After 16 years at Fidelity, Eugene Philalithis announced that he will step back from his fund management duties in January 2024 and leave the firm at the end of March 2024.

Philalithis has been managing several funds in the Fidelity’s multi-asset range, including the £824.3m Fidelity Multi Asset Income, his largest portfolio in the Investment Association (IA) universe.

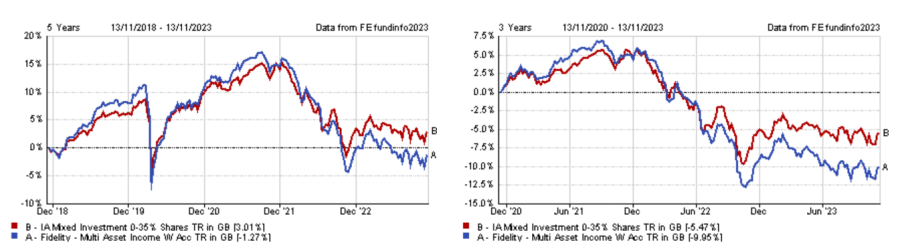

Under Philalithis’s tenure, the fund has outperformed the IA Mixed Investment 0-35% Shares sector, but only by a tight margin. The fund has, however, underperformed its sector over shorter timeframes.

Performance of fund under Philalithis’s tenure vs sector

Source: FE Analytics

A reason for this modest performance is down to the zero-interest rate environment under much of Philalithis’s tenure, which means it has been challenging to find attractive high-yielding investments.

Ryan Hughes, investments director at AJ Bell, said: “The Fidelity Multi Asset Income fund has had a challenging time in recent years, with its core exposure to fixed interest holding it back.”

However, he noted that the fund is “not alone in this” as many multi asset income funds have been heavily exposed to the asset class – particularly in the least equity heavy IA sector.

“While long-term performance is broadly in line with the peer group, more recent performance has been particularly challenging with some sharp underperformance of the sector, which will have disappointed investors,” he noted.

Performance of fund over 5yrs and 3yrs vs sector

Source: FE Analytics

Given that the fund has a strict focus on generating a competitive yield, Gavin Haynes, co-founder of Fairview Investing, doesn’t judge Philalithis’ performance too severely and considers that he, in fact, produced a solid return versus the benchmark over his tenure.

To replace Philalithis, Talib Sheikh will join the firm. His most recent role was with Jupiter Asset Management where he headed the multi-asset team. He has also previously worked at JP Morgan.

Sheikh’s appointment came as a surprise for Haynes, but he believes that it is sending a positive signal to investors.

He said: “Fidelity has traditionally favoured succession planning of bringing through managers internally, so it is interesting to see it recruit a high profile manager externally to take over this strategy.

“Sheikh is highly experienced in managing multi-asset income funds both at JPMorgan and Jupiter. I believe that taking on a manager of this pedigree shows a commitment from Fidelity to look to generate strong performance from this fund.”

Hughes added that two factors could help Sheikh to return to his previous successes.

He said: “Sheikh may benefit from the significant global resources that Fidelity brings and, if interest rate increases have peaked, there’s a chance he will also benefit from a dose of luck should those challenging fixed interest positions prove to be a lot more stable in the months ahead.”

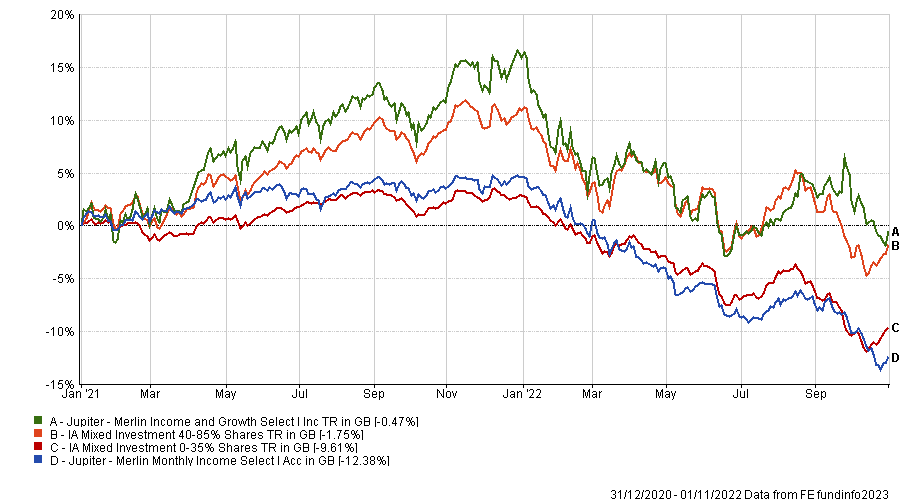

However, he noted that Sheikh had a tough time at Jupiter as he was not able to replicate the success he had while at JP Morgan.

Performance of funds under Sheikh’s tenure vs sectors

Source: FE Analytics

It is difficult to identify as this point how and whether the fund will operate differently under Sheikh. Haynes suggested there may be more of a focus on capital preservation as Fidelity has also appointed Mario Baronci as portfolio manager. He joins from Quaesio Capital Management, with his role being to shore up capital protection within the strategy.

He added that it is possible Sheikh and Baronci widen the scope of the underlying portfolio, which is currently focused towards investing in Fidelity’s own funds: the top six holdings are all single strategy Fidelity funds.

Overall it is to early to judge and Haynes believes that existing investors should stick with the fund if they already hold it.

He said: “The new manager has a demonstrable track record and I believe the current backdrop is well suited to this fund generating a high level of income and taking a cautious risk profile. It currently yields more than 5%, which is attractive distribution or as a compounder if reinvesting.”

Darius McDermott, managing director of FundCalibre, was less positive on the fund and believes that a significant improvement in performance is needed.

He said: “We don’t hold it, and unless there is a sustained, multi-year improvement in performance it will not enter our universe of rated funds.”

Alternatives to Fidelity Multi Asset Income

While the fund is particularly suitable for income-orientated investors with a low-risk appetite, there are also plenty of alternative options available. A good place to start is Fidelity Multi Asset Income’s sector, the IA Mixed Investment 0-35% Shares sector.

For those that do wish to switch, or are looking to invest in the sector for the first time, Haynes suggested Royal London Sustainable Managed Growth Trust, which follows a cautious approach with 25% in stocks and the rest in fixed interest and cash.

Performance of funds over 10yrs vs sectors

Source: FE Analytics

The fund has a bias towards UK-based corporate bonds, while the equity allocation follows a thematic approach investing in sustainable areas.

It has also benefited from short duration within the bond portfolio, which has enhanced performance during the inflationary shock.

Haynes’s second option is Vanguard Lifestrategy 20% Equity, which he considers to be a good benchmark fund to beat in the sector.

Performance of funds over 10yrs vs sectors

Source: FE Analytics

It has 80% of the portfolio in bonds and 20% in equities while at least 90% of the fund is invested in Vanguard’s own passive funds. “This aims to offer a simple low-cost defensive diversified portfolio in a single fund,” he said.

While FundCalibre does not rate any funds in this sector, McDermott said the Ninety One Diversified Income is currently under consideration. The fund has an objective of generating a 4% income stream while limiting capital loss.

Performance of funds over 10yrs vs sectors

Source: FE Analytics

Analysts at FE Investments said that the fund is a strong solution for investors with a clear income target.

They said: “Due to its mixed asset – but also defensive – approach, we have been impressed by the capacity of the fund to generate this stream of income, irrespective of the directions of equity and bond markets.

“This is a key differentiator to its peers, which have relied too much on equity markets to generate income and capital returns. Therefore we believe it is acceptable to consider the fund as an alternative asset in a portfolio, thanks to the fund’s capacity to generate uncorrelated returns from equity and bond markets.”