Value funds overtook their growth peers in the latest FE fundinfo Crown Rating rebalance as cyclical managers have come up trumps over the past three years, while strategic bond funds have also soared.

The crown ratings are a quantitative score based on a fund's historical performance relative to an appropriate benchmark over three years and highlight funds that have superior performance in terms of stock picking, consistency and risk.

Alpha, volatility and consistent performance are the three main points used, with the top 10% of funds receiving an FE fundinfo Crown Rating of five. The next 15% are awarded four crowns; the remaining quartiles are ranked one to three.

Despite the rise of artificial intelligence (AI), growth-focused funds are still reeling from a disappointing 2022 (and to a lesser extent 2021), while the gains made in the pandemic-laden year that was 2020 have now washed out from the three year track records.

It is a continuation of the trend from the previous rebalance in July 2023, when smaller companies funds dropped and value portfolios rose.

Charles Younes, deputy chief investment officer at FE Investments, said: “Contrary to expectations one year ago, 2023 unfolded as a seamless extension of 2022, with inflation and central bank decisions emerging as pivotal influencers in financial markets.

“While the trajectory of equity and bond markets shifted from negative to positive, the prevailing victors remained consistent – strategic bond managers, displaying adeptness in adjusting their interest rate sensitivity, and equity managers focused on value and cyclical assets.”

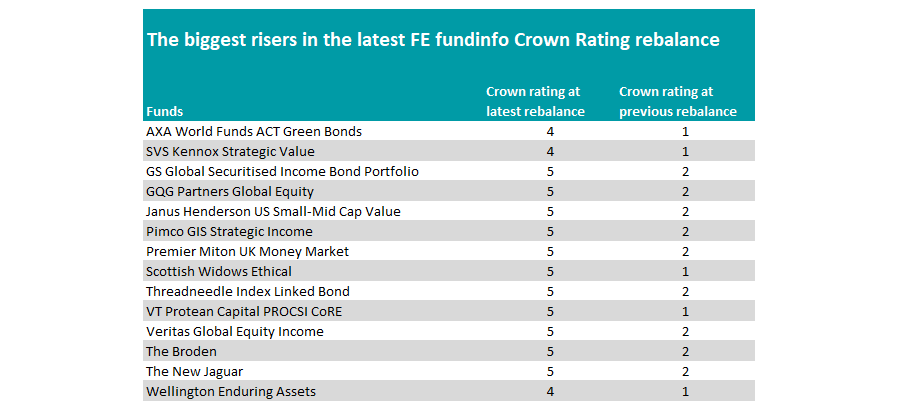

Source: FE fundinfo

Janus Henderson US Small-Mid Cap Value and SVS Kennox Strategic Value both headline the list of funds with the biggest positive change to their ratings this time around. The former went from two to five crowns, while the latter rose from one to four.

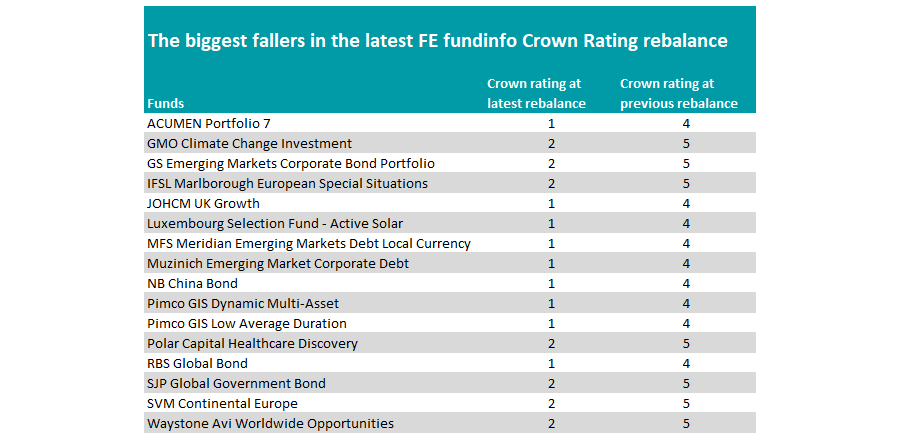

Conversely, growth names such as JOHCM UK Growth and Polar Capital Healthcare Discovery headline those funds falling the most at the latest rebalance, as the below table shows.

Source: FE fundinfo

Overall, the IA Sterling Strategic Bond sector now houses 22 five-crown rated funds, or 28.6% of the peer group – the highest percentage of any Investment Association (IA) sector alongside IA Asia Pacific Including Japan, although there are only seven funds in that peer group. IA Japan was in third – 15 of the 65 funds (or 23.1%) achieved the highest ranking.

Conversely, there were no five-crown rated funds in the IA UK Equity Income sector, despite 68 eligible funds, while IA Sterling High Yield and IA North American Smaller Companies were also among the 16 peer groups without a top ranking.

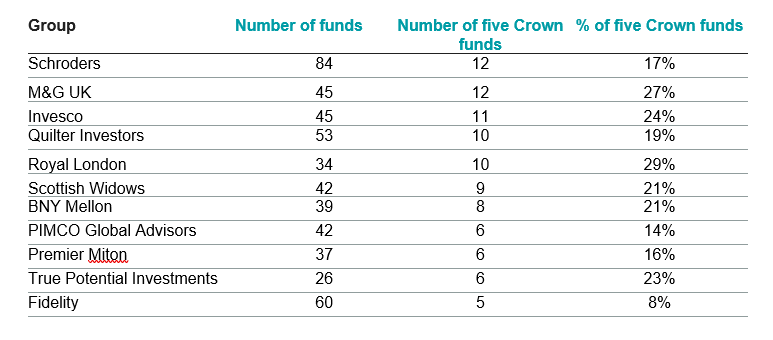

At a fund group level, Schroders remains in joint top position with 12 funds granted a five-crown rating, although this is one fewer than at the previous rebalance. Four new funds were given a top ranking, while five lost their title.

The fund groups with the most five-crown rated funds

Source: FE fundinfo

Alongside Schroders is M&G, where three funds were given the best rating this time around, taking it from fourth to joint first position. M&G Asian, M&G North American Dividend and M&G Short Dated Corporate Bond were all bumped up from four to five crowns.

Quilter – which had previously held the joint top spot – slipped down to third, with nine funds achieving a five-crown ranking, down from 12 in July.

Having had zero five-crown rated funds at the latest rebalance, Baillie Gifford was awarded one top ranking, with Baillie Gifford UK Equity Core rising from four to five crowns.