UK small- and mid-caps have been the targets of M&A activities in recent years, as valuations have collapsed in this part of the market.

This has reached a point where even quality companies, which were once too expensive for potential acquirers, are now on their radar.

For instance, WS Whitman UK Small Cap Growth – a top ‘young’ UK fund investing with a quality growth bias – has had some of its investee companies taken over in the past two years, including DX Group, Ideagen and Emis.

However, looking for potential M&A targets is not a strategy the manager of the fund, Joshua Northrop, is pursuing. Instead, he is looking to back leading businesses that he believes will come out stronger from this challenging period.

He said: “They are businesses that are taking market share, have better capacity and have invested in their operations. It will really come through in the earnings when we get a better period of economic growth.”

Below, Northrop highlights three UK quality-growth small-caps he feels particularly confident can match his expectations.

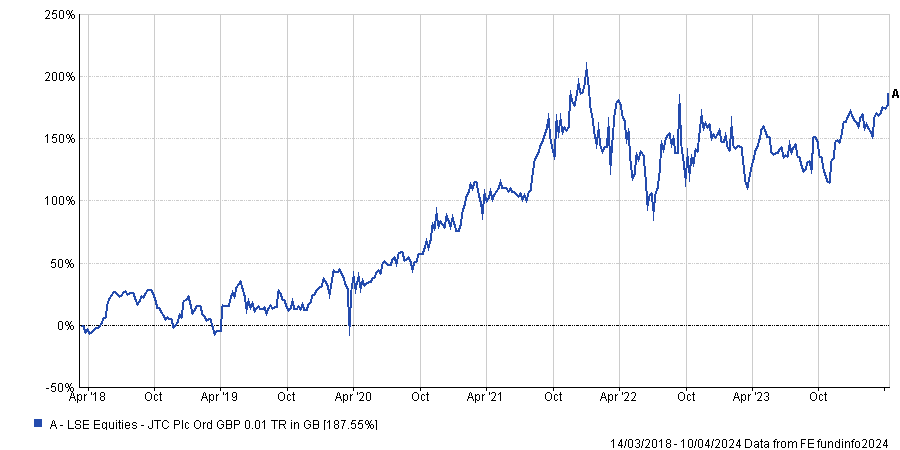

JTC

JTC is a FTSE 250 constituent that was launched in 1987 as a provider of fund management services and currently is WS Whitman UK Small Cap Growth’s largest holding.

Northrop said: “What this company does is basically back office and admin for financial services. It is the market leader in those areas. The nature of the business means its revenues are sticky, it has mid-30% EBITDA [earnings before interest, tax, depreciation and amortisation] margin and just reported organic growth of 20%.

“At the peak of the market, JTC traded on 30x price-to-earnings (P/E), but trades now on 18x. To us, this is high quality and good value.”

Performance of stock since listing

Source: FE Analytics

Another thing he finds exciting about JTC is that it operates globally and recently expanded its activities in the US with the acquisition of a business called South Dakota Trust.

Northrop explained: “This business has a very unique position in the US personal trust sector. It is doing trusts administration for 1,700 high net and ultra-high net worth clients. JTC has just acquired it, which gives the company a fantastic ability to cross sell to that client base.“

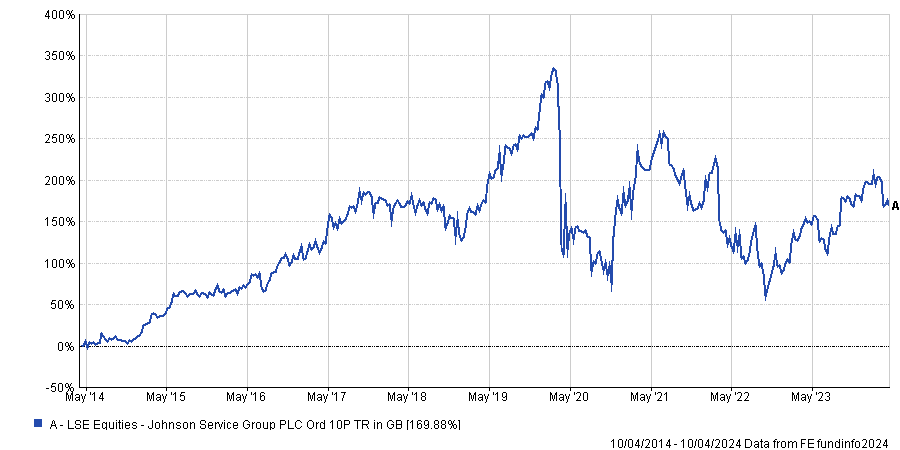

Johnson Service Group

Another stock Northrop highlighted is Johnson Service Group, which is one of the fund’s top five holdings. The company provides textile rental, cleaning and care, but he also highlighted its market leading position in the workwear and hospitality markets.

He said: “It is growing organically and by acquisition. The management team has invested in capacity over the past two years and has opened up a new facility in the southeast for 600,000 items per week. It has also done some M&As with the acquisition of a business in Ireland called Celtic Linen.”

Performance of stock over 10yrs

Source: FE Analytics

Northrop also believes Johnson Service Group’s operating margin is poised to increase in the coming years, as energy prices come down.

He explained that energy bills used to account for 6.5% of the company’s sales but currently stands at 10% because energy costs have surged.

However, he expects operating margin to grow from 10% to 15% when energy bills fall back to 6.5% Johnson Service Group’s sales. He added: “There's a margin story underneath the top line growth story here.”

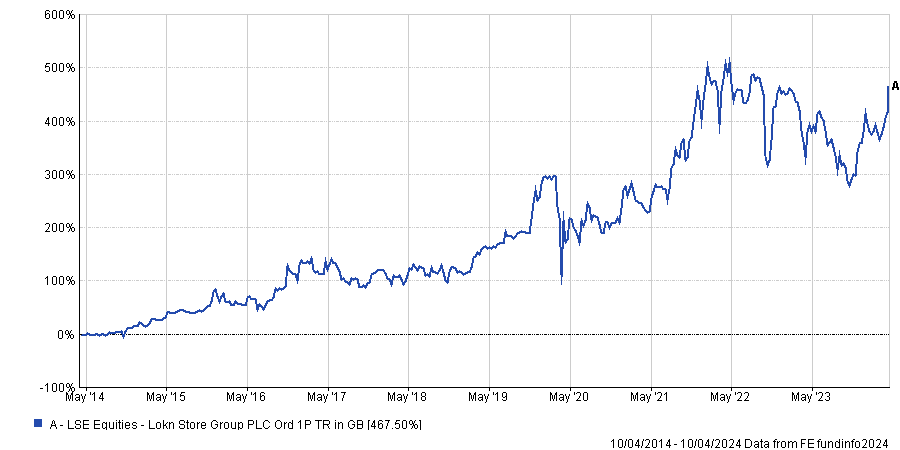

Lok'nstore

A third stock Northrop highlighted is Lok’nstore, which unlike the two previous companies does not feature in the fund’s top five holdings. The company owns self-storage sites and also manage sites on behalf of other owners of self-storage facilities.

Northrop explained that a difficulty in this market is that self-storage sites are expensive to build. However, they are very cheap to run because it does not require a lot of people on-site.

He added: “Lok'nstore owns the vast majority of its sites, but more interestingly, it has a pipeline of new sites. This will lead to a roughly 40% increase in the amount of square footage that Lok'nstore manage and, therefore, a much larger business.

“You can buy this company now at a 20% discount to net asset value, but this net asset value is going to go up over the next six or seven years by at least 50%.

Performance of stock over 10yrs

Source: FE Analytics

While properties in the UK have suffered in recent times, Northrop does not believe self-storage is exposed to the same headwinds.

He explained: “There's a structural under supply of self-storage, which is different from commercial property or other areas of the property market. That’s why we think this discount to NAV is wholly unwarranted.”