Baillie Gifford has topped FundCalibre’s Fund Management Equity Index for the first time, following an exceptional run of performance in 2020.

The index, which is now in its seventh year, sees FundCalibre’s research team aims to identify the asset management companies that have the most consistently strong stock-picking teams.

It examines all actively managed equity funds within the Investment Association universe and compares their five-year returns with their sector averages. Each group’s funds are grouped together to calculate its average fund performance and companies must have a minimum of four qualifying funds to be included in the index.

For the past three years, FundCalibre’s Fund Management Equity Index has been led by Morgan Stanley. However, a strong showing in 2020 means that Baillie Gifford has come out in first place in the latest edition, with Morgan Stanley slipping into second.

Baillie Gifford’s funds were among the best performers in many sectors last year, including the competitive IA Global sector. Four of the sector’s five best funds were run by the firm: Baillie Gifford Long Term Global Growth Investment, Baillie Gifford Positive Change, Baillie Gifford Global Discovery and Baillie Gifford Global Stewardship.

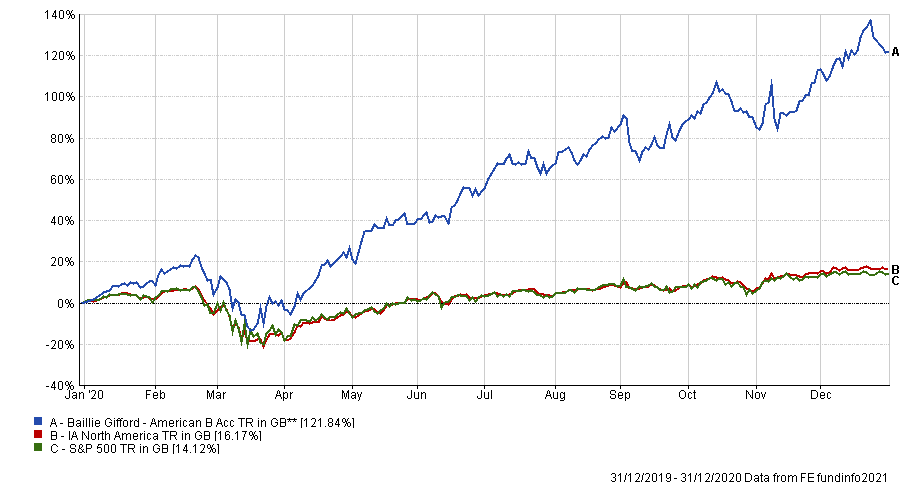

Performance of fund vs sector and index in 2020

Source: FE Analytics

But the standout performer was Baillie Gifford American – it made 121.84 per cent in 2020, which was the highest total return of the entire Investment Association universe.

The group thrived in 2020 thanks to its quality-growth approach and a preference for innovative companies in the tech space. This meant Baillie Gifford’s funds were holding many of the ‘coronavirus winners’; for example, the company is the one of the biggest shareholders in Tesla, which surged more than 700 per cent last year.

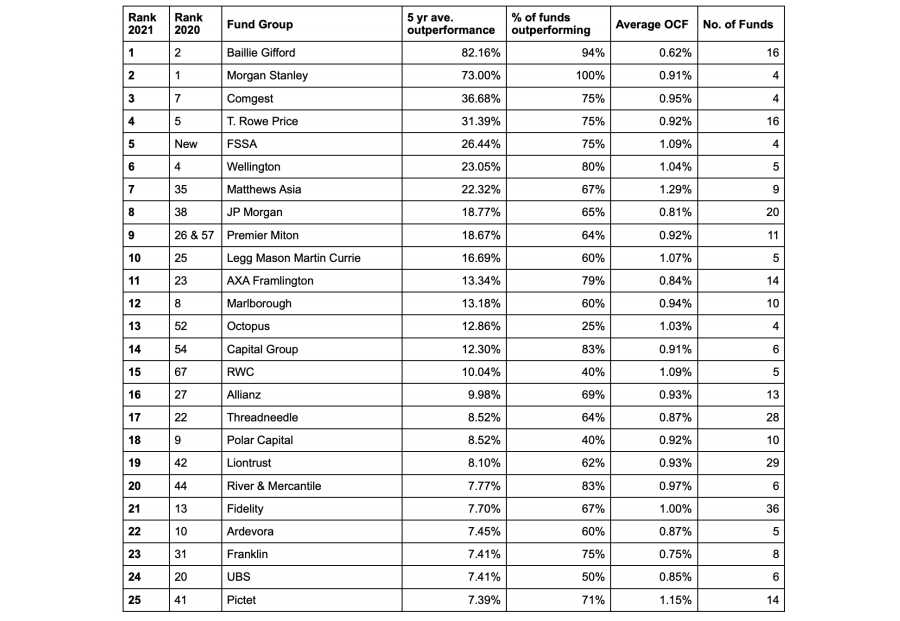

FundCalibre’s research has the average Baillie Gifford fund beating its sector by 82.16 percentage points over the past five years. This is 100 percentage points higher than the worst-performing company in the research.

Darius McDermott, managing director of FundCalibre, commented: “Agility, flexibility and good stockpicking skills were key in the 12 months of 2020 and research from Quilter found that active equity managers outperformed market indices in seven of the 10 major Investment Association equity sectors.

“FundCalibre’s research goes one step further, demonstrating that 2020 wasn’t just a lucky year for active management, or indeed Baillie Gifford whose performance in 2020 has raised questions as to whether it can be repeated. While the level of outperformance may drop, it is still highly likely the outperformance will remain. Over five years the average outperformance of Baillie Gifford’s equity funds is almost 10 per cent more than the second-placed company and almost 50 per cent more than the firm in third.”

FundCalibre’s Fund Management Equity Index

Source: FundCalibre

McDermott highlighted several other key findings from this year’s Fund Management Equity Index, including the consistency of Baillie Gifford and T. Rowe Price’s outperformance. Both have been in the research’s top-10 companies in each of the seven annual surveys.

“That shows consistently excellent stockpicking skills and value added for investors,” he added. “Both are also larger groups with 16 qualifying funds each – maintaining such a level of consistency across that many products is extremely impressive.”

However, five fund management houses – Baillie Gifford, Morgan Stanley, Comgest, Wellington and T. Rowe Price – were in the top-10s for both the 2020 and 2021 rankings. McDermott said it is important than these five firms are a mixture of both large and small, showing that active managers can outperform using a variety of business models.

That means five groups are new to the top-10 in the latest edition: FSSA, Matthews Asia, JP Morgan, Legg Mason Martin Currie and the newly combined group Premier Miton. McDermott described Legg Mason Martin Currie’s rise as “phenomenal”; the group climbed 26 places in the previous research and another 25 places in the latest edition.

Finally, FundCalibre said the research highlights how important fund charges are.

“Baillie Gifford also has the cheapest charges of any of the companies in the survey,” McDermott explained. “Charges matter as they compound over time, so having a lower charge really helps performance as well as demonstrating a really good attitude of putting the client first.”