Smaller companies in the UK, emerging markets and Japan all have better prospects than their US rivals, according to experts.

Small-caps have suffered in recent years, as central banks started an aggressive interest rate hiking cycle, which has hit their earnings. As smaller companies tend to have more short-term debt than their large-cap peers, a sharp increase in interest rates has been particularly harmful for the asset class.

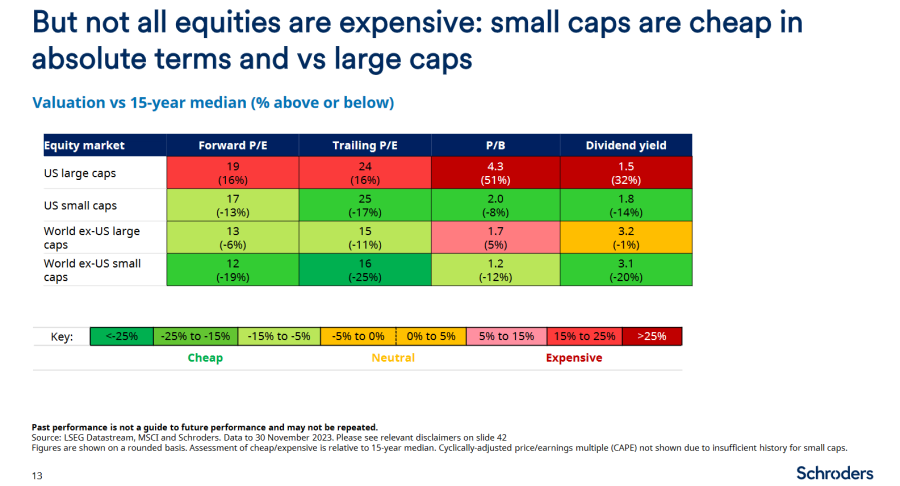

As a result, small-caps are now cheaper than they have been for many years. While they have historically commanded higher price-earnings (P/E) ratios than large-caps, data from Schroders shows that global small-caps are currently trading on a 12x forward P/E and global large-caps on 13x.

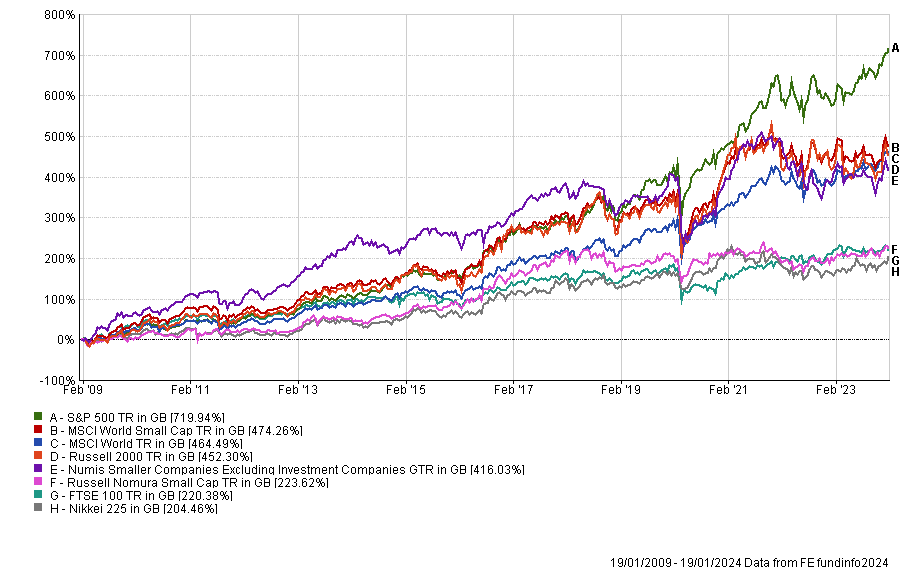

Moreover, small-caps have generally outperformed their large-cap peers over the long term. Over the past 15 years, the MSCI World Small Cap (global), the Numis Smaller Companies Excluding Investment Companies (UK) and Russell Nomura Small Cap (Japan) indices have all beaten their respective large-cap equivalent. The US is the only outlier, as the S&P 500 has significantly outpaced the Russell 2000.

Although headwinds remain, a stabilisation and potential fall in interest rates could support a small-cap rebound, while supply chain normalisation could also help.

Michael Oliveros, manager of the Invesco Global Smaller Companies fund, said: “Supply chain disruptions have hurt smaller company sales more than large-caps. They have weaker purchasing power than larger companies making it more difficult to source scarce working capital at attractive prices. They also tend to sit further up the supply chain from larger companies. As supply chains normalise, this will help both input costs and demand (this is often referred to as the ‘bullwhip effect’).”

Therefore, now could be a good time for investors to increase their exposure to smaller companies in their portfolios. Below, small-cap experts discuss where they are seeing the best opportunities across the different small-cap markets.

Performance of indices over 15yrs

Source: FE Analytics

The UK stands out

Small-caps are trading on attractive multiples across developed markets, but all the managers Trustnet spoke to pointed to the UK as a standout.

Cedric Durant des Aulnois, chief executive officer at Montanaro, said: “UK equities have been chronically depressed ever since the Brexit referendum of 2016, with smaller companies feeling the pain even more acutely.

“On 10.2x future earnings, UK small-caps are currently not only on an 18% discount to their historical average but also on a discount to US, European and Global small-caps. To us, this presents a clear opportunity for the patient, contrarian investor.”

Performance of UK small-cap indices since Brexit Referendum

Source: FE Analytics

Invesco’s Oliveros also sees UK small-caps as an “interesting pool”. While he acknowledged the difficulties encountered by the asset class since the Brexit referendum, he sees a lot of value in the small-cap space that just needs a catalyst.

He said: “High quality UK businesses regularly trade on 25-30% discounts to comparable continental peers. The upcoming general election could be a catalyst. A change of government will almost certainly see winners and loser emerge from the legislative agenda. That said, political stability can go a long way to clear the way for investment and re-rating.”

Kirsty Desson, manager of the abrdn Global Smaller Companies fund, added cuts in interest rates and policy incentives as further potential catalysts.

Emerging market small-caps continue to shine

Emerging markets was the best performing region for smaller companies in 2023 and one of the few that managed to beat its large-cap peers last year.

This show of force has not gone unnoticed and some experts believe this outperformance may well continue as inflation has been less of a problem for emerging markets.

Desson said: “Analysts believe there is scope for emerging market countries to cut rates more than in developed markets as inflation has been held in check to a greater degree post pandemic.

“Falling rates, alongside a cyclical recovery in the tech sector and restocking across a number of industries, as well as ongoing strength from structural themes such as near shoring, are supportive of emerging markets outperformance this year. Adding valuation into the mix increases the attractiveness of emerging markets.”

Oliveros was high on emerging markets as they seem to benefit from the deglobalisation process. He explained that intra-emerging market trade is growing rapidly, while the dependence on developed markets is decreasing. As a result, he believes that emerging market small-caps can provide “significant” diversification benefits to a portfolio.

He added: “Clearly you need to mind valuations and pick stocks wisely, but the potential for sustained growth could surprise.“

Performance of indices in 2023

Source: FE Analytics

Desson also mentioned China as a “wild card” for 2024, as Chinese small-caps are trading at a sizeable discount to the rest of the region and the US. She warned, however, that the outlook is highly dependent on government stimulus.

Japanese small-caps: Some positives, some negatives

Alan Rowsell, lead fund manager of the Premier Miton Global Smaller Companies fund, highlighted Japanese small-caps as the corporate governance reforms are gathering momentum.

Last year, the Tokyo Stock Exchange called for Japanese listed firms trading on a price-to-book value of below 1 to come up with plans to improve this ratio, or face public shaming and ultimately delisting. Most of the companies concerned by those warnings are to be found in the small- and mid-cap space.

Roswell said: “The corporate reforms should drive improving returns on capital and return of capital to shareholders. With many companies trading below book value, there is considerable upside potential.”

While Desson also identified this driver, she finds the valuation of Japanese small-caps less compelling. Moreover, they are unlikely to benefit from the tailwind of cuts in interest rates as Japan finds itself in a different monetary environment.

US small-caps are less attractive

US small-caps account for 60.7% of the MSCI World Small Cap index, making it the largest small-cap market in the world. It has also outperformed its international since the global financial crisis, as they have benefited from a strong US dollar, loose fiscal policy and a vibrant technology sector.

Performance of small-cap indices since bankruptcy of Lehman Brothers

Source: FE Analytics

Yet, none of the experts found US smaller companies attractive.

Roswell said: “Can this outperformance continue in 2024? I think not. GDP growth is likely to slow as the country faces tough competition, the lagged impact of interest rate hikes and less government spending. Moreover, the US dollar will probably decline as interest rates are cut, valuations are higher and the Presidential election creates uncertainty.”

Desson also feels that US small-caps are not attractively valued and does not see further tailwinds beyond infrastructure spendings. She added that the combination of softening demand and the struggle to maintain margins in a disinflationary environment is likely to pressure corporate earnings.