Government bonds and bond yields

Latest News Image - with Title format, Latest News Image - with Title format

Latest News Image - with Title format

Malik also warned that there could be further commotions in the future and expects credit funds with significant exposure to the real estate sector to run into problems. This is the case of Zhongrong International Trust, for example, a major Chinese investment trust that has recently missed payments to corporate investors.

Malik said: “You're going to see more of those credit funds, which have bet the whole house on property, run into trouble. That is inevitable. But to say, that the whole sector is going to collapse is a big stretch, at least for now.”

While Malik does not exclude that things could get even weaker before they get better, he said that the risk-reward ratio of Chinese equities is currently very attractive.

He added: “As long as investors are willing to stomach the fact that there could be more volatility, today's prices are very attractive relative to other major equity classes.

“Considering where Chinese equities stand right now, you at least have the possibility of a re-rating in valuation multiples. If you target structural growth areas, you can get access to good quality compounding stocks trading at their cheapest prices in 10 years.”

A thing that could help Chinese equities in the short-term for Malik is more transparency and a clear plan from the government.

Malik said: ”It doesn't help that China is not disclosing certain data points. The Chinese have stopped reporting consumer confidence and youth unemployment data. That is exactly the wrong signal to be sending in this situation and I don't offer a defence for that.

“We need a plan from the government on what they are going to do about the property developers and distressed assets. That confusion is not helping Chinese equities.

Expected size image

Expected size image

Big Image Big Image Big Image

Big Image Big Image Big Image Big Image Big Image

Source: FE Analytics

Yet, Sharukh Malik, manager of the Guinness Best of Asia and Guinness Greater China funds, claimed that this crisis in the Chinese property sector is mostly government-induced and manageable.

He said: “Property has accounted for about 20% to 25% of GDP over the past few decades, therefore, the government was fine with letting the property sector drive a big portion of the economic growth. But that has led to a debt build-up that needed to be addressed at some point.

“Back in 2020, when the Chinese economy was probably the strongest major economy worldwide, the government thought it was time to rein in the property developers and try to stop the bubble in a controlled manner.”

The positive side of the situation, according to Malik, is that nearly three-quarters of property developers’ debt is owned by Chinese state-owned banks and the rest by credit funds. It means loans could be extended by 10 years to give time to property developers to work through their issues.

Small Image Small Image Small Image - Small Image

Small Image Small Image Small Image

Screenshots Screenshots Screenshots

Screenshots Screenshots Screenshots

The Chinese property market is the largest asset class in the world, with an estimated market value of $62trn. In comparison, the S&P 500’s market value is $15.6trn. Therefore, a collapse of the Chinese real estate sector would have wide implications not just domestically buy far outside of China.

According to Standard & Poor’s, about 50 Chinese property developers have defaulted on debt payment in the past three years. A direct casualty of those commotions have been Chinese equities, with the MSCI China falling 9.5% year-to-date.

Largest Image Largest Image Largest Image Largest Image

Largest ImageLargest Image Largest Image Largest Image Largest Image

Country Garden, one of China’s largest property developers, reported a loss of between 45bn and 55bn Chinese Yuan (£4.9bn and £6bn) for the first half of the year. This compares with earnings of around 1.9bn Yuan (£206m) during the first half of 2022. The company also announced it had missed interest payments on two bond payments.

The Chinese property market is the largest asset class in the world, with an estimated market value of $62trn. In comparison, the S&P 500’s market value is $15.6trn. Therefore, a collapse of the Chinese real estate sector would have wide implications not just domestically buy far outside of China.

According to Standard & Poor’s, about 50 Chinese property developers have defaulted on debt payment in the past three years. A direct casualty of those commotions have been Chinese equities, with the MSCI China falling 9.5% year-to-date.

Performance of index YTD

Largest one

Largest one

Gallery image - Large Gallery image - LargeGallery image - Large

Gallery image - Large Gallery image - Large v Gallery image - Large Gallery image - Large Gallery image - Large

Gallery image 3

test test test test test test test test test test test test test test test

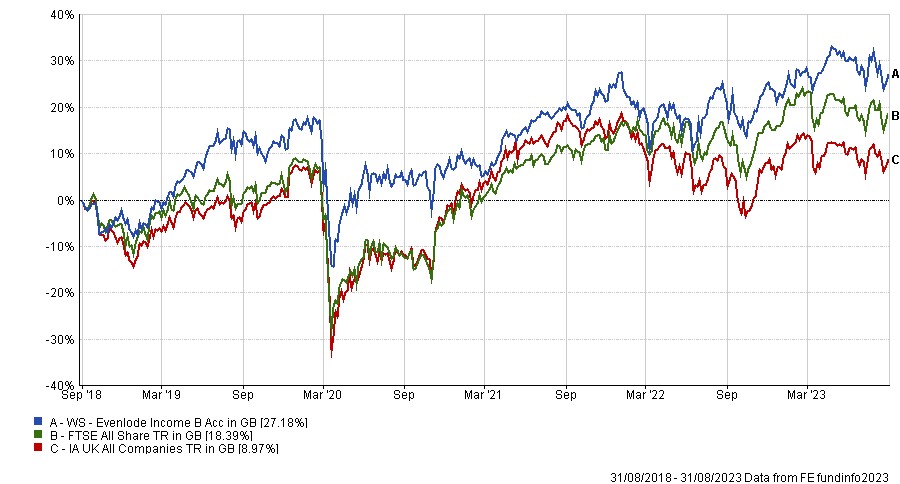

Total return of fund vs benchmark and sector over the past five years

Jonathan Winton was lead manager for most of that period, taking over from Alex Wright (who he worked alongside since 2014) in 2019, but researchers at Square Mile raised concerns around “his relative inexperience as a fund manager operating in a highly specialist area of the market”.

Nevertheless, Winton’s ability to generate a return that outpaced inflation in an especially challenging environment for his asset class soothed their concerns.

“We continue to take comfort from his focus on downside risk and the subsequent protection of capital during times of market distress, which we view as an extremely sensible approach in what has, historically, been a volatile asset class,” the Square Mile researchers said.

“The philosophy centres around the principle that markets can be slow to react to a changing situation of companies and therefore the manager searches for unloved firms that are entering a period of positive change. The manager is essentially looking to purchase companies before the market has recognised their prospects for improving growth.”

Two of the expert fund pickers Trustnet spoke to highlighted one fund on the list as a standout portfolio – WS Evenlode Income. It was up 27.2% over the past five years, beating the IA UK All Companies sector average by 18.2 percentage points.

Rob Morgan, chief investment analyst at Charles Stanley, said the fund’s “straightforward, repeatable strategy” gives investors “a growing income with capital growth on top”.

He added: “The managers focus on what they call cash compounders – businesses able to generate high returns on their investments without the need for debt.

“Focusing on cash generation helps them avoid many of the pitfalls in the UK market, and although the fund can suffer at times from holding more expensively valued companies, owning these higher-quality businesses has helped weather the turbulent markets of the past few years.”

Gallery Image1

Gallery gallery gallery

Thanks Image

Yet, Sharukh Malik, manager of the Guinness Best of Asia and Guinness Greater China funds, claimed that this crisis in the Chinese property sector is mostly government-induced and manageable.

He said: “Property has accounted for about 20% to 25% of GDP over the past few decades, therefore, the government was fine with letting the property sector drive a big portion of the economic growth. But that has led to a debt build-up that needed to be addressed at some point.

“Back in 2020, when the Chinese economy was probably the strongest major economy worldwide, the government thought it was time to rein in the property developers and try to stop the bubble in a controlled manner.”

The positive side of the situation, according to Malik, is that nearly three-quarters of property developers’ debt is owned by Chinese state-owned banks and the rest by credit funds. It means loans could be extended by 10 years to give time to property developers to work through their issues.

Malik said: “That's quite different to the Western financial system where we don't really have state-owned banks. In China's case, as it has done in the past, it can give itself a decade if it needs to build a breathing space for the property developers.

“At least for now, it's unlikely that the weakness in the property market will lead to a contagion within the financial system, because it's mostly a debt Chinese owe to themselves.”

The negative side of the real estate sector crisis is that it could harm the Chinese long-term growth story, as it would extend the life of firms that should go bankrupt today.

The Chinese property sector is once more causing concerns as Country Garden has become the latest property developer to face financial difficulties, two years after the Evergrande’s liquidity crisis.

Country Garden, one of China’s largest property developers, reported a loss of between 45bn and 55bn Chinese Yuan (£4.9bn and £6bn) for the first half of the year. This compares with earnings of around 1.9bn Yuan (£206m) during the first half of 2022. The company also announced it had missed interest payments on two bond payments.

The Chinese property market is the largest asset class in the world, with an estimated market value of $62trn. In comparison, the S&P 500’s market value is $15.6trn. Therefore, a collapse of the Chinese real estate sector would have wide implications not just domestically buy far outside of China.

According to Standard & Poor’s, about 50 Chinese property developers have defaulted on debt payment in the past three years. A direct casualty of those commotions have been Chinese equities, with the MSCI China falling 9.5% year-to-date.

Thank you for watching