UK companies have been the laggards of the global market for years, but such poor performance has caused the vultures to circle and investors should take note, according to FE fundinfo Alpha Manager Ken Wotton.

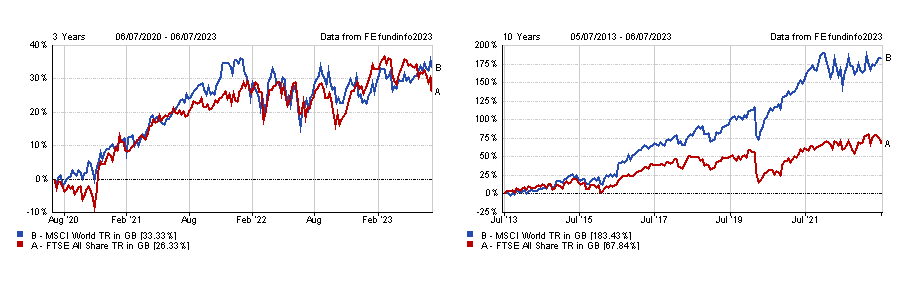

The underperformance has been stark. Over the past three years, the FTSE All Share is 7 percentage points behind the MSCI World index, compounding a trend that has been ongoing for more than a decade. Indeed, over 10 years, UK stocks have made around a third of the returns of their global peers.

After Brexit, Covid-19 and the war in Ukraine, investors have shunned the domestic market in favour of safer pastures. Add to this rising interest rates to combat sticky inflation and the macroeconomic picture remains far from certain.

Performance of indices over 3 and 10yrs

Source: FE Analytics

While investors continue to move away from the UK, companies are taking a closer look and making myriad of mergers and acquisitions (M&A).

It is a trend that has been ongoing since the Brexit vote in 2016, with the number of deals jumping from below 1,000 per year to more than 1,500 in 2018, and breaching the 2,000 mark in 2021.

“Although activity dipped slightly in 2022 due to geopolitical concerns, and later in light of rising interest rates, dealmaking has restarted in earnest with 356 deals of more than $1m in value in the first quarter of 2023,” said Wotton.

Below, the manager of the Strategic Equity Capital investment trust looks at three sectors where more activity is likely.

Healthcare

An ageing worldwide population provides a structural reason to back the healthcare sector, despite not being immune to the economic headwinds affecting global markets.

Smaller companies have been adversely affected by the latter, with investors largely ignoring the former, said Wotton, particularly compared with private equity.

“Amid this backdrop, we have been taking advantage of the significant discount the market has applied to some smaller UK companies compared to their private market counterparts,” he said.

Trading at a more than 50% discount to similar private businesses, Medica, a provider of outsourced X-ray services, is one such company he is keen on, taking a 20% stake in the company.

“Medica's sales have more than doubled over the past five years, as the trend for outsourcing the provision of medical goods and services has gained momentum. Earnings before tax, depreciation and amortisation (EBITDA) growth has been steady except for 2020, when Covid-19 affected normal operations,” Wotton said.

“Our view was validated when Medica recently received and accepted a £269m cash bid from private equity group IK Partners.”

Wealth managers

An area that has already had a significant amount of movement is financial services and the wealth management industry could continue to consolidate, the Strategic Equity Capital manager said.

There were 341 deals across the sector in 2022, an 11% increase from the previous year, with nearly 70% of those transactions involving private equity buyers.

“In this environment, discounted financial services businesses capable of multi-year growth are likely to stand out to potential acquirers. Brooks MacDonald, a UK investment management firm, provides a good case study for this price arbitrage opportunity,” Wotton said.

“Despite strong cashflows, structural tailwinds and a diversified return profile, the company trades at a significant discount to its unlisted peers. For example, the business currently trades at less than half the multiple Brewin Dolphin was recently acquired at by Royal Bank of Canada, despite both companies having ostensibly similar strategies.”

Performance of stocks vs sector over 5yrs

Source: FE Analytics

Advice

Another area of financial services having a renaissance are consultants and advice firms, with private equity firms ploughing into the sector last year.

“Within the sector, several niche areas are benefiting from structural growth tailwinds, with pension consultancies offering advisory services to trustees emerging as an alluring prospect,” Wotton said.

One example is XPS Pensions, which provides specialist advice to defined benefit (DB) occupational pension schemes. It has been boosted by regulatory factors and the increasing complexity of running DB schemes, as well as benefiting from inflation.

“However, its current valuation on a high single-digit enterprise value-to-EBITDA multiple represents an attractive discount to its peers – as well as to the multiples seen in M&A activity in the sector,” the manager said.