With nine days to go until the end of the tax year on Friday 5 April, investors don’t have long if they want to make full use of this year’s £20,000 ISA allowance.

For people who intend to open a stocks and shares ISA, a key decision is which platform to use and costs are usually a significant factor in that choice.

Fees differ according to whether investors prefer to use open-ended funds, investment companies, shares, or a mixture of all three, as well as how many trades they intend to make every year and the size of their portfolio.

Below, we have looked at the cost of platforms for a range of portfolio sizes. Although new investors can put in a maximum £20,000 this year, we have added much larger pots so investors can see which platform is cheaper should they continue to save each year and their investments grow.

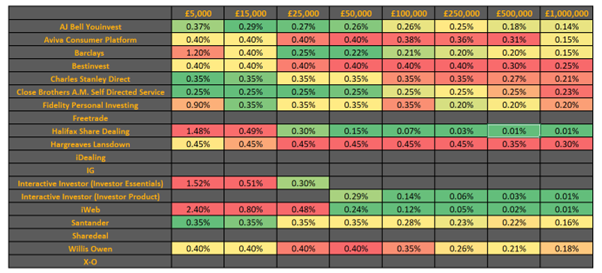

Best platforms for funds

For lump-sum investors who only want to use open-ended funds, the cheapest platform for a £5,000 to £15,000 ISA would be Close Brothers Asset Management’s self-directed service, as the table below shows.

For investors with £25,000, Barclays is just as cost effective as Close Brothers, according to platform research specialist, the lang cat.

For a larger sum worth anything from £50,000 to £500,000, Halifax Share Dealing is cheaper. It has a flat annual charge of £74, regardless of the portfolio size.

How much it costs to invest lump sums in funds with different providers

Source: the lang cat, data to 17 Dec 2023. Some of the rows are left blank because those platforms focus on shares and don’t accommodate funds.

The charges in the table above show the cost of investing a lump sum for a year and making four transactions (buys or sells) during that year. Calculations include ongoing platform fees, any additional wrapper charges and trading where applicable.

The colour-coded heat map reflects whether charges are cheap (green) or expensive (red) relative to competitors.

Of the three largest platforms in the UK – AJ Bell, interactive investor and Hargreaves Lansdown – AJ Bell is the cheapest for those with less than £50,000 to invest.

Interactive investor works out cheaper for investors with larger cash pots thanks to its flat fee structure, which is reduced for smaller pots but is still the most expensive for portfolios up to £15,000.

Hargreaves Lansdown meanwhile charges a flat 0.45% charge on most portfolios, which is much more expensive than its rivals when investing more than £15,000.

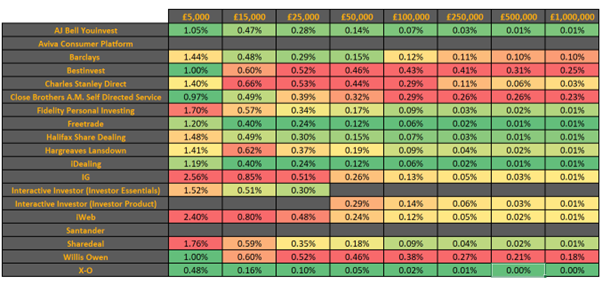

Best platforms for investment trusts

Savers who prefer to use investment trusts are charged differently from fund investors, as the next table illustrates.

Execution-only share dealing platform X-O is the cheapest venue for ISAs of all sizes if they invest exclusively in trusts. It has no annual fees and charges a flat £5.95 per trade.

The table below assumes four transactions in a year, so costs will be higher for people who want to trade more often and vice versa.

Elsewhere, savers with relatively small nest eggs of £5,000 would be better off choosing funds on most platforms, whereas for wealthier savers, trusts are more cost effective.

Among the ‘big three’, AJ Bell is once again the cheapest for all portfolios, while Hargreaves Lansdown and interactive investor change position depending on pot size.

How much it costs to invest lump sums in trusts with different providers

Source: the lang cat, data to 17 Dec 2023. Some rows are left blank because those platforms don’t offer investment trusts.

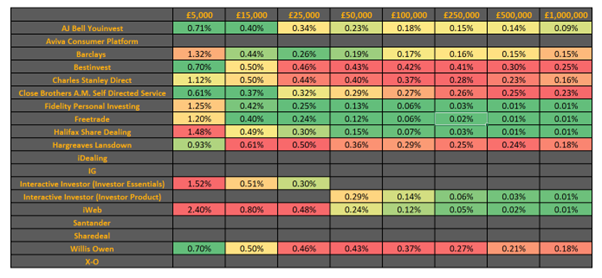

Best platforms for flexibility

For investors using a mix of funds and investment companies, costs vary and the table below shows charges for a 50/50 split.

Investors starting out with a £5,000 lump sum should use Close Brothers if cost is their main concern, while AJ Bell, Bestinvest and Willis Owen are also competitively priced.

Close Brothers is the cheapest provider for ISAs worth £15,000. However, for £25,000 portfolios, Freetrade and Fidelity Personal Investing prove more cost effective.

For portfolios of £50,000 or more, Freetrade takes pole position, closely followed by Fidelity Personal Investing, while Halifax Share Dealing also offers great value.

How much it costs to invest equal amounts in funds and trusts

Source: the lang cat, data to 17 Dec 2023.

Cost is not the only reason to choose a platform. Investors may prefer the technology and user experience of a certain provider or might find best buy lists to be a useful part of the service.

Some platforms are more conducive to investing directly in shares alongside funds and trusts. The frequency at which an investor wishes to trade is another factor to include in calculations.