Fidelity Special Values and JPM UK Equity Core were the only additions to interactive investor’s (ii) Super 60 list in 2023.

Fidelity Special Values, which made it into the ii list in January 2023, is a popular choice among fund pickers and ii is far from alone in recommending the portfolio.

Peel Hunt analyst Anthony Leatham recommended it for its “multiple layers of value”, while it was also chosen by Numis’ Ewan Lovett-Turner as his “top pick in the IT UK All Companies space, due to its contrarian approach with a record of outperforming in a variety of market conditions”.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

The trust is managed by FE fundinfo Alpha Manager Alex Wright, who has been at the helm since 2012 and invests in unloved companies that have the potential to recover, basing his choice on factors such as a business model/corporate change or industry cycles and buying them at an early stage.

The trust, therefore, tends to have a contrarian value bias, an approach currently favoured by several experts, who are expecting undervalued UK companies to re-rate soon.

This was indeed one of the characteristics that attracted the fund selectors at interactive investor.

Dzmitry Lipski, head of funds research at ii, said: “The thorough and well-defined contrarian value approach leads us to have a positive view on the fund’s investment process.

“Wright is an experienced manager with expertise in the smaller-cap equity and we feel the fund is a strong option for investors seeking a contrarian and value orientated approach to investing across the market cap spectrum of the UK market.”

The portfolio also shows biases down the market-cap scale versus the FTSE All-Share Index and at the sector level, there is often an overweight to industrials and an underweight to consumer staples. These tilts will impact relative returns at times, said Lipski, but over the longer term returns have been strong.

Since it became part of the Super 60, the trust has returned 2.2% against 0.13% of the FTSE All Share index.

In comparison, the second vehicle that convinced Lipski and his team, JPM UK Equity Core (which entered the Super 60 list in May 2023) didn’t deliver an equally outstanding performance, only making 0.45% over the past year.

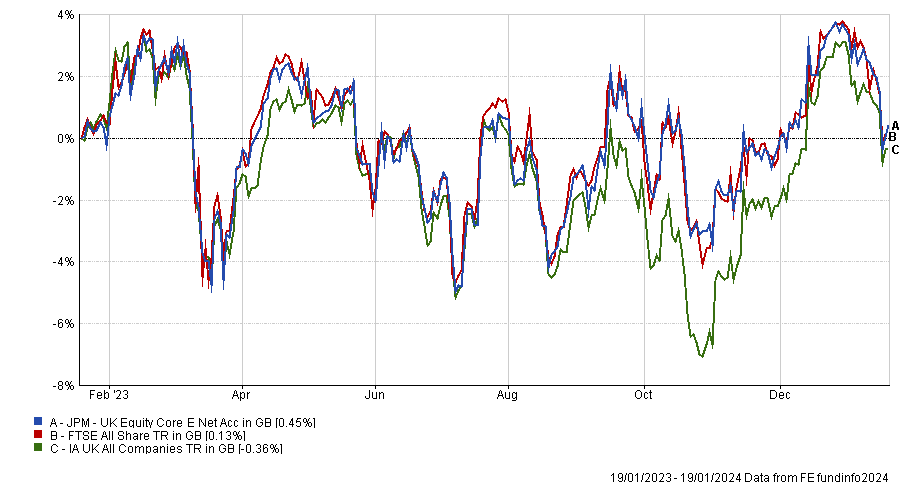

Performance of fund vs sector and index over 1yr

Source: FE Analytics

That might be appropriate, however, for a core option such as this, which aims to provide “consistent returns moderately ahead of the FTSE All-Share Index”.

“The fund is clearly managed as a core UK equity offering, with deviations from the FTSE All-Share Index closely monitored, and should not therefore be expected to produce high levels of outperformance,” said Lipski.

However, the portfolio has the ability to deliver relatively consistent alpha over time, net of the “competitive” fees, with its ongoing charge figure (OCF) at 0.40%.

JPM UK Equity Core follows a “structured and risk-controlled approach” to identify stocks with attractive quality, value and/or momentum characteristics.

“It may find market inflection points difficult to navigate, but has shown its ability to produce consistent excess returns over time, particularly when all three of its broad alpha factors have been favoured by the market, such as in 2013 and 2015,” said Lipski.

Being benchmark-aware (meaning that it broadly holds the same shares as the index) the fund tends to be diversified by nature, the analyst explained. However, in an attempt to outperform, it takes slight bets on shares and sectors that are viewed as having the highest potential to outperform.

Its active share (divergences from the benchmark) can be lower than those of concentrated funds.

Source: FE Analytics

Previously in this series, we covered the new AJ Bell Favourite Funds, those added to Hargreaves’ Wealth Shortlist and to Fidelity’s Select 50.