RBC Brewin Dolphin is urging savers to look beyond the historically high yields available from cash deposits and make their money work harder in investment trusts.

As many as 150 investment trusts have yields of over 5.25%, according to the Association of Investment Companies (AIC), offering savers a higher income than cash.

Furthermore, many trusts are trading at historically wide discounts so could deliver significant returns if those discounts narrow.

John Moore, a senior investment manager at RBC Brewin Dolphin, said that over the long term a balanced portfolio of equities has outperformed cash and delivered real returns in line with or above inflation.

“Given the yields available on many trusts, you have the safety net of an income stream that keeps pace with base interest rates,” Moore said.

“Companies can decide to increase their dividends to match or beat inflation, provided their finances allow it – and we’ve seen many management teams decide to do that in the last year or two. Investment trusts are particularly good at this, holding back cash in reserve during good years for when times are tougher.”

Moore suggested five investment companies delivering strong yields that investors should consider.

HICL Infrastructure

The £2.6bn HICL Infrastructure trust has a long history of paying a stable and growing dividend. It invests in a portfolio of infrastructure assets across the UK, Europe, North America and New Zealand including hospitals, government property and schools.

Its current yield of 6.3% may be due to its low share price; however, the trust's assets are well-positioned for a higher interest rate environment.

Moore said: "Having traded at a small premium to NAV in early 2023, the shares have fallen to a deep discount of -25%. Yet, like Greencoat UK Wind, many of the trust's assets come with a degree of inflation protection, placing it well for the higher interest rate environment we're likely to see in the years ahead compared to the decade or so prior to the pandemic."

Performance of trust vs sector over 10yrs

Source: FE Analytics

Greencoat UK Wind

Moore's next trust is the aforementioned Greencoat UK Wind, which invests in a portfolio of operational wind farms in the UK. Its focus on wind power aligns with global sustainability goals and green energy is expected to become increasingly important as the world seeks to reduce its carbon footprint.

The £3.3bn trust is the best performer in its sector over 10 years. Its dividend yield is currently 5.3% and is expected to grow with RPI inflation.

Performance of trust vs sector over 10yrs

Source: FE Analytics

Moore said: "The share price has struggled in recent months – the shares trade at a historically large discount of 17% – but the fundamental case for holding the trust over the long term remains as compelling as ever and notably the trust has been buying back shares with its excess cash."

TR Property

Moore's third suggestion is the £1bn TR Property investment trust, managed by Marcus Phayre-Mudge.

TR Property invests in a diversified portfolio of real estate assets in the UK and Europe, with significant stakes in UK property development companies such as Land Securities alongside internationally recognised players like Klépierre, the second-largest European shopping mall operator.

The trust's assets are well-positioned for a higher interest rate environment, as many are in the logistics and healthcare sectors.

TR Property has had relatively stable performance over the past 10 years, with a current yield of 4.9%.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

Moore added: "Property has been one of the hardest-hit sectors of the past year, but there are signs of consolidation, which has often been a catalyst for self-made recovery in time. Further, the cost of building should underpin existing well invested assets."

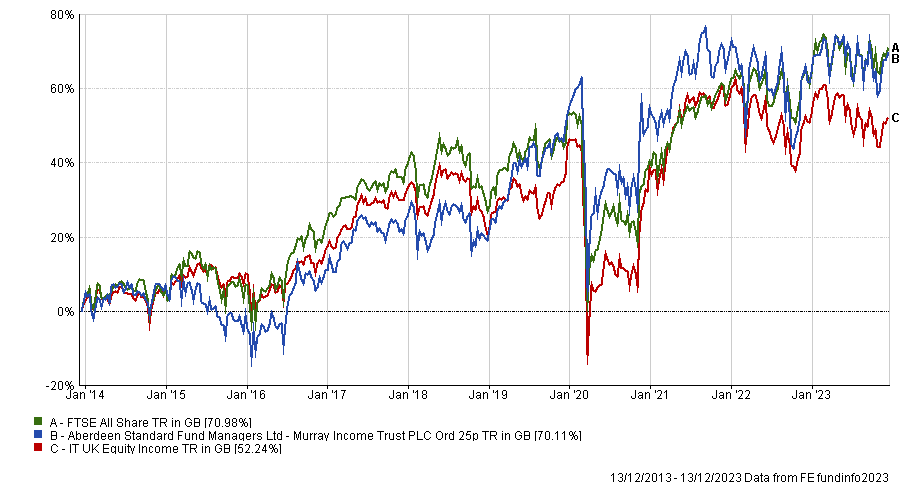

Murray Income Trust

The £902m Murray Income Trust, managed by abrdn’s Charles Luke, was Moore’s next choice. The trust's portfolio of blue-chip UK-listed companies is well-diversified across various sectors, including consumer goods, healthcare, and industrials, and includes AstraZeneca, BP, Unilever, and Diageo.

These well-established companies are expected to generate a reliable income stream while also offering the potential for capital growth.

Murray Income Trust's current yield is 4.5% and it is a top quartile performer over five years.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

"Murray is a venerable trust, dating as far back as 1923 and combines the more familiar names mentioned with some high growth potential smaller companies and the prudent use of derivatives to keep costs down,” Moore explained.

"The trust is a survivor with good scale and offers a slightly higher than average yield at the moment, making now a decent entry point even if it does not quite match cash rates."

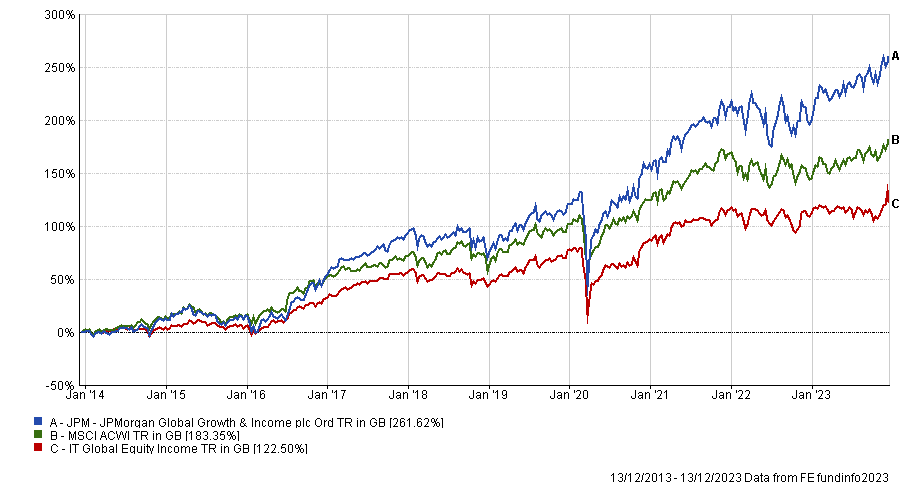

JPMorgan Global Growth & Income

The final selection is the £2bn JPMorgan Global Growth & Income investment trust, managed by FE Fundinfo Alpha manager Helge Skibeli along with Timothy Woodhouse and Rajesh Tanna.

Its top holdings are predominantly North American companies, with Amazon, Microsoft and Coca-Cola making up approximately two-thirds of the portfolio.

Its 3.45% yield is lower than the other trusts on this list. However, the trust's portfolio is focused on growth, so it is expected to outperform the market in the long term, as shown over the past 10 years.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

"Unlike many other investment trusts over the past year, JPMorgan Global Growth & Income's share price has largely stuck tight to its NAV and the shares currently trade at a small premium. So, while it may not pay a cash-equivalent yield, it has nevertheless been a good trust to hold for most economic circumstances," Moore explained.