Fundamentals are back in the foreground this year and we expect structural tailwinds for higher quality debt. Investors with the freedom to pivot towards better performing parts of the market should be well placed to take advantage of increased dispersion as well as historically high yields. As such, we believe there are six reasons why an unconstrained credit approach may make sense from here.

Reason 1: Inflation may be normalising but investors with the ability to manage duration can accommodate even a higher-for-longer-scenario

Consensus expectations see developed market inflation coming close to target in 2024 as tight monetary policy constrains activity, unemployment slowly picks up and labour market pressures cool.

Developed market central banks have indicated they see themselves at the peak of the cycle, with interest rate hikes largely done.

For fixed income investors, this normalisation of central bank policy is good news but, even in its absence, investors with the flexibility to actively manage duration have scope to find upside.

Reason 2: Fundamentals (should be) back in the driving seat

If 2022 and 2023 were characterised by the market responding in lockstep to the latest messaging from central banks, 2024 promises to be a year where, once more, issuers can be considered on their own merits.

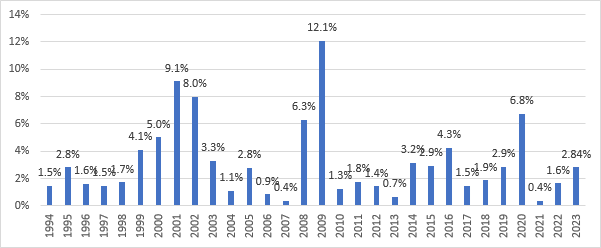

We believe fundamentals have re-asserted themselves. Earnings are softening, leverage levels, defaults and levels of distressed debt are all ticking up – even as interest coverage begins to fade.

Last year, the lower quality component of the market outperformed due to the absence of the hard landing scenario and limited issuance. This year, we expect a reversal of the 'trash' rally and an opportunity for investors to position themselves in the higher quality part of the market.

Investors with the flexibility to position themselves across the credit quality spectrum may be able to take advantage of these trends.

US high yield defaults, as at end of December 2023

Source: JPMorgan as at Dec 2023

Reason 3: Technicals are supportive

After an issuance drought in 2022 and 2023, the supply of new high-yield credits has once more started to flow. Investment grade supply has also picked up and continues to be well supported by the market with new issue premiums at the lower end of the scale.

Despite the uptick in issuance, the overall size of the high-yield market is shrinking, having fallen 6% in 2023 and we don’t expect it to grow significantly this year. This is due not only to the lower issuance in 2022 and 2023 but also because of the ascendence of rising stars versus fallen angels in recent years. Given this smaller pool of opportunity, it can make sense for investors to be able to cast their net as widely as possible – something well suited to an unconstrained approach.

Reason 4: Current yields may be an indicator of future returns

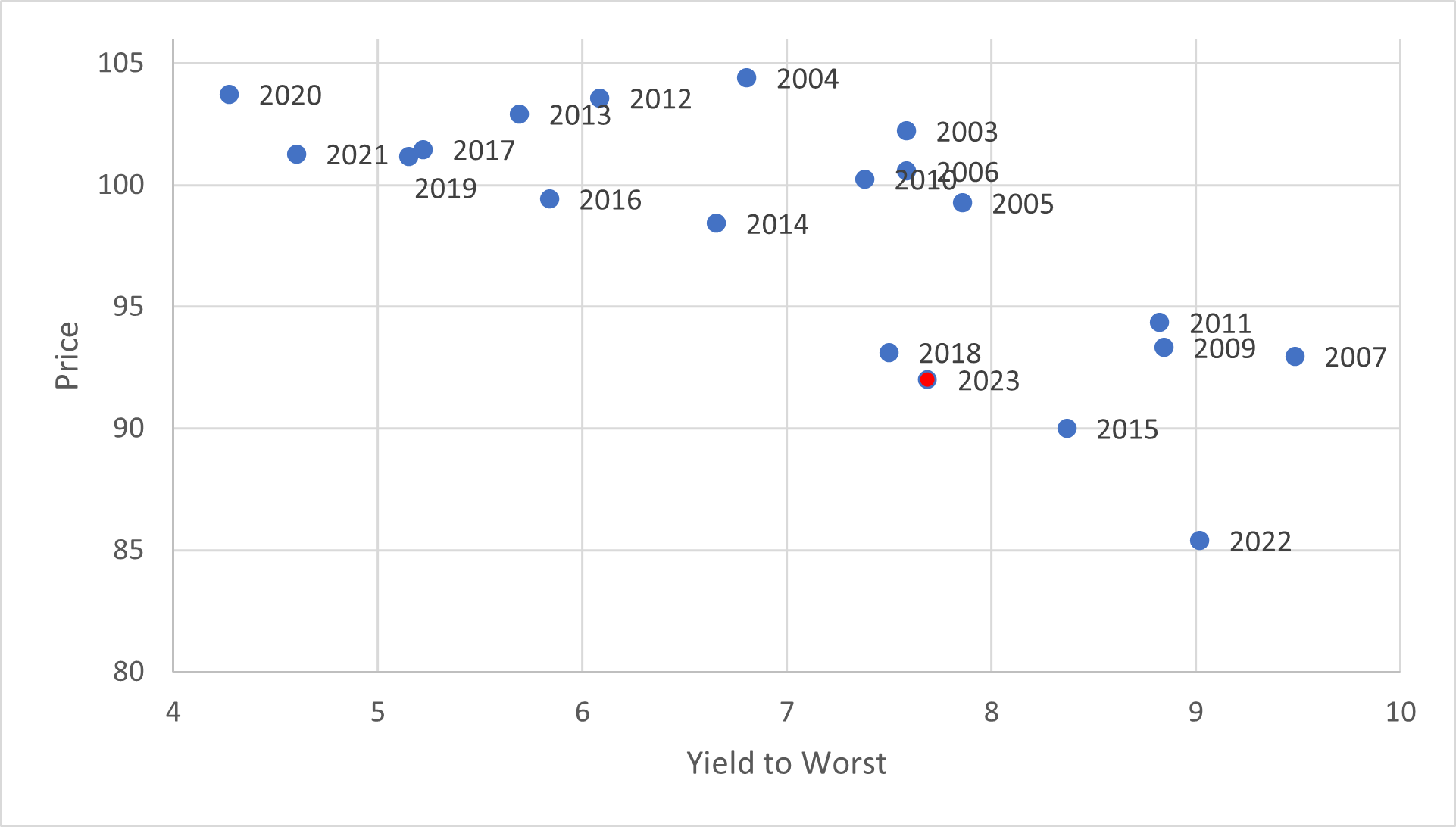

Spreads may not be appealing today versus long-term averages, but yields tell a different story. In investment grade they are at their highest level since the global financial crisis, while for high yield they are hitting record highs.

We believe this combination of high yields along with historically low cash bond prices is likely sufficient to protect investors from a moderate recession and potentially even systemic stresses.

Investors with the freedom to allocate to the higher quality segment of the market may be well placed to take advantage of this dynamic.

Reason 5: Prices are at attractive levels

The cash price of investment grade and high-yield bonds are reading at approximately 92 cents on the dollar, making for among the most attractive levels in recent history. Because of this, we believe convexity concerns have all but banished and our expectations are high for healthy levels of income going forward.

Global high yield prices are at historic lows, while yields are among historical highs

Source: Bloomberg, ICE, prices at end of each calendar year. Price of approx. 60 in 2008 excluded.

Reason 6: Last year’s laggards are this year’s leaders

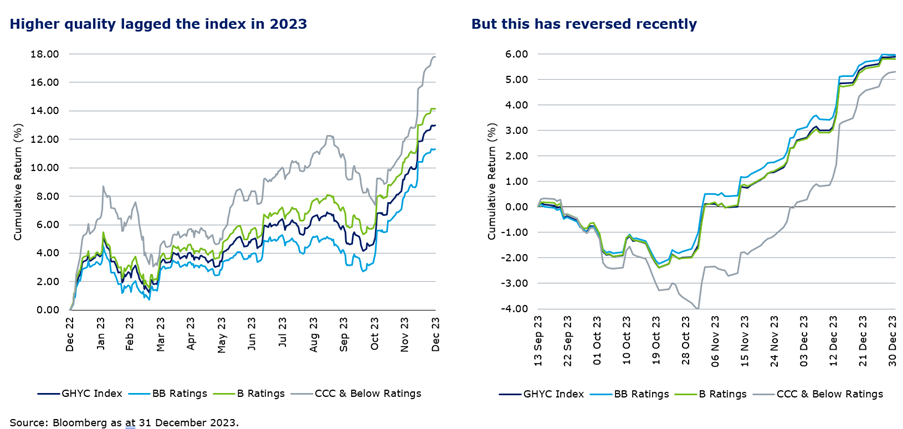

Some might say 2023 was the dog that didn’t bite: such was the relief at the absence of a hard landing that, for the most part, even the lower quality component of the market outperformed. Conversely, subordinated debt underwhelmed.

This year, things are different. Helped by the change in mood music around central bank policy, last year’s laggards have become this year’s leaders. We expect structural tailwinds from here for higher quality debt as well as for national champions who issue subordinated bonds.

Investors with the freedom to pivot to better-performing parts of the market can ride these tailwinds in pursuit of alpha.

From challenge to opportunity for quality

Fraser Lundie is head of fixed income, public markets at Federated Hermes. The views expressed above should not be taken as investment advice.