Commodities produced very different levels of return in the past two decades: they have rewarded investors extremely well in the 2000s but punished them in the 2010s. But which environment is more akin to today?

At the turn of the century commodities shot the lights out and outperformed all other asset classes. BlackRock World Mining Trust perhaps best illustrates their reign in this decade, as it was the best performing investment trust between 1 January 2000 and 31 December 2009.

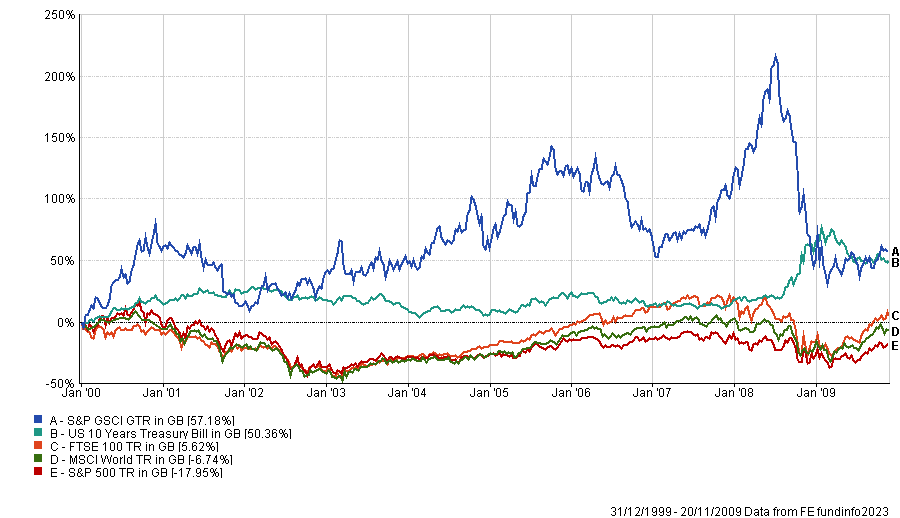

This is also true at the index level, as the S&P GSCI, a leading commodity benchmark, performed better than major equity indices and US 10-year Treasury bonds.

Performance of indices in the 2000s

Source: FE Analytics

The main reason for this commodity ‘super cycle’ is linked to the integration of China in the world’s economy and the resulting needs for resources, explained Nitesh Shah, head of commodities and macroeconomic research at WisdomTree Europe.

He said: “Shortly after China was accepted into the World Trade Organisation it started exporting much higher volumes than in the past and urbanising at a rapid pace as people were moving away from rural communities into cities. All of these things are very energy intensive but also require a lot of metals and materials.

“The supply side was caught short and lagged this increased level of demand until around 2010. It’s difficult to build out a mining facility and it takes time to expand capacities.”

This commodity super cycle was, however, not unprecedented and isn’t dissimilar to what happened in Europe during the industrial revolution or in the USA in the early 1900s.

Shah added: “Super cycles don't happen frequently because they require a lot of activities and/or massive industrialisation. But when they happen, they are very meaningful for the commodity markets.”

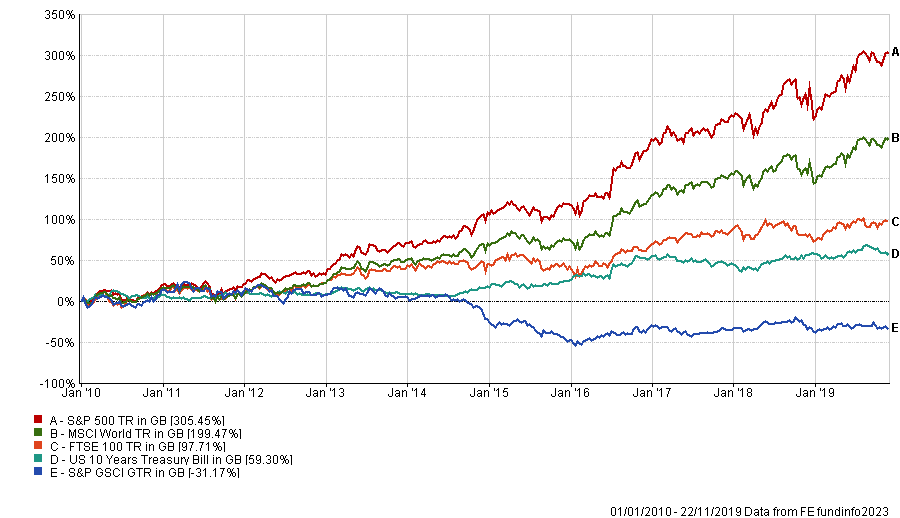

Unlike the 2000s, the 2010s was a difficult decade for commodity investors as the asset class performed poorly. In fact, the S&P GSCI made a loss over the decade and lagged the main US equity index S&P 500 by 336.6 percentage points.

Performance of indices in the 2010s

Source: FE Analytics

One of the factors for this was the global financial crisis (GFC) in 2008 and the way it impacted economic demand.

Paul Syms, head of EMEA ETF fixed income and commodity product management at Invesco, said: “When the GFC hit, it meant that supply outweighed demand. This led to a bearish super cycle from 2008 until just after the pandemic with commodities performing poorly until early 2020.”

China was also an important factor in the lower demand for commodities in the 2010s as the country’s growth started slowing down. Moreover, China moved up the supply chain and started focusing on higher end components, while the urbanisation process reduced in intensity as it neared completion.

Shah said: “China had to adjust to its new realities. The growth levels that it experienced in the 2000s were unsustainable. You need a much more strongly growing population to be able to maintain that level of economic growth.”

Commodities have performed well since the beginning of the current decade, although the asset class collapsed in 2020 as the demand for energy plummeted when the world went into lockdown due to the Covid crisis.

Syms said: “Covid and lockdowns caused a final leg down for commodities in early 2020 but, since then, commodities have rallied. However, it’s not been a straight line higher. Commodities performed very well when rates were at record lows and central banks had aggressive quantitative easing programmes. But since they started hiking rates, commodities have given back some of the earlier gains.”

Performance of indices since 1 January 2020

Source: FE Analytics

Syms added that we may, nonetheless, be at the dawn of a new commodity super cycle as there has been a lack of investment over the 2010s in the commodity space. As a result, demand might outstrip supply again. Another driver for a super cycle could also be the switch to a net-zero economy.

Shah explained: “That will involve a lot of spending on technologies that will help decarbonise such as electric vehicles, renewable energies, etc. Those things tend to be metal intensive and as a result of that we could see a boom in metal demand.

“At the same time, supply is woefully short of what the demand is likely to be, so we may see those supply-demand imbalances occur once again.”

Shah added that this super cycle would not be regionally focused, unlike the previous ones, but global in nature. He also stressed that it will not benefit every type of commodities, but be specific to metals.

For Syms, however, this process will take several years. Therefore, he believes the demand for oil and gas will remain significant over the next few years.

He concluded: “Even if commodities do not rally by as much as the bullish outlook suggests, they can still play a useful role in a multi-asset portfolio. Commodities have historically exhibited low correlations with equities and fixed income, making them a useful diversifying asset class.

“They also tend to be a useful inflation hedge, mainly due to having a direct link to the prices of manufactured goods and can also perform well during times of heightened uncertainty as demand for precious metals tends to increase in periods of high market volatility.”