On 9 November 2020, the world breathed a sigh of relief as it seemed that the Covid-19 crisis had an endpoint as the Pfizer/BioNTech vaccine reported having a 90 per cent efficacy in protecting people from transmission of the virus.

With several effective coronavirus vaccines being announced in quick succession, what happened after was a significant reversal in fortunes for the stocks and areas that had been so badly hit by the pandemic and, after a decade of underperformance, value investing came back in fashion.

With a rough end-date in sight, investors piled into undervalued names in anticipation of a re-opening of global economies in the spring and summer of 2021.

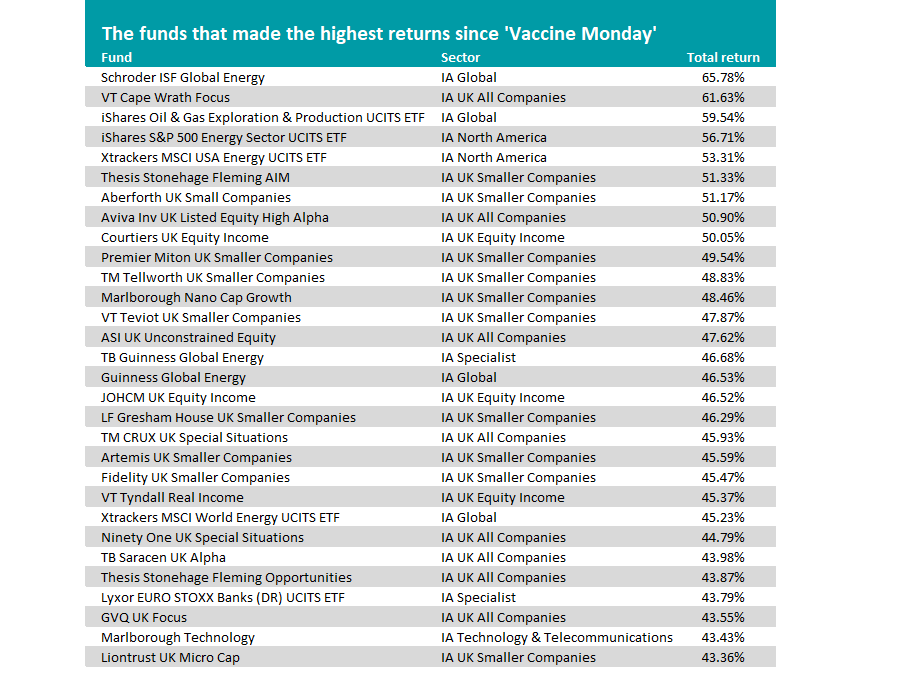

With that in mind, Trustnet wanted to see who the biggest beneficiaries of this swing had been across the Investment Association (IA) sector since that fateful Monday back in November.

At a broad level, it was the performance of UK funds in the top performers that is most noteworthy, after years of undervaluation, a resolution on Brexit and an end to the Covid crisis made UK equities look quite attractive.

This is quite clear in the data as 20 out of the top 25 performers were UK funds.

Top performing IA funds since 9 November 2020

Source: FE Analytics

The top performing fund since 9 November was the £263m Schroder ISF Global Energy fund, which has been managed by Mark Lacey since 2013. Investing in equity and equity-related securities of global energy companies, the fund has made 65.78 per cent over the time period.

The energy sector was one of the hardest hit sectors in the early days of the pandemic as global travel, both personal and commercial, was halted in response to nationwide lockdowns. Energy stocks had been under pressure before this and the fund had made a heavy loss in the five years before the coronavirus crisis owing to a falling oil price.

However, energy stocks have rallied hard in the ‘re-opening trade’ as investors anticipate a spike in economic activity and the consumption of commodities. This is reflected in the fact that funds such as iShares Oil & Gas Exploration & Production UCITS ETF and iShares S&P 500 Energy Sector UCITS ETF are also up more than 50 per cent since ‘Vaccine Monday’.

The second best performing fund, and highest performing UK fund in the list, is the £7.6 VT Cape Wrath Focus fund, overseen by Adam Rackley. It has made 61.63 per cent.

The fund follows a value philosophy, looking for situations in which investors have over-reacted to events and where valuations no longer reflect company fundamentals.

According to Cape Wrath Capital, the best opportunities are often found after a period of disappointment has created emotional reasons not to invest.

Tobacco company, Imperial Brands, is its largest holding at 6.1 per cent.

Several members of the IA UK Smaller Companies sector are found on the list of the best performers, including Marlborough Nano Cap Growth, which made a total return of 48.46 per cent since 9 November.

Managers Guy Field and Eustace Santa Barbara also run the Marlborough Special Situations fund, which has been a strong performer for investors over the long-term.

Other well-known UK smaller companies strategies on the list include the £113.3m Thesis Stonehage Fleming AIM and £213.5m Premier Miton UK Smaller Companies funds.

The Thesis fund, formerly known as the TM Cavendish AIM fund, is run by veteran UK manager Paul Mumford and Nick Burchett - and posted a return of 51.33 per cent over the same period.

Investing mainly on the UK Alternative Investment Market, (AIM) Mumford runs a diversified portfolio of shares spread across multiple sectors of AIM.

“Although the last year has been a difficult one to contend with, most companies have adapted well and used the opportunity to cut costs and improve efficiency,” he said.

“Obviously, some sectors have been better placed than others and difficulties will remain in a few areas of the economy.”

Gervais Williams, who runs the Premier Miton fund, has overseen a 49.54 per cent return since 9 November.

Both Williams and co-manager Martin Turner run the closed-ended Miton Micro Cap trust, which has been in the top quartile of its sector over 2020 and 2021.

The £80.4m Marlborough Technology fund is the only addition from the IA Technology & Telecommunications sector.

Six months ago, the fund was taken over by Guy Field, and Richard Hallett and since 9 November has returned 48.01 per cent.

The fund focuses on smaller names and more than a third of which are UK companies.