Having international exposure in your equity allocation has become the norm. The consensus view is that opportunities in global equity markets can be as attractive than those at home and should not be overlooked. But when it comes to fixed income, the home bias remains strong.

While there’s comfort in familiarity, considering only GBP debt can result in a constrained opportunity set and unintended concentration risk.

Let’s dig into the composition of the UK fixed income universe to see how expanding your geographic remit could prove less risky, with greater return potential, than staying close to home.

Gilts & beyond

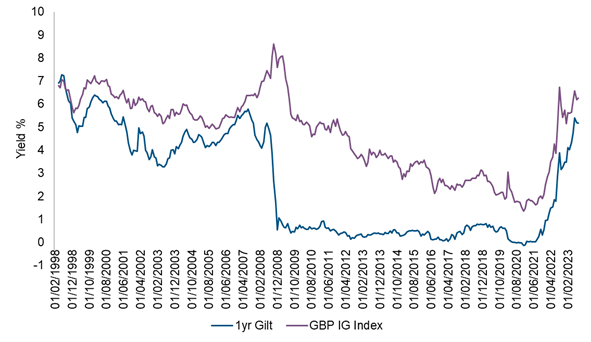

After 12 years of ultra-low yields, income has returned, with segments of the bond market offering returns akin to equities, making it an opportune time to review allocations.

GBP high-quality yields %

Source: Mirabaud Asset Management, ICE BAML, Bloomberg as at 31 August 2023.

Investment grade (IG) is going to feature in most bond portfolios but holding only UK names can unwittingly leave you exposed to an alarming level of concentration risk. Of the 940 bonds within the UK market, 39% of these are banking and real estate names. In today’s environment of elevated mortgage rates, this creates significant sector risk, pushing yields out.

To get the best of IG with the lowest level of risk, we believe broadening your geographic remit and taking an international view provides the optimal solution. The US IG market has only a slightly lower yield of 5.9% (hedged) compared to 6% for the UK, but much less sector concentration risk.

In the US, banks comprise 19% of the market and real estate just 3%. There are also opportunities in US IG names in the growth sectors like technology and energy that are not available in the UK market.

The story is similar in high yield (HY). The UK market is small, with 99 bonds offered by 66 issuers. Some 26% of these bonds sit in the retail sector, with supermarket names dominating. With CPI sitting at 6.7% and unemployment ticking up, the UK consumer is set to decline and this degree of retail concentration could negatively impact returns.

While HY can be an interesting allocation for higher potential returns, we believe exposure needs to come from a spread of sectors for an optimised risk/return profile. The US and European markets are much larger and are without the elevated concentration risk that the UK has, yet yields are attractive at 8.7% (hedged) and 8.6% (hedged) respectively, versus 10.4% for the UK.

Costing-up foreign exchange hedging

We believe allocating across geographies lets you capture the best of the opportunity set while minimising concentration risk. But maybe you’re wondering ‘at what cost?’ The perception that it’s prohibitively expensive to hedge foreign exchange risk back to sterling isn’t accurate. In fact, the potential pay-off means it’s something we think investors should actively consider.

The cost to hedge foreign currency bond funds back to sterling is essentially the government interest rate differential – so at the end of August 2023, it cost around 8 basis points to hedge back from dollars to pounds.

However, fixed income assets in dollars have a higher yield to begin with, as risk assets are priced off a higher risk-free rate. Therefore, the hedging cost nets out and you should invest in the region where you see the highest potential returns going forwards.

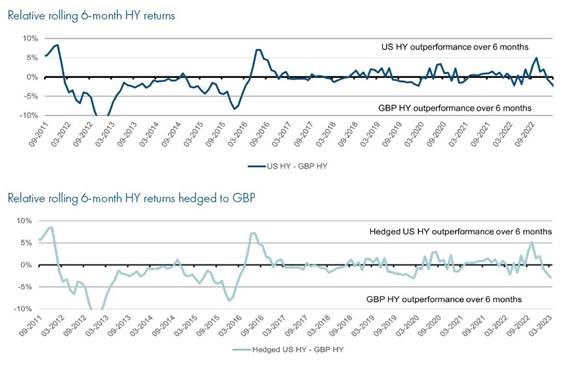

To illustrate this, we can looked at six-month periods where US HY outperforms UK HY by 2% or more, even after hedging costs are applied. Holding the higher-yielding US assets with a stronger outlook cancelled out the hedging costs and generated a better overall return.

The same illustrations played out in the IG market. But putting return potential to one side, we believe the real benefit is the additional diversification that currency exposure brings – even if overall performance is neutral, your portfolio risk will be lowered.

Including geographic flexibility in your investment arsenal can give you a useful fifth lever to pull on (alongside asset allocation, duration, credit quality and sector) as market direction shifts.

Periods of outperformance for US high yield

Source: Mirabaud Asset Management, ICE BAML, Bloomberg, 31 March 2023.

While yield has returned to UK fixed income, having a strong home bias could leave your portfolio unduly exposed to sector concentration risk. Evaluating your fixed income allocations through a global lens is, in our view, the best way to optimise risk-adjusted returns.

Al Cattermole, portfolio manager at Mirabaud Asset Management. The views expressed above should not be taken as investment advice.