Women are set to inherit 70% of global wealth over the next two generations, not least because they live longer than men, so encouraging more women to get put their cash to work is crucial.

Indeed, there is a wide gender investment gap, with just 28% of women invest, compared to 45% of men. Yet those women who do invest have more money in their stocks and shares ISAs than men (£57,520 versus £54,971 on average for Hargreaves Lansdown’s clients, as at 31 January 2024).

Achieving decent returns early in their investment journey and, ipso facto, the timing of those initial investments, are key factors in keeping women investing. “All confident investors commented that early success gave them a motivational boost,” Hargreaves Lansdown’s report said.

Successful female investors want to be in control of their finances and do this by setting goals, Hargreaves Lansdown found. Almost half the women surveyed (49%) said they were saving for retirement, over a third (35%) invest to generate an income, a quarter (25%) are building a buffer to meet any unanticipated expenses and another 25% want to provide an inheritance for their families.

The number one priority for 80% of women is investment returns. Fees were in second place, revealing that women recognise the corrosive impact of high charges.

How women invest

Most UK-based women prefer to invest in domestic equities and hold plenty of cash. More than a third (36%) use actively managed funds, which increases to 50% among those who use a financial adviser. Almost a quarter of women (23%) use passive funds.

Women avoid “investments which are speculative, specialist, risky or hard to understand,” Hargreaves Lansdown said; cryptocurrency and foreign currencies were the least popular assets.

More than a third of women (37%) make ad-hoc investments as and when they can afford it rather than saving regularly, with around a quarter of women (22%) investing monthly and another 22% doing so quarterly.

Although a third (34%) of women hold their investments for less than five years, many other women are long-term buy-and-hold investors. A fifth (22%) hold their investments for around five years and 24% for the next five to 10 years.

Hargreaves Lansdown said: “A buy and hold strategy – where you stick with your choices – is less time-consuming than chopping and changing a portfolio frequently. That’s got to be a plus when time is such a precious commodity for women.”

The barriers to investing

Taking responsibility for family finances is a double-edged sword and, for some women, can actually be a barrier to investing.

“Women think and approach overseeing money differently than men. They don’t see it as their own money, but rather family money that is shared with children, a partner or parents. If you think about money this way and shoulder the responsibility of running the family money (rather than just your own), it follows that you will be less willing to take risks with it,” the report explained.

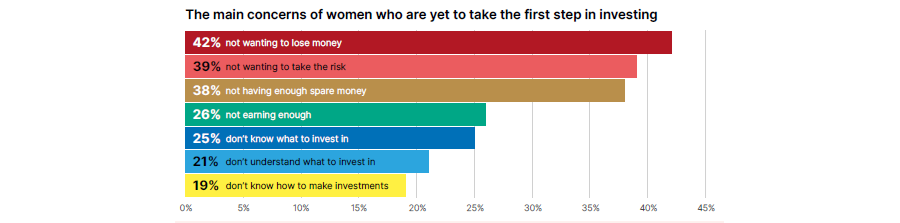

Women who do not yet invest said the biggest barriers to starting were they worried about losing money, they did not know what to invest in and they did not understand investments, as the chart below shows.

Barriers to investing

Source: Hargreaves Lansdown

Much of the blame for this lack of comprehension lies squarely at the door of the financial services industry for making their literature unnecessarily complex, the report found.

The language and terminology used in financial disclosures discourages 63% of women, who are put off by risk warnings such as ‘investments can go up or down’.

Hargreaves Lansdown is working with The Investing and Savings Alliance (TISA) and the University of Nottingham to trial alternative wording such as ‘investing for longer increases the likelihood of positive returns. Over a period of five years or more, investments usually give you a higher return compared to cash savings’.

These trials showed that when risk warnings were phrased differently, women increased the amount they invested by 21% (as opposed to leaving their money in cash).