Legendary investor Peter Lynch said you should be able to summarise why you are buying a stock on a single page of A4 paper, otherwise it is too complicated or you don’t understand it.

FE fundinfo Alpha Manager Sam Morse and co-portfolio manager Marcel Stötzel, who run the £4.4bn Fidelity European fund and the £1.5bn Fidelity European trust, have taken this on board.

Every time they buy a company, they summarise their investment thesis into three simple reasons.

While the three reasons are different for every stock, the first one usually relates to the industry in which the company operates and then the other two are specific to the company itself.

Morse writes his three reasons down on one piece of paper per stock.

During the three-to-five holding period, Morse returns to his stack of papers whenever he needs to adjust or elaborate on one of the three reasons, so that gradually the papers become annotated with additional notes and coloured inks.

This makes it easy to see if one of the three reasons has changed to such an extent that it is longer valid – a sell signal.

Stötzel, who described his approach as “Lynch 3.0”, types his three reasons into excel with additional notes in adjacent columns, but he makes sure each case can be printed out onto a single piece of paper.

Stötzel and Morse bought mining equipment company Epiroc last year. Their three reasons for investing are: growing demand for deep underground mining; Epiroc’s lack of competitors; and the green transition, which will increase demand for metals generally and for Epiroc’s electric drills specifically.

To facilitate the energy transition, the world needs more iron, copper and lithium, but ore grades are declining, so miners are having to dig deeper underground.

There are only two companies whose drills are equipped for deep underground mining, Epiroc and Sandvik, and mines typically only use one supplier for drilling. Both companies have servicing capabilities for their equipment around the world in remote places, which is a high barrier to entry, and they earn ongoing revenues from repeat part replacements.

For all these reasons, Epiroc should be able to deliver double its historical growth rate for the next 10 years, Stötzel said.

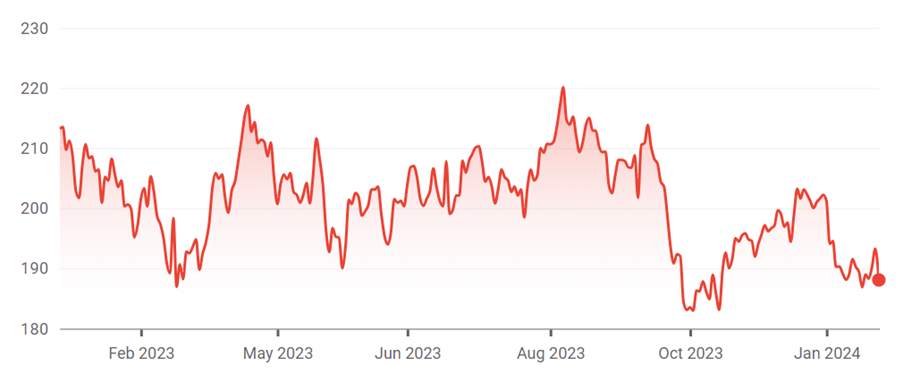

The company has a strong balance sheet with low net debt, it pays a 2.4% dividend and it is attractively valued at a price to 2024 earnings (P/E) ratio of 19x.

Performance of Epiroc shares over 1yr

Source: Google Finance

In a similar vein, Stötzel’s three reasons for investing in Puma begin with the athleisure industry, which is growing at 5% per annum as people switch to a healthier lifestyle, as demand from younger consumers and Asian markets accelerates, and as the lines blur between athleisure and luxury.

The next reason is Puma’s strong brand and the third is its potential to grow faster than Adidas or Nike and close the margin gap between itself and the two market leaders.

Puma is the third largest athleisure brand globally but its brand recognition is higher than its market share would imply, especially in the US, Stötzel said. At a valuation of 20x 2023 P/E, Puma is not expensive, he added.

Puma has been on the watchlist for a while and was hurt by the cost of living crisis, which provided an entry point last year.

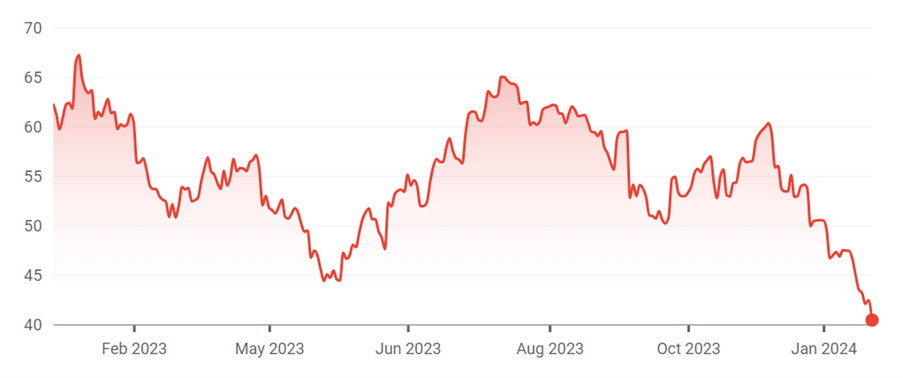

The share price has continued to fall since then due to geopolitical concerns and currency headwinds, but Stötzel remains confident in his investment thesis. Focusing on the three reasons helps him to separate the short-term noise from the more important factors that “we believe will matter more over our five-year holding period”, he said.

Performance of Puma shares over 1yr

Source: Google Finance