Aristotle famously said that “probable impossibilities are to be preferred to improbable possibilities”. He thought people would prefer to imagine impossible things that are easy to picture (flying pigs come to mind), rather than possible things that are hard to conceptualise (a recurrence of swine flu, for instance).

Active managers and investors, however, need to imagine those ‘improbable possibilities’ and attempt to profit from or hedge against them, according to Paul Jackson, global head of asset allocation research at Invesco. “I believe the biggest returns are earned (or the biggest losses avoided) by successfully taking out of consensus positions,” he explained.

Jackson has identified 10 counter-consensus scenarios that he thinks have at least a 30% chance of happening this year.

- The US experiences a short recession

US GDP growth could turn negative for two consecutive quarters as the delayed effects of the Federal Reserve’s tightening cycle kick in.

The US economy was sustained by government consumption and consumer spending in 2023 but Jackson expects both to wane as government debt mounts and household savings shrink.

- The S&P 500 finishes the year lower than it started

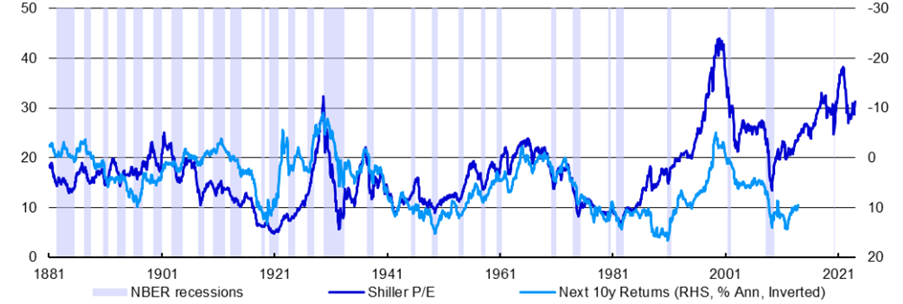

The S&P 500 looks expensive after its strong performance last year, up 24%. Its Shiller price-to-earnings (P/E) ratio (price divided by average earnings over the past 10 years adjusted for inflation) is above 31x, indicating that the US equity market is overvalued.

“Long-term returns have tended to be poor from these valuations and I suspect the optimism implied by markets may go unrewarded, especially if there is recession or higher inflation,” Jackson warned.

US recessions, Shiller P/E and future equity returns (% year-on-year)

Sources: Invesco, Robert Shiller, Federal Reserve Bank of St. Louis, LSEG Datastream. (NBER recessions are period of US recession as defined by the National Bureau of Economic Research.)

- Chinese stocks to outperform the US

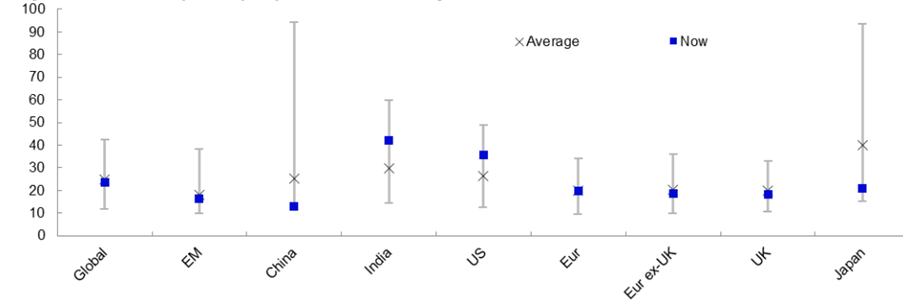

Chinese equities look attractively valued, with a cyclically-adjusted P/E ratio of 13.1x at the end of 2023, compared to 35.7x in the US, 42.2x in India and China’s own historical average of 25.3x.

“I think China’s economic performance has been better than many give it credit for,” Jackson argued. China’s third quarter year-on-year GDP growth of 4.9% was significantly higher than the US at 2.9%.

“With a central bank that has been easing over recent years, I suspect China’s economy will continue to outperform the US,” he continued. “I also think that China’s policy making approach has now become more predictable, which may not be the case in the US if there is a change at the White House.”

China’s cyclically-adjusted P/E ratio is lower than elsewhere

Sources: Invesco and LSEG Datastream

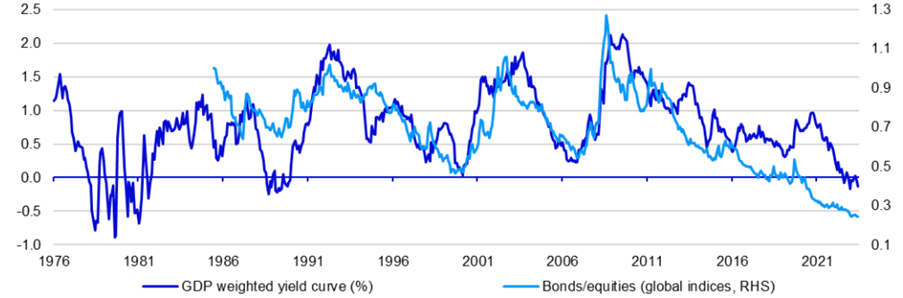

- Government bonds beat equities

Jackson expects global government bonds to outperform global equities this year for the first time since 2018 (and before that, 2011), especially if a recession occurs in the US. Government bonds tend to beat stock markets when the yield curve steepens, which is what he thinks will happen this year as central banks start to cut rates.

Bonds tend to outperform equities when yield curves steepen

Sources: Invesco, ICE BofA, MSCI and LSEG Datastream

- Democrats win at least two of three major races

The US elections on 5 November 2024 will encompass three races: the White House, all the seats in the House of Representatives, and 34 of the 100 Senate seats. Opinion polls put the Republicans in the lead for a hat-trick but Jackson thinks the incumbent Democrats stand a fighting chance.

“Fed rate cuts may improve the national mood, Republicans have underperformed opinion poll indications in recent elections/referenda (as women rebel) and there is always the possibility that Donald Trump’s legal travails finally erode his popularity,” Jackson suggested. “I doubt the Republicans will make a clean sweep.”

- Dollar-yen falls below 125 as the yen rallies

The US dollar/Japanese yen exchange rate peaked at a 33-year high of around 152 in November 2023, then ended the year around 141 as the yen rebounded on speculation that the Bank of Japan would unwind its ultra loose monetary policy.

“With real GDP growth of 1.5% in the year to 2023’s third quarter (not bad given the demographics) and CPI inflation of 2.8% in November (3.8% if fresh food and energy are excluded), I find it hard to understand why the Bank of Japan continues to operate such a loose policy,” Jackson said.

“Supposing the Bank of Japan does start to normalise, and that most other major central banks start to ease, I expect the yen to strengthen substantially. A 10% strengthening of the yen in 2024 would take the dollar/yen below 125 and I think that is easily achievable. The yen would then still look historically cheap in real terms.”

- Geopolitics push Brent/gold above $100/$2350

“With problems mounting in the Middle East (including the risk of Iranian involvement and problems in the Red Sea), the ongoing conflict between Russia and Ukraine and a US election cycle that could destabilise global geopolitics, I think it possible that the price of Brent crude goes above $100 per barrel in 2024 (up nearly 30% from 29 December 2023, based on the first month future price),” Jackson said.

“Gold has gained more than $200 since the Hamas attack on Israel and I think it could go above $2,350 per ounce, especially with a repeat of the 2016 ‘Trump premium’ (which I reckon added more than $200 to the price).”

- Colombian stocks to outperform major indices

Pakistan, Bahrain, Czechia, Kenya, Romania and Colombia all possess “the holy grail of a dividend yield that exceeds the price-to-earnings ratio,” Jackson said.

Colombia experienced a 7% index decline in 2023, leaving the stock market’s P/E ratio at 6.1x with a dividend yield of 11.2%. Consensus forecasts for 2024 are 6.4x and 7.7%, respectively (according to Bloomberg) so although dividends are likely to fall, yields look set to remain higher than the P/E ratio.

“Usually, whenever valuation metrics are at such levels it signifies either that a big opportunity has presented itself or that something is about to go very wrong,” Jackson said.

In Colombia, he thinks the upside outweighs the risks: “The usual macro metrics (inflation and government/international balances) do not signal impending disaster and the peso strengthened during 2023.”

- ANC loses sole control of South Africa

The African National Congress (ANC) has been South Africa’s governing party since 1994 but opinion polls suggest that its share of vote could drop to 40-50% in the 2024 general election, leading to the formation of a coalition government.

- Last but not least, France wins Euro 2024

Bookmakers currently favour England to win UEFA’s Euro 2024 football tournament, which will be hosted by Germany in June and July. “Looking at the potential pathways through the competition, I suspect (unpatriotically) that England will be eliminated in the semi-finals by France, who I think will then register a Bastille Day victory against Spain,” Jackson predicted.