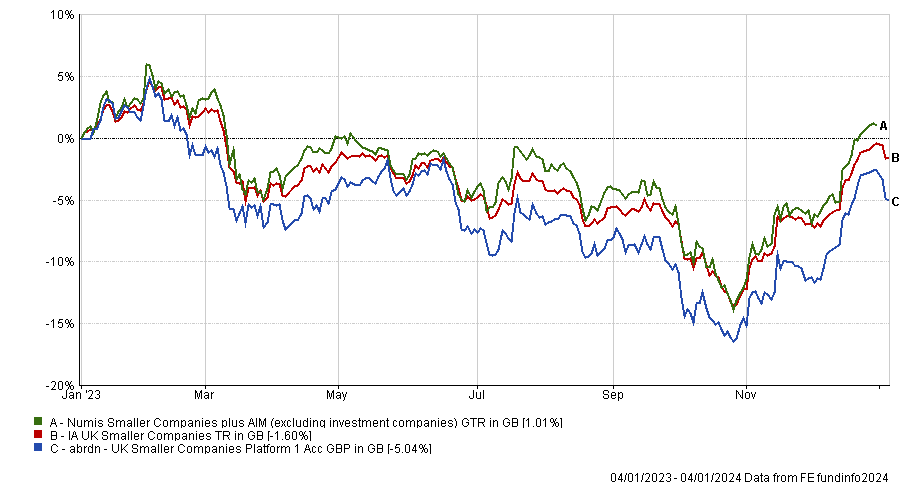

UK smaller companies have been unloved for a long time and funds in the space have struggled. This is something abrdn UK Smaller Companies fund co-managers Abby Glennie and Amanda Yeaman know well, having resided in the fourth quartile of its IA UK Smaller Companies sector over one and three years, losing 5% and 22.6%, respectively.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

FE fundinfo Alpha Manager Glennie is convinced, however, the problem lies somewhere else and there’s nothing wrong with small-caps, and she isn’t alone: all-cap managers are also ditching large caps for their smaller peers.

Below, she discusses what it’s like to follow in the steps of veteran stockpicker Harry Nimmo, who retired at the end of 2022, why the size of the fund isn’t a concern and why she thinks the consumer has been more resilient through the cost-of-living crisis than media are suggesting.

What does your process entail?

We buy tomorrow's larger companies today by looking long term and hopefully finding strong total return businesses that can develop over years. We select those with quality, growth and momentum and we stick to this process through different economic cycles. It has been a challenge in the past couple of years, but it provides clarity for clients about what they are investing in.

The companies we like have good balance sheets, cash generation and attractive margins and are growing sustainably and profitably. We also like businesses expanding into an adjacency. Talking to the management team is key to us and requires a whole set of different skills as well.

What recent changes have you made to the portfolio?

In the past two years, markets have been driven by top-down considerations such as interest rates and inflation and that was unfortunate for us because it’s against quality-growth businesses and more in favour of value businesses.

That has made us a bit more conscious, for instance, about highly-rated businesses which sit on premium price-to-earnings ratios, and more conscious about reducing some of their highest-value exposure.

Sectors have come and gone too. We own less technology than we would have historically and more oil and gas, some of which comes through in the form of services.

We have also been quite positive on the consumer, which is different for us. We thought companies weren’t going to feel the pressure of the cost-of-living crisis the same way that the new newspapers would like us to believe. Not all consumer stocks were going to do well, but we were less concerned. For example, one company we owned last year was bowling and minigolf business Hollywood Bowl, and that’s done well.

What were the best and worst stocks of the past year?

Ashtead Technology, an oil and gas and renewables equipment rental business was our best one. We only bought it at the start of last year, a year after it had come to market, paying £3.10. The price now is £6.12.

It's a really good business. At some point, it will be cyclical, but the cycle is working in its favour at the moment. It took the opportunity to increase prices last year and also made an interesting acquisition.

On the downside, one that we bought last year and have now exited was FDM, which recruits, trains and then deploys staff in different skill sets, particular financial services. We bought it through March at an average price of £8.28 and sold it through December at an average price of £4.80.

What was disappointing about it is that it had a really good first quarter, but then suffered a lot of pressure on demand for people. What we probably got a bit wrong is that this business has really diversified globally and we thought that would help its resilience, but it hasn't. It has seen a lack of demand in every country.

How was it to follow in on the steps of Harry Nimmo?

The last year Harry was with us we had a really difficult performance and markets have not been any more favourable in 2023. But what's important is that Amanda and I have worked with Harry for many years and we’ve stuck with the same investment process.

We've been quite pleased with the asset retention that we've had, even though the market and asset class performance has been tough.

At £900m, the fund is quite sizable. Does that cause restraints?

The fund was soft-closed in 2011 and has been a lot bigger than it is now. The biggest point would have been the end of 2021 when it was £2.2bn.

Markets went down, we've underperformed and had a bit of outflow, so the size has come down. Around £1bn is not small, but isn’t the peak in terms of what we've experienced in the fund.

What do you do outside of funds management?

I play golf and do pottery, where I find some parallels with investing, for example the patience and the perseverance. You think you know how to make a bowl but half the time something will go wrong and you have to say, how do I react to that? Do I correct this or do I have to scrap this one and start again? It was also handy for my Christmas gifts.