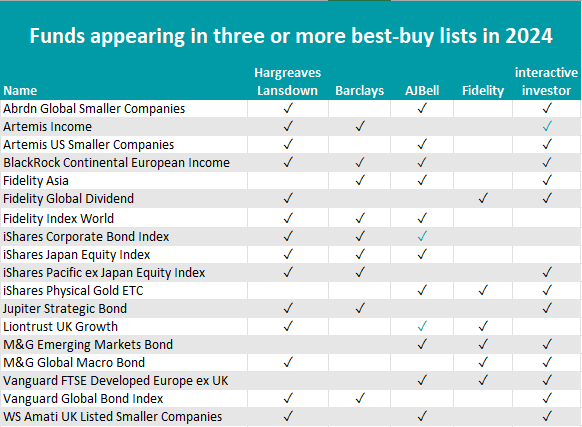

Artemis Income, Liontrust UK Growth and iShares Corporate Bond Index are the latest funds to become the most recommended by best-buy lists in 2024.

Every year, the investment platforms Hargreaves Lansdown, Barclays, AJ Bell, Fidelity and interactive investor publish their best-buy lists including the top funds covered by their analysts.

This January, the total number of those taken into account by at least three out of the five platforms increased from 15 to 18, following the addition of the three strategies above and the removal of Steward Investors Asia Pacific Leaders Sustainability, which continued to be ranked by Fidelity and AJ Bell, but was dropped by Barclays.

Just like last year, there was no fund recommended by all five providers and only one that convinced four – Blackrock Continental European Income, which is the standout pick for investors seeking dividend payers from across the channel.

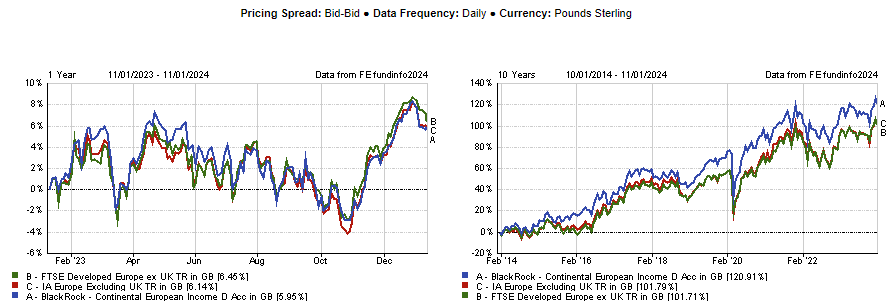

It has a solid long-term record, outperforming its peer group by 20 percentage points over the past 10 years, but in 2023 it slightly underperformed the rest of the market, as shown in the graph below.

Performance of fund vs sector and index over 1 and 10yrs

Source: FE Analytics

The first new addition, Artemis Income convinced Hargreaves and AJ Bell, but crucially this year interactive investor too, which added it to its Super 60 list for its “highly experienced management team” with FE fundinfo Alpha Manager Adrian Frost at its helm, who has “consistently applied a sensible, tried-and-tested approach”.

“The core-like nature of the approach means it is unlikely to significantly under- or outperform over shorter-term time periods, however the consistency of approach has delivered strong returns over the long term,” analysts at interactive investor said.

“With its considerable size [£4.4bn of assets under management], the fund does not have the flexibility to invest significantly down the market-cap scale, but that has not hindered performance relative to the index over the medium term.”

Source: Trustnet

Liontrust UK Growth was the second new entrant, with Alpha Managers Anthony Cross and Julian Fosh swaying AJ Bell on top of Hargraves and Fidelity.

The team invests in 55 to 65 UK mid- and large companies with growth prospects, with the goal of beating the returns of the FTSE All Share index.

AJ Bell analysts praised the “clear philosophy and process” and the “disciplined and pragmatic investment approach” and said “the longevity of the team and consistency of implementation provides credibility, with a strong focus on long-term sustainability of profits on companies held within the portfolio”.

AJ Bell’s Favourite Funds list now also includes iShares Corporate Bond Index, one of the largest passive UK corporate bond funds in the UK, which tracks the performance of the Markit iBoxx GBP Non-Gilts Overall TR index, an index of sterling-denominated bonds, excluding gilts.

Both AJ Bell and Heargreaves Lansdown analysts highlight it for its low price (with an ongoing charge figure of 0.11%) and as “a great choice” for broad exposure to this area of the bond market.

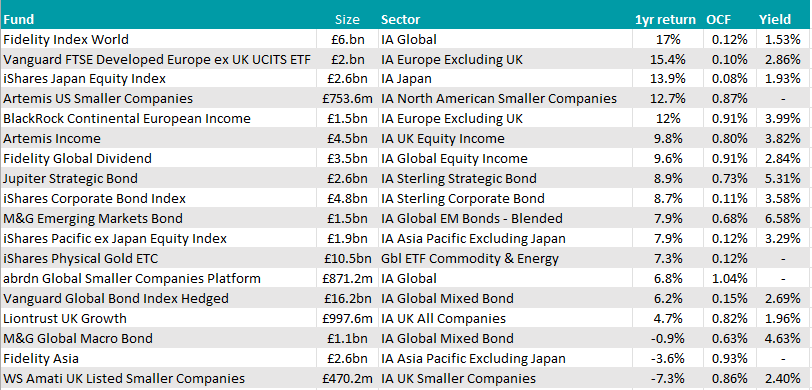

Other notable funds in the list included abrdn Global Smaller Companies, Fidelity Global Dividend and Fidelity Asia, Jupiter Strategic Bond and M&G’s Global Macro Bond and Emerging Markets Bond.

Some of these funds struggled more than others.

Fidelity Asia has lost 3.6% in the past year and hasn’t managed to rank in the first quartile of the IA Asia Pacific Excluding Japan sector in the past 12 months nor over the past three, five or 10 years. iShares Pacific ex Japan Equity Index meanwhile has been in the top quartile of the sector for all those time frames with the exception of 10 years, when it came in the second quartile.

On the other hand, Fidelity’s Index World was the top performer of all the most recommended funds in the past year, returning 17% over the past 12 months.

It resides in the IA Global sector, where it fared much better than its peer, abrdn Global Smaller Companies, which had been in the last quartile of performance for most of the past five years – but a direct comparison might be unfair given the vastly different investment propositions.

However, the other smaller companies strategy in the list, WS Amati UK Listed Smaller Companies, also has had troubles, sitting in the bottom performance quartile of the IA UK Smaller Companies sector and was the worst performer of the year, losing 7.3%.

The second-best performer was the Vanguard FTSE Developed Europe ex UK UCITS ETF, followed by another passive vehicle, iShares Japan Equity Index. They returned 15.4% and 13.8%, respectively.

Source: FE Analytics