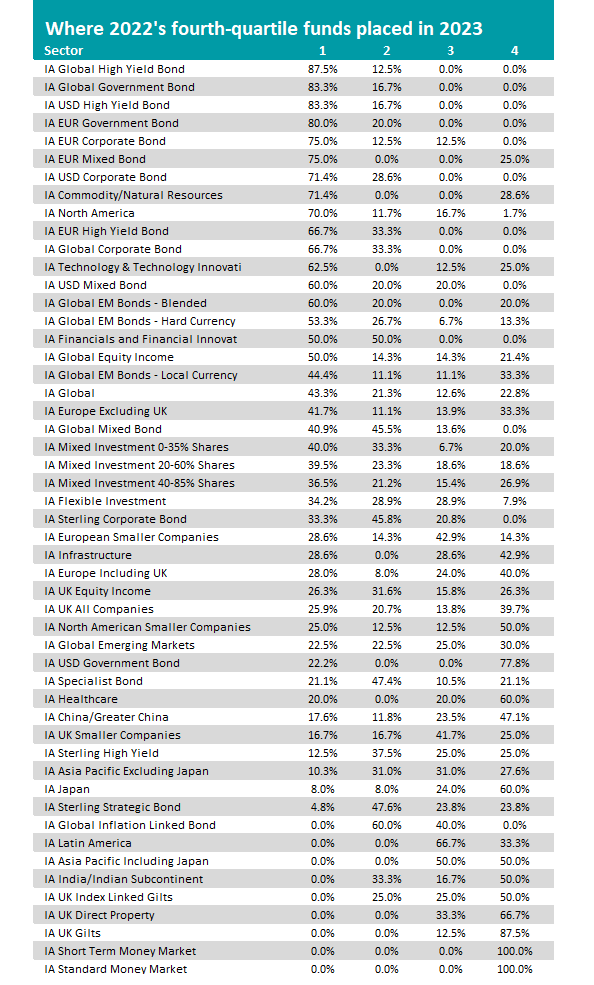

The table below shows where each sector’s fourth-quartile funds of 2022 ranked in 2023 following the latest shift in market dynamics (ranked according to the percentage that went into the top quartile).

Source: FE Analytics

The top of the table is full of relatively small bond sectors, reflecting the change in sentiment towards fixed income over recent years.

While bonds were hit hard in 2022 as central banks aggressively hiked interest rates to curb inflation, last year investors started to eye peak rates and eventually cuts.

The IA Commodity/Natural Resources sector is another where a large proportion of its fourth-quartile funds jumped into the top quartile in 2023 with 71.4% achieving this.

Again, this is down to a big shift in underlying dynamics – commodity prices surged in 2022, contributing to the global inflation problem, but they fell in 2023 because of lower demand and a slowing Chinese economy.

This meant that only five commodity funds – all of them specialist – went from the fourth quartile to the first: Pictet Timber, Pictet Clean Energy Transition, iShares Global Timber & Forestry UCITS ETF, Pictet Water and iShares Global Water UCITS ETF.

A more mainstream sector is also close to the table: IA North America, where 70% of 2022’s bottom-quartile funds jumped into the top quartile.

The reason for this is simple and dominated the financial headlines for much of 2023. US large-cap tech stocks bore the brunt of 2022’s sell-off but rallied hard in 2023 as investors jumped on the artificial intelligence (AI) bandwagon.

This means that tech specialist such as Xtrackers MSCI USA Information Technology UCITS ETF and Invesco NASDAQ-100 ESG UCITS ETF made high returns in 2023, as did active US funds with an overweight to tech, such as Baillie Gifford American, Morgan Stanley US Advantage and AXA Framlington American Growth.

In the IA Technology & Technology Innovation sector, where all members have a heavy tech exposure by default, four funds – WisdomTree Artificial Intelligence UCITS ETF, T. Rowe Price Global Technology Equity, Liontrust Global Technology and WisdomTree Cybersecurity UCITS ETF – were able to turn 2022’s fourth-quartile returns in first-quartile numbers last year.

IA Global, the largest sector in the Investment Association universe, had 43.3% of its fourth-quartile funds make a top-quartile return last year. This included well-known strategies such as Rathbone Global Opportunities, WS Blue Whale Growth and Baillie Gifford Long Term Global Growth Investment.

The picture is less rosy in the IA UK All Companies sector, where only 25.9% of fourth-quartile funds jumped to the top of the rankings. Among them were Polar Capital UK Value Opportunities, BlackRock UK and IFSL Marlborough Multi-Cap Growth.

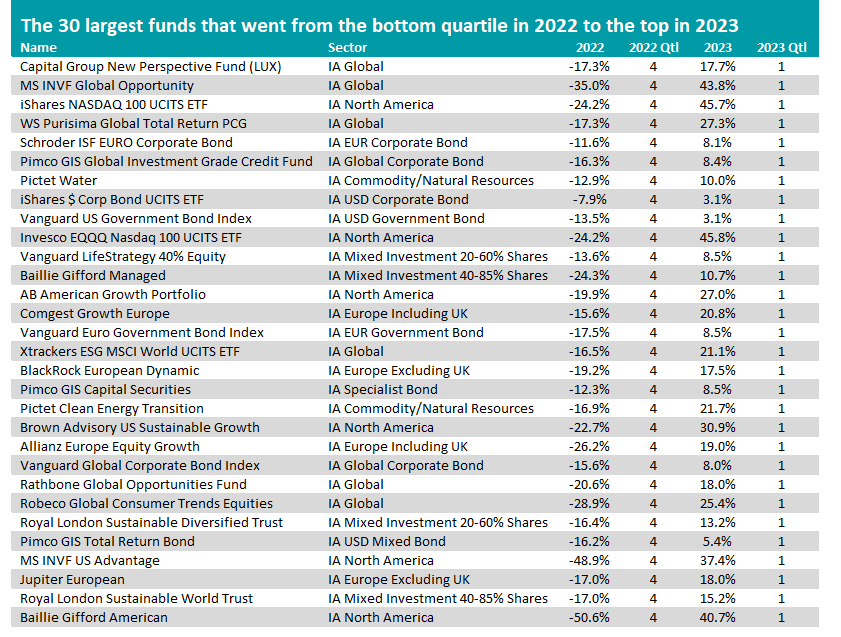

In all, there are 328 funds in the Investment Association universe that went from the bottom quartile in 2022 to the top one in 2023, which is too many to be shown in full. However, the 30 biggest funds making this jump can be seen in the table below.

Source: FE Analytics