Investors locked out from accessing the JOHCM UK Dynamic fund for several years now have an opportunity to buy the fund.

Initially soft closed to investors in December 2019 after it reached its optimum size of £2bn, managed Alex Savvides told Trustnet that it has been reopened after a tumultuous couple of years.

“Since then of course we've had some pretty major issues in the world, i.e. Covid and particularly for the style of investing that I run it led to a tricky period in 2020, much better in 2021, but tricky in 2020,” he said.

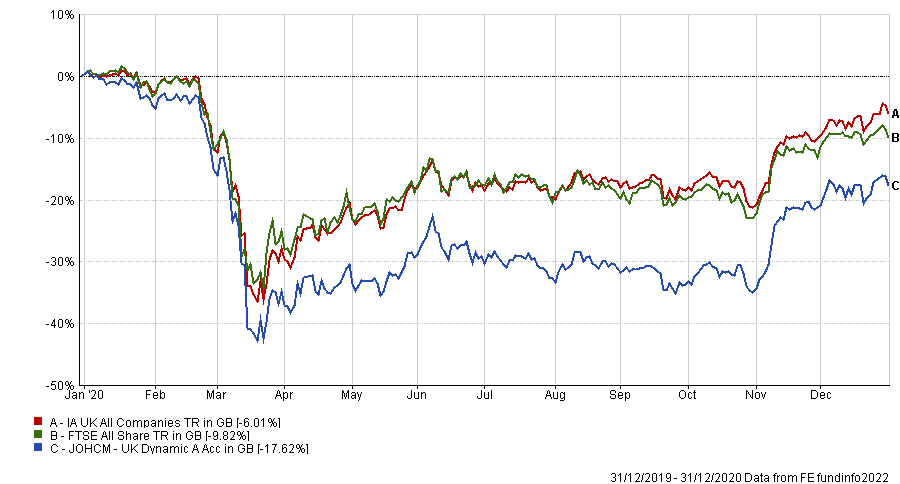

In 2020 the fund lost more than the sector average, 17.6% versus 6% in the IA UK All Companies. This was a break away from the fund’s long-term track record. Since it launched in 2008 it has made 246.3%, beating the sector’s 141.1% total return and the FTSE All Share’s 135.2%.

Performance of fund vs sector and benchmark in 2020

Source: FE Analytics

The firm uses soft closures to make sure that managers are focused on performance rather than increasing assets as much as possible, a strategy many agree with.

But this run of poor performance has caused the assets under management to drop to £1.4bn, freeing up enough capacity to reopen the fund new investors. JO Hambro has also reopened JOHCM UK Equity Income, which soft closed in 2013.

The fund has increased its maximum capacity ahead of the reopening to £2.75bn, which Savvides said had been stress and liquidity tested.

Below, the manager explains why his stock picking approach is better than a thematic fund, why he has fought some lonely battles against companies bidding for his holdings and why he does not feel the need to throw a “sustainable” badge on his portfolio, despite using environmental, social and governance (ESG) principles.

What is your stock picking process?

Our process is solely focused around business transformation: companies that are underperforming, where expectations are low and there is some disappointment in the share price but they are going through a through strategic change and can turn around the outlook for that company. Typically this involves new management with a plan to improve cash generation, revenue, growth possibilities and return on capital.

Why should investors pick your fund versus other UK equity portfolios?

We have a consistent approach which has been proven over many years and requires a lot of discipline and patience, which I think differentiates us. We don’t get pushed or pulled around in different directions, chasing a particular theme or flavour of the day because we know what companies we are looking for.

We also have a level of responsibility with our stewardship which I don’t think is matched across our peers. We take our responsibilities as investors and owners of these stocks very seriously. We're not passive owners of companies, which we’ve proven recently by publicly disputing several bids for companies in our portfolio including Morrisons, St Modwen and DGMT, where we fought some lonely battles to get a revision in the bid price.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

What have been your best and worst calls in the past year?

In absolute terms our best holding was Man Group. It is a fairly tech-enabled, quantitative-based fund management company and has been transforming for many years. Under Luke Ellis, the past five years have had a material transformation, particularly with the acquisition of Numeric, which has helped broaden out its asset allocation decisions and supported the quantitative investment strategy. The company made 51.3% in the past 12 months.

The worst performer was Hive, which works in the events industry, an area which has obviously struggled with Covid with everything closing down and the travel restrictions. So it has been a struggle for that company, but the management team are doing their best to try and fix the situation, I daresay it'll be a much improved 2022 for that company. The company has lost 35% in the past 12 months.

What is the most exciting stock in the fund?

We try not to get too excited about stocks in the portfolio just in case we get emotionally involved. But I do think that a lot of our FTSE value names offer a lot of opportunity, so a company like Land Securities, although you might not think an office and property retail developer is exciting.

It has had a torrid few years but its new management has made material changes, selling out of some central London offices at high valuations and recycling capital into other prime retail or urban, mixed-use locations.

It is trading on a 30% discount to net asset value but this has now stabilised for the first time in many years and is starting to move up slowly. That is a genuinely interesting situation to me and one to watch.

Are there any sectors you won’t invest in?

We don’t have the sort of philosophy that we won’t invest in certain sectors. Our process takes us anywhere that there is material, strategic management change we will be interested in.

There is only one sector that we haven't delivered a relative return from since launch and that's utilities. It’s not a particularly large sector in the UK but it's not a sector that has offered this fund many opportunities in the past. That does not mean we have stopped looking however.

What frustrates you most about the investment industry?

The way money moves nowadays is very frustrating. I think sadly, the evolution of factor investing has dumbed down single stock investing and made it less relevant. I am probably the most micro, bottom-up investor that you will find, myopically focused at what is going on at a company level, and sometimes that pales into insignificance relative to what a company's macro exposures are or what factor exposure it has, whether it be value or growth, momentum or quality.

This factor or theme investing can often miss the bigger picture of what is going on intrinsically within a company, but it is a source of deep profit for investment banks which sell these factor-linked ETFs. But I’m not sure how healthy this type of investing is over time, in my humble opinion.

Do you incorporate ESG into the fund?

Yes we do. To us, ESG means investing in a fairly responsible way at a fund and corporate level. We think about it more holistically in terms of a company’s sustainability mindset, mapping out their impacts on society and dealing with them systematically. I think ESG to the majority of the market is about carbon at the moment.

So, is a sustainable mindset integrated into the portfolio? Absolutely. Do we need to call ourselves a sustainable fund to be that? Absolutely not.

What are your hobbies outside of fund management?

Any hobbies I did have, like going to watch Chelsea or kickboxing or running , have been taken over by my three young children now.