The interest rate hikes carried out by central banks around the world might have sparked significant volatility in risk assets but one area that benefitted is money market funds.

For much of the recent past, the low returns on offer from cash meant investors overlooked these portfolios in favour of asset classes such as stocks, bonds and alternatives.

However, higher interest rates have made cash attractive once more. For example, money market funds have been getting researched more on Trustnet in recent months and they have been appearing in the most-bought lists put out by the platforms.

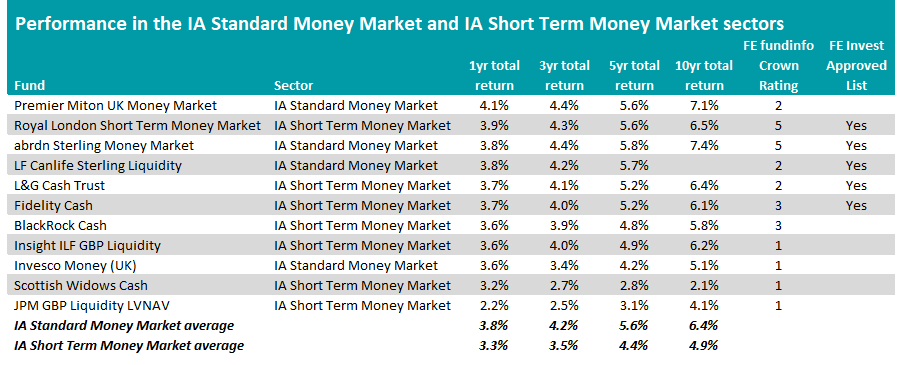

In this article, Trustnet reviews two money market sectors to find funds that have a top FE fundinfo Crown Rating (which identifies funds that have outperformed strongly over three years) and feature on the FE Invest Approved List (funds chosen by the analysts in the FE Investments team).

The table below shows the returns of the 11 funds in the IA Standard Money Market and IA Short Term Money Market sectors over various cumulative time frames to the end of August 2023, ranked by their performance over 12 months.

Source: FE Analytics

At the top of the table is the £263m Premier Miton UK Money Market fund, which has made 4.1% over the past year. It has also outperformed its average IA Standard Money Market peer over three, five and 10 years.

However, the fund only has an FE fundinfo Crown Rating of two. According to FE Analytics, the fund has been more volatile than its average peer and suffered a higher maximum drawdown over the past three years.

The fund placed second on the list – Royal London Short Term Money Market – has made the highest return of the IA Short Term Money Market sector over one, three, five and 10 years, as well as over shorter time frames.

The £6.1bn fund holds the top crown rating of five, has a place on the FE Invest Approved List and has FE fundinfo Alpha Manager Craig Inches as co-manager.

Analysts with the FE Investments team said: “Inches joined the management team in 2016 to offer his expertise regarding rates. Therefore the team now takes into account sensitivity to interest rates and credit to position the portfolio.

“The management team has great access to money market instruments, given the fund size. It is also one of the cheapest funds in the sector.”

Close behind for 12-month returns is abrdn Sterling Money Market, which also holds five FE fundinfo Crowns and is on the FE Invest Approved List.

While the £769m fund is third on the list over the past year, it is also the highest returning member of the IA Standard Money Market sector over three, five and 10 years.

FE Investments analysts said: “One of the key features of the fund is the strong use of bonds issued by non-financial entities. This is unusual for a money market fund as it can add credit risk. Nevertheless, the team has proven over time that it has been very conservative in allocating to those companies.”

Of the remaining funds in the IA Standard Money Market and IA Short Term Money Market sectors, another three are members of the FE Invest Approved List.

However, none also hold five FE Crowns. Fidelity Cash has an FE fundinfo Crown Rating of three and LF Canlife Sterling Liquidity and L&G Cash Trust have two crowns each.

But in addition to its crown rating and FE Invest Approved status, L&G Cash Trust has a ‘Recommended’ rating from Square Mile Investment Consulting and Research, thanks to its defensive characteristics.

“The primary reason investors invest in a money market fund is to protect their capital from losses. We like this fund because it has been set up with a very deliberate focus on capital preservation and liquidity, with income generation considered a secondary objective,” Square Mile’s analysts explained.