A recurring question posed to us by our clients stretching from Bogota to Taipei is: Why should we invest in bonds when cash-like instruments provide attractive returns?

That’s a fair question. US Treasury bills (T-bills) maturing in three months are yielding above 5%. Gilts and bunds too offer relatively attractive yields.

Cash-like instruments are in favour as the high yields on offer are a far cry from the near zero environment that marked the years following the global financial crisis. Yields have jumped mainly due to aggressive interest rate increases by major central banks including the US Federal Reserve (Fed), the European Central Bank and the Bank of England since early 2022.

Unlike bonds, short-term instruments such as T-bills carry little credit or duration risk, another factor perceived as an advantage by some investors. However, investors need to bear in mind the reinvestment risk they could face as the environment could potentially change when it’s time to roll over. Investors in short-term instruments can’t always be assured of a compelling investment case matching existing opportunities.

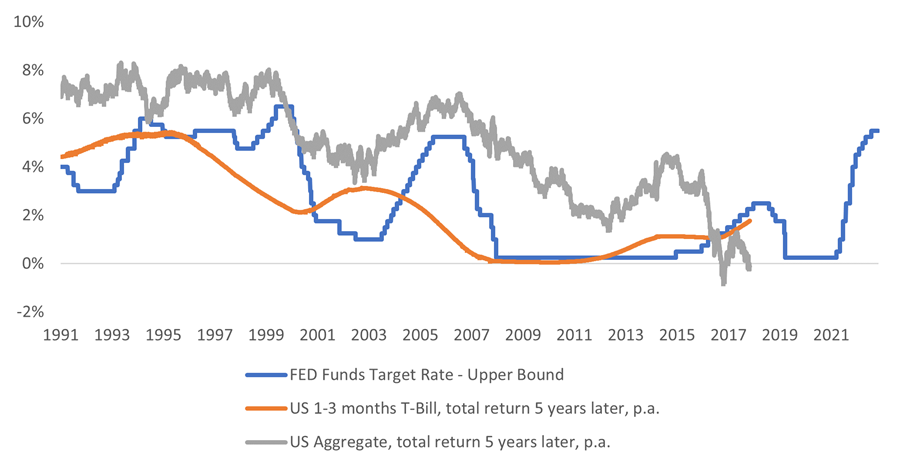

That’s not all. We believe the current period is an anomaly. As the chart below shows, it is the first time in the past 30 years that US cash (amber line) has outperformed the five-year annualized forward return of the Bloomberg US Aggregate Bond Index (grey line), a broad-based benchmark that measures the investment grade, US dollar-denominated bond market.

The underperformance of the Bloomberg US Aggregate Bond Index was due to the rapid rise in Fed rates that pushed bonds yields sharply higher and prices lower (bond yields and prices move in inverse directions).

Source: Jupiter, Bloomberg. As of 27.10.23. US 1-3 months T-Bill is Bloomberg US 1-3 months Treasury Bills Total Return Index, US Aggregate is Bloomberg US Aggregate Total Return Index.

If history is any guide, rate cutting cycles by the Fed tend to be very fast and sudden. That’s another factor that investors need to keep in mind and such a scenario could mean that the performance of cash over a five-year period could be lower than the starting yield.

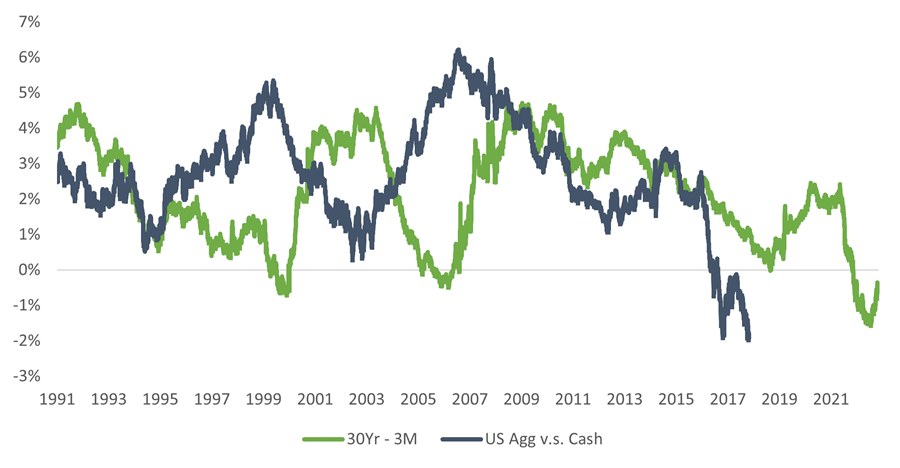

The most interesting point, however, is borne out by the chart below.

Source: Jupiter, Bloomberg. As of 27.10.23. US Aggregate is Bloomberg US Aggregate Total Return Index.

The five-year period of highest outperformance for US duration (using the Bloomberg US Aggregate Bond Index as proxy) vs US cash came immediately after the Fed rate hike in July as investors believed that the central bank was close to its peak in terms of rate increases.

Surprisingly, those are also the moments in which duration was giving the least over cash in terms of starting yield. The green line, in particular, shows the slope of the US curve between the three months and the 30 years. In this sense, during those moments, an investor that might have decided to allocate to cash would have missed the biggest rallies for duration.

Of course, there could be objections to our assumption of effectively keeping a five-year allocation to cash. Cash is just a tool to wait for better opportunities could be the argument. That would be fair, but market timing is never an easy exercise and waiting for the best moment to reallocate to fixed income might actually mean missing a decent part of the rally.

At Jupiter, investment managers are free to express their own macro thesis and investment views without an overarching company view. What many of our fixed income managers are telling us today however is that the Fed funds rate has probably peaked. If that’s the case, history tells us that the time to reallocate to bonds from cash is now.

Valerio Angioni is investment director of fixed income at Jupiter Asset Management. The views expressed above should not be taken as investment advice.