Investors have had to ride a seesaw of market, macroeconomic and geopolitical turbulence over the past three years but some funds have been able to stay the top of their sector regardless of what rocked them.

Research by Trustnet has found that fewer than 2% of funds in the Investment Association universe have maintained a top-quartile ranking in 2021, 2022 and 2023, as conditions in each of the years differed widely.

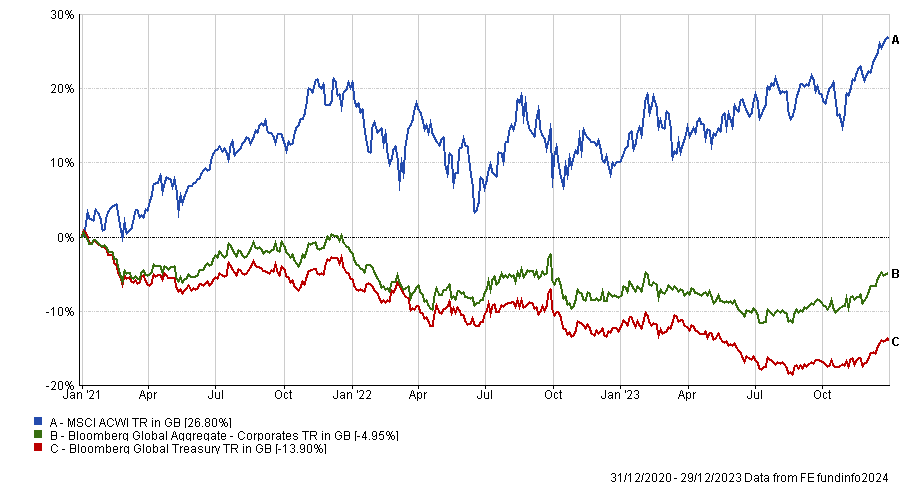

Performance of stocks and bonds over 3yrs

Source: FE Analytics

If we think back to 2021, the world was emerging from Covid pandemic and undergoing a global economic recovery after a year of lockdowns; however, this renewed demand combined with bottlenecks from frozen supply chains to create worries about inflation.

In this environment, stocks outperformed bonds, value beat growth (although tech stocks continued to lead the market) and environmental, social and governance (ESG) investing did better than a traditional approach.

In 2022, inflation in some countries had reached levels not seen in several decades, prompting the US Federal Reserve, the Bank of England and other central banks to hike interest rates. Meanwhile, Russia launched its invasion of Ukraine and China’s economy slowed.

Amid this, government bonds outperformed stocks (although both asset classes sold off heavily), tech stocks crashed, value investing continued to outpace growth and the US equity market – which had dominated for a decade – lagged behind its international peers.

Finally, in 2023 investors watched as the global economy avoided a recession and inflation started to come down from its highs, leading central banks to start pausing their hiking programmes. In addition, the emergence of generative AI sparked a renewed interest in tech businesses.

Last year equities beat bonds by a large margin (albeit with a narrow band of stocks leading these returns), growth and tech stocks returned to the fore and commodity prices – which had soared in previous years – fell.

So, it’s clear that the past three years have presented investors with a wide range of scenarios to contend with. Trustnet ran the numbers to see if any funds have been able to maintain a first-quartile ranking in each of 2021, 2022 and 2023.

A handful did – just 77, or 1.7% of the 4,633 funds in the Investment Association universe with a three-year track record. The 25 that made the highest returns over the entire period can be found in the table below.

Source: FE Analytics

Topping the list is BlackRock BGF World Energy, managed by Alastair Bishop and Mark Hume, with its three-year total return of 124.2%.

As can be seen from the returns in the individual years, the fund handed some handsome gains to investors in 2021 and 2022, when energy prices were spiking. However, it made a 1% loss last year – although this was enough to keep it in the top quartile (it was the seventh best result of 30 funds in its sector).

The fund is the only member of the IA Commodity/Natural Resources sector to have made a top-quartile return in each of the past three years.

The most common peer group to make the shortlist, however, is the IA Global Emerging Markets sector. Although none of its members have made a high enough three-year return to be featured in the top 25 performers listed above, there are 13 on the full 77-strong list of funds with three consecutive first-quartile years.

Among them are larger funds such as Artemis SmartGARP Global Emerging Markets Equity, Dimensional Emerging Markets Core Equity, Lazard Emerging Markets, M&G Global Emerging Markets and Robeco QI Emerging Conservative Equities.

IA Japan funds have also come out well in this research, with 11 achieving consistent top-quartile returns over the past three years. The country is currently being closely watched by investors, following strong performance over the past year.

Japanese equity funds with a value tilt seem to have done particularly well in recent years, with Nomura Japan Strategic Value, Man GLG Japan Core Alpha, Arcus Japan, WS Morant Wright Nippon Yield and WS Morant Wright Japan among the consistent outperformers.

Closer to home, there are three IA UK All Companies funds (JOHCM UK Dynamic, JPM UK Equity Value, Jupiter UK Special Situations), three IA UK Smaller Companies funds (Aberforth UK Small Companies, Artemis UK Smaller Companies, Fidelity UK Smaller Companies) and one IA UK Equity Income fund (Royal London UK Equity Income) topping their sectors in all three years.

The table below lists all 77 funds that made a first-quartile return in 2021, 2022 and 2023.

Source: FE Analytics