The IA Global sector is the most popular area for UK investors, with the average fund in the group garnering assets under management (AUM) of just over £1bn.

But among these giants are some small portfolios that outperform their larger peers. Trustnet found five funds in the sector awarded a five FE fundinfo Crown Rating despite being smaller than £300m in size.

Only the top 10% of the thousands of funds on the market gain a full five crowns after having displayed exceptional alpha, volatility and consistently strong performance over the past three years.

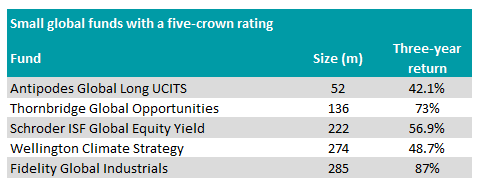

Source: FE Analytics

The smallest fund on the list to gain the top ranking was Antipodes Global Long UCITS, with $52m in AUM. It climbed 42.1% over the past three years, beating the average IA Global fund by 12.3 percentage points, while simultaneously being one of the least volatile – its 11.9% means its performance was the least bumpy on the list.

Antipodes Global Long UCITS is not available to retail buyers, yet there were better performers on the list that are easier for investors to get their hands on.

Total return of fund vs benchmark and sector over the past three years

Source: FE Analytics

Source: FE Analytics

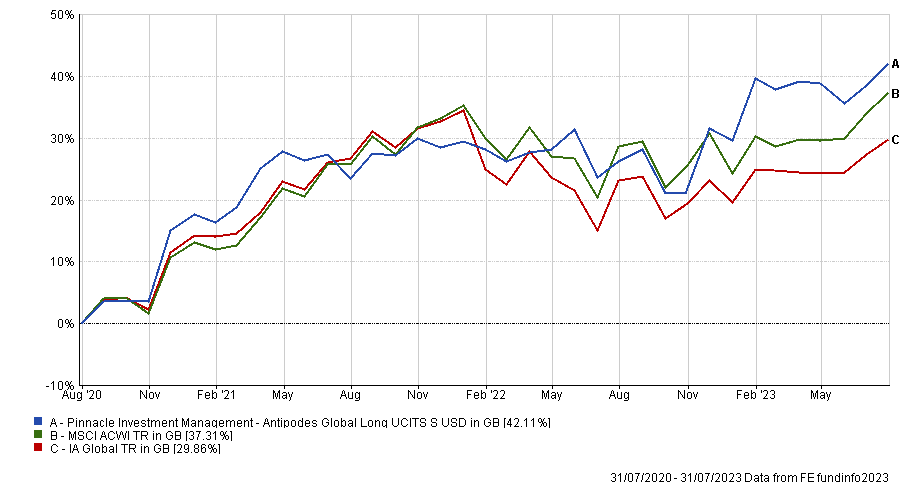

Fidelity Global Industrials delivered the greatest total return over the past three years, soaring 87% whilst its peers trailed almost three times behind at 29.9%.

It was the fourth best performing fund in the IA Global sector over the period, beating 447 of its actively managed peers.

The €285m portfolio run by Ashish Bhardwaj may have been overlooked due to its relatively small size, but this strong outperformance could put it on investors’ radars.

Total return of fund vs sector over the past three years

Source: FE Analytics

Source: FE Analytics

Its focus on cyclical and natural resources industries may not have the broad appeal of more diversified global equity funds, but investors may want to keep an eye if value stocks and particularly commodities continue to surge as they have done in recent years.

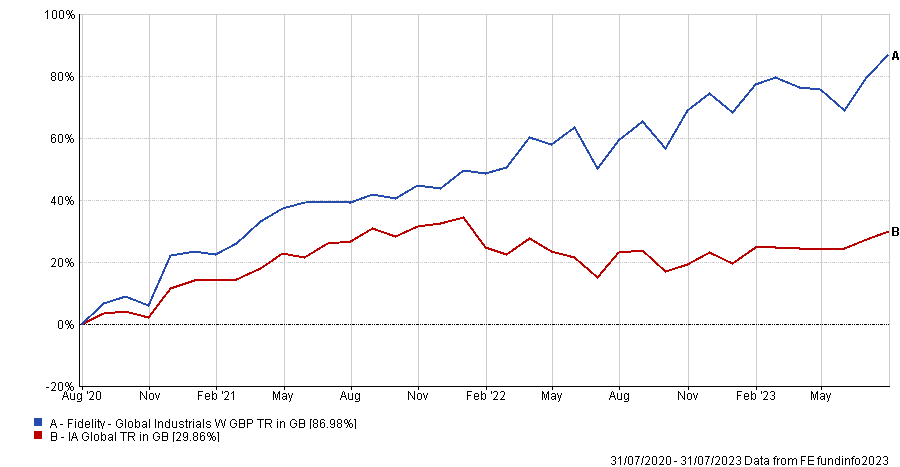

Investors who want a wider scope of investment areas may alternatively want to look at Schroder ISF Global Equity Yield and Thornbridge Global Opportunities, which have AUM of £222m and £136m respectively.

The Thornbridge fund delivered a total return of 73% over the past three years but its manager – Robert Oellermann – has only been at the helm since December last year.

Managers Nick Kirrage, Simon Adler and Liam Nunn, on the other hand, have run the Schroder portfolio for the entire duration of the three-year period, making a total return of 56.9%.

Total return of funds vs sector over the past three years

Source: FE Analytics

Source: FE Analytics

Schroder ISF Global Equity Yield proved itself to be one of the strongest players in the IA Global sector, but its ongoing charges figure (OCF) of 2.61% makes it one of the most expensive.

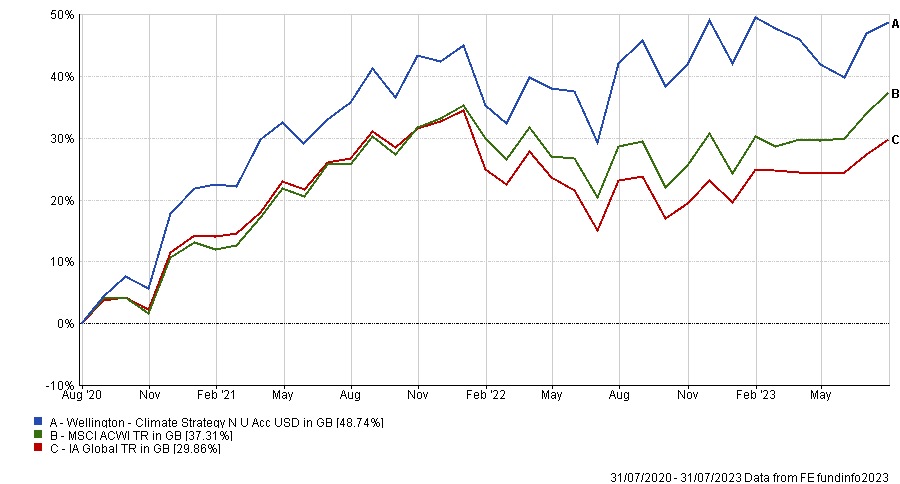

Only one fund on the list had a dedicated environmental, social, and governance (ESG) focus – Wellington Climate Strategy.

The $274m fund contains 43 companies that are contributing to the environmental objective of climate risk mitigation. By investing in this types of businesses, returns have risen 48.7% over the past three years.

Total return of fund vs benchmark and sector over the past three years

Source: FE Analytics

Source: FE Analytics

Wellington Climate Strategy’s five-crown rating makes it stand out from the majority of funds, but having a FE fundinfo Alpha Manager in charge is another eye-catching quality.

Managers awarded the title must have top alpha and consistent outperformance across all the funds they have been responsible for across their career, distinguishing them as expert investors.

This is one of two funds managed by Alan Hsu, running it since launch in 2018. The other is Wellington Climate Market Neutral. He was named Best Responsible Manager at this year’s FE fundinfo Alpha Managers Awards.