Fundsmith’s Terry Smith is up against stiff competition from the likes of Fidelity International technology specialist Hyunho Sohn and Stewart Investors’ David Gait for the title of overall Alpha Manager of the year in 2024, according to FE fundinfo.

They will compete against Julian Fosh and Anthony Cross, who lead Liontrust’s Economic Advantage team, and Robin Parbrook, who runs Schroder Asian Discovery and Schroder Asian Total Return, all three of whom have been nominated for the second year running in the headline category.

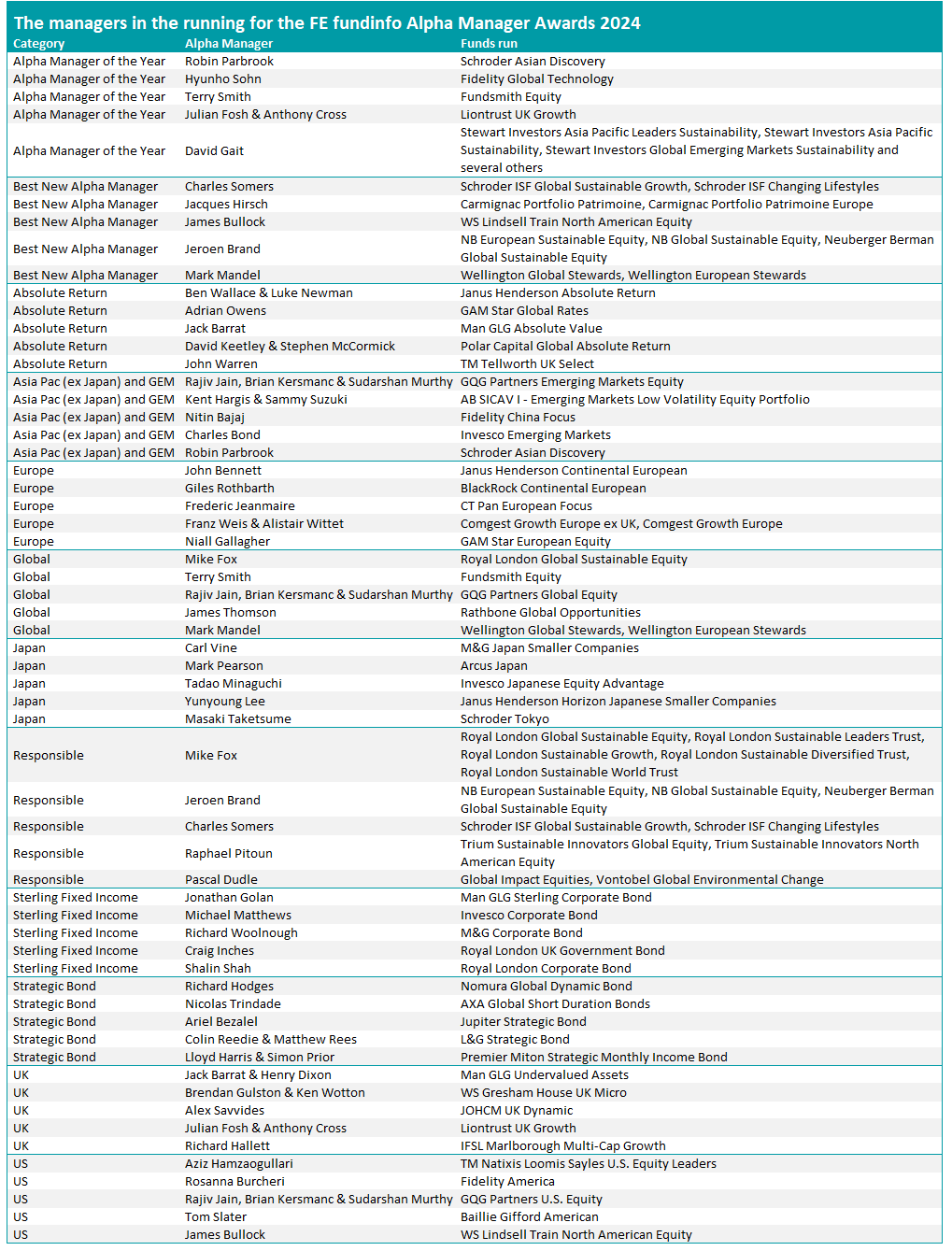

The awards also showcase up and coming talent, with five managers nominated for the best new Alpha Manager accolade after being rated as Alpha Managers for the first time this year.

The nominees are Jacques Hirsch from Carmignac, Mark Mandel from Wellington, Jeroen Brand from Neuberger Berman, Charles Somers from Schroders and James Bullock from Lindsell Train.

In total, FE fundinfo has chosen 60 nominees over 12 categories for its upcoming awards, all of whom already have an Alpha Manager rating – meaning they are amongst the top 10% of managers overseeing funds for UK-based retail investors.

Some of the best-known managers in the running include: James Thomson of Rathbone Global Opportunities; Tom Slater, who manages Baillie Gifford American and the Scottish Mortgage investment trust; Mike Fox, who runs a range of sustainable investment strategies for Royal London Asset Management; and Richard Woolnough of M&G Corporate Bond.

Nominees were chosen based on their Alpha Manager scores, with the five highest scoring investment professionals in each asset class category being put forward.

Those scores – and the Alpha Manager ratings – look at funds managers’ performance across their entire careers, based on risk-adjusted alpha (using the Sortino ratio) and consistent outperformance of their benchmark, with a track record length bias to reward longevity.

The Alpha Manager of the Year nominees have the best scores overall but FE fundinfo also considered managers’ styles and took into account how difficult it was for managers in different asset classes to beat their peer groups.

While nominees have been selected in recognition of their track records across their entire careers spanning different firms and products, the winners will be chosen for their 2023 performance alone.

Charles Younes, deputy chief investment officer of FE Investments, said that last year equity market performance became highly concentrated into the largest stocks and there was a style rotation into growth, technology and artificial intelligence – whereas cyclicals and value outperformed in 2022.

To succeed in fixed income, managers needed to have been short duration in the first half of 2023 then add duration in the second half, which was “a big game changer”, Younes recalled. This shift in dynamics meant that “for strategic bond managers it was a bit more difficult to generate alpha.” Meanwhile, managers were rewarded for being long credit in both 2022 and 2023. “This is a gift that keeps on giving. Never short the credit market, never give away your coupon,” he noted.

“Market uncertainty is rapidly becoming the norm for fund managers, with wars in Europe and the Middle East, record high interest rates, and political instability around the world. The Alpha Manager Awards recognise the best of the industry, highlighting the achievements of fund managers who have faced these challenges head on and helped unlock value for their clients in unpredictable times,” Younes said.

A full list of the nominees in each category is below.