Growth stocks are only too expensive if they fail to deliver, says Artemis Fund Managers’ Cormac Weldon, who believes the current low-rate environment is perfect for the investment style.

Since the start of the year, US blue-chip growth stocks have outperformed their peers strongly – rallying harder on the back of measures to support the economy in the coronavirus pandemic.

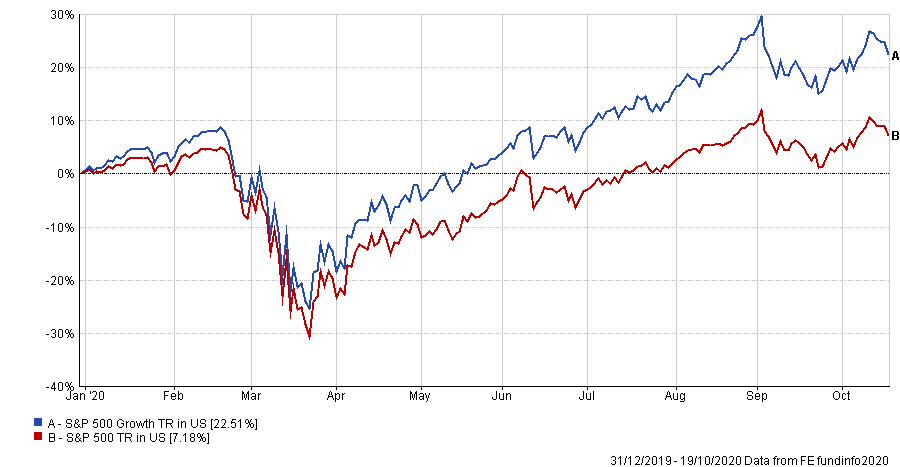

As the below chart shows, the S&P 500 Growth index has made a total return of 22.51 per cent – in US dollar terms – compared with a 7.18 per cent gain for the broader index.

Performance of indices YTD

Source: FE Analytics

Valuations of growth stocks in the US remain elevated because interest rates are low and investors are confident that they will remain so – particularly given the noises from the Federal Reserve – according to Weldon, manager of the £2bn Artemis US Select fund. The manager noted that the yield on 10-year US Treasuries is low and will likely remain low for some time to come, which impacts the discount rate – the rate used to value future cash flows.

As such, the environment is “perfect” for growth investors, said Weldon (pictured).

“The discount rate you use for valuing – in particular – growth companies has come down, which means those growth companies are more valuable," he added.

“Are some of the high growth equities far too expensive? Sure, especially those that don’t deliver. And we know that with growth companies there’s an attrition rate. But if they deliver what’s expected of them, we think that some of those valuations are entirely justified.”

Weldon continued: “What I’m saying is, we’re not looking at some of our growth equities and saying: ‘This is absurd, we must sell them’ and go elsewhere.

“Some of them, we think, are still quite attractively valued.”

The Artemis US Select manager said while the economic recovery from the pandemic hasn’t been smooth, with the cases of coronavirus continuing to be recorded, the economy is nonetheless moving in the right direction.

However, there are also opportunities for more companies in more cyclical industries and sectors given the economic recovery and Weldon said his stockpicking approach has therefore led to a barbell-shaped portfolio.

While there is more cyclicality in the portfolio currently, Weldon said he is making investments on a case-by-case basis.

Banks, for example, a typically cyclical sector, are underweight in the portfolio despite strong earnings because of the headwind of lower interest rates.

“Usually coming out of an economic recovery, you’d want to own more banks than we do now,” he said, but the low-rate environment is putting pressure on their net interest margins.

On the other hand, Weldon is more bullish about industrial stocks, which counterintuitively are performing well in the current environment due to low inventory levels.

“An interesting and different aspect of this recession and recovery is that usually in an economic recession you end up with too much inventory in the economy,” he said. “So, imports into the US went to very low levels, but demand actually kept up at a reasonable level.

“If I give the example of Caterpillar, it makes those big yellow pieces of machinery then sells them to a dealer who sells them to an end customer. So, Caterpillar actually makes money on the initial sale.

“If there’s too much inventory in the dealer network as the economic recovery starts, demand benefits the dealer rather than Caterpillar because they’re not making new trucks until that inventory is cleared. That’s not the case this time.

“The inventory is much leaner which means that when somebody goes to buy a big yellow piece of equipment and Caterpillar's then manufacturing one and replacing it immediately.”

A more robust economy should also fare well for equities down the lower end of the market cap scale, he said, even if they have underperformed so far this year.

Year-to-date, the Russell 2000 index has underperformed its large-cap peers in the S&P 500, making a loss of 2.54 per cent in US dollar terms, compared with a 7.18 per cent gain for the blue-chip index.

Performance of indices YTD

Source: FE Analytics

However, it could all hang on who occupies the White House after the presidential elections in November, said Weldon, who also oversees the £549.9m Artemis US Smaller Companies fund.

“The Russell 2000 has had some better days recently but it’s still underperformed large-caps,” he said. “Part of that is because there’s a lot of low-quality companies in the Russell 2000, which obviously we seek to avoid.

“At this point, it’s looking more like a Joe Biden victory and there’s good and bad news and if he gets in.

“There’s likely to be significant stimulus an infrastructure bill perhaps aimed around green energy. But the downside is [that] Biden’s also said he’s going to raise taxes and that’s obviously [imapcts] on domestic profits and smaller companies are more exposed to that.

“We’re assuming taxes go up and that, as a consequence, earnings numbers will be somewhat lower. So, we’re adjusting for that.

“I would say it’s not at all given that Biden will do that in his first year. Typically, presidents get to have maybe two big pieces of legislation before the midterms.

“Now, part of that depends on the nature of Congress [and] if the Democrats win the Senate as well.

“But even there, the Democratic Party or the Republican Party is not a single entity. The house tends to lean left: Democratic senators tend to be more centrist and, indeed, some Democratic centrists would be mistaken for centrist Republicans because they come from a conservative state and will vote accordingly.”

Performance of fund vs sector & benchmark since launch

Source: FE Analytics

Since launch in September 2014, the five FE fundinfo Crown-rated Artemis US Select fund has made a total return of 169.29 per cent compared with a 133.14 per cent gain for the S&P 500 and a 119.63 per cent return for the average IA North America peer.

The fund has an ongoing charges figure (OCF) of 0.85 per cent.