The political marriage between the UK and Europe might have ended in 2016, but that doesn’t mean that your investments in the region have nowhere to go.

Yet despite the break, both markets have thrived more recently, with Europe and the UK returning 8.8% and 7.7% over the past 12 months, respectively, while the performance of global markets didn’t make it past 0.7%, as the chart below shows.

Both exceeded investors’ expectations by outperforming considerably on the back of a milder energy crisis than anticipated.

Performance of indices over 1yr

Source: FE Analytics

Below, we asked three expert fund pickers for their UK-Europe ‘perfect pairings’, or the two funds from each region that they think would complement each other in a portfolio.

Sheridan Admans, head of fund selection at Tillit, went all-in on value and chose Invesco UK Opportunities and Lightman European, which, given their valuation drive, would blend and perform well together in bear markets, recessions, and/or in inflationary and rising rate environments, he said.

The £1.3bn Invesco fund employs a large-cap, traditional value investment approach and is benchmark agnostic, with a history of high active share (meaning that its allocation can drift considerably from that of its peers).

“The fund is managed by Martin Walker, who has a particularly long track record of delivering strong risk-adjusted returns compared to peers, which we believe can be traced back to his expertise in combining bottom-up stocking with macro considerations.”

Similarly, Lightman European, with £626m of assets under management (AUM), is a traditional value fund investing in European companies that are out of favour with the market but which the manager, Rob Burnett, thinks have the potential for a turnaround.

The process is based on traditional company valuation analysis, with thematic economic considerations taken into account. The manager, who has been investing in this style and region since 2005, can invest across the market-cap spectrum but focuses on large- and mid-caps, split across a combination of large household names and smaller local brands.

“European equity funds with a traditional value style approach are fairly rare,” said Admans.

“Most tend to focus on growth or GARP (growth at a reasonable price). The value philosophy combined with Burnett’s experience in the sector and the fact that he is the founder of Lightman, a focused, single-strategy asset manager boutique, makes this stand out from peers.”

Performance of funds over 1yr against their respective sectors

Source: FE Analytics

Jason Hollands, managing director at Bestinvest, paired Artemis UK Select with the BlackRock Continental European Flexible fund.

The Artemis UK Select fund, co-managed by Ed Legget and Ambrose Faulks, seeks out ‘growth’ companies with “strong free cash flow generation” that they believe are undervalued by the market.

Major positions include BP, Shell, 3i Group and Oxford Instruments and Hollands praised an additional tool available to the managers, which is to take the occasional short position in stocks they are negative on. Currently, the fund has two shorts and 47 long positions.

“The fund has a flexible remit and can invest right across the UK market-cap spectrum, but is primarily invested in large- and mid-cap stocks,” he said.

“Short-term performance has been impacted by top 10 holdings in three banks: Barclays, Natwest and Standard Chartered, which were caught up in recent negative sentiment towards the sector, but the fund’s medium-to-longer term track record has been impressive.”

The BlackRock Continental European Flexible fund, managed by Giles Rothbarth, also focuses on large- and mid-cap companies but is currently overweight technology, healthcare and industrials and underweight consumer staples, energy and utilities, with the main holdings including Novo Nordisk, LVHM Monet Hennessy Louis Vitton and ASML Holdings.

Performance of funds over 1yr against their respective sectors

Source: FE Analytics

“While the fund overall is skewed towards growth companies, the manager takes a barbell approach of considering both high-quality growth stocks and undervalued opportunities with the potential for a re-rating,” said Hollands.

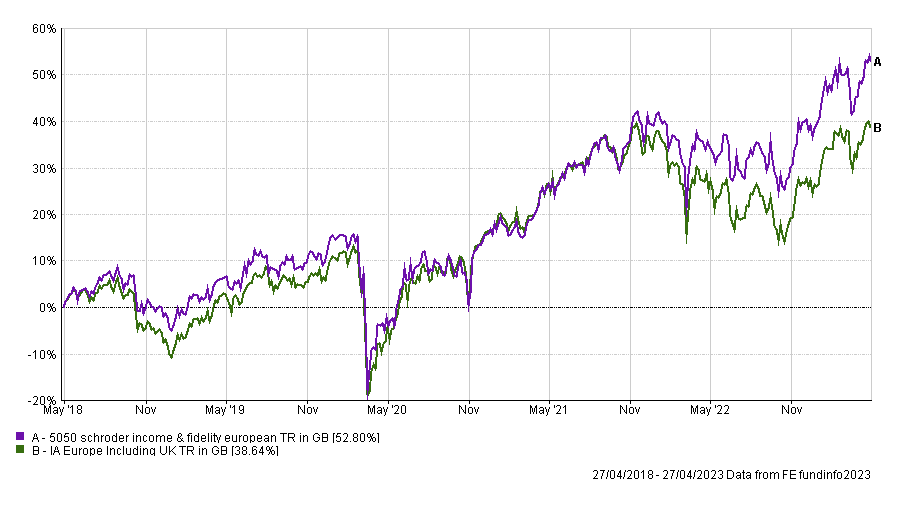

Finally, John MacTaggart, senior fund analyst at FE Investments, chose a 50-50 combination of Schroder UK Income and Fidelity European, whose combined performance is highlighted below against the IA Europe Including UK sector.

Performance of 50-50 split of funds since 2018 against sector

Source: FE Analytics

“To get the most from the geographic exposure it makes sense to have one of the funds focused on value and one more growthy play,” he said. “That's probably the best combination to give investors the best diversification across the board.”

On the Schroder fund, UK fund analyst at FE fundinfo Thomas Green praised the “thorough and ongoing company analysis, which allows them to move into positions quickly when stocks sell off aggressively”.

“Their process has evolved to include features that aim to counteract human biases, which is an attractive addition. This is also one of the few UK funds managed by Schroders’ Global Value team that does not have liquidity concerns, due to the fund’s focus on large companies,” he said.

The Fidelity fund convinced FE fundinfo’s fund analyst James Piper, who focuses on the European market, among others.

He said: “The managers Samuel Morse and Marcel Stotzel believe the key is to invest for the long term and not to become complacent with any one name. They believe that being fully invested is key to long-term success rather than trying to time the market.”

“The process has consistently delivered performance in line with expectations. The fund would suit an investor looking for core European exposure amongst a diversified portfolio of funds,” he concluded.