Hargreaves Lansdown has removed Liontrust UK Equity from its Wealth Shortlist after the departure of long-running manager Chris Field.

He ran the £330m fund since 2003 alongside fellow FE fundinfo Alpha Manager James de Uphaugh, who also retired earlier this year.

Under his management, the fund made a total return of 528.1% – some 207.6 percentage points greater than the average of the IA UK All Companies sector.

Total return of fund vs benchmark and sector under Field’s management

Source: FE Analytics

Field will be succeeded by Imran Sattar, who has co-managed Liontrust UK Equity alongside him since 2019, but Joseph Hill, senior investment analyst at Hargreaves Lansdown, said this change in leadership may alter how the fund works.

“Following these changes, the fund’s style will evolve to reflect Sattar’s investment philosophy,” he explained. “We expect the fund to become more concentrated but invest more in larger companies, and less in smaller companies.

“We also expect the fund’s style to become more growth orientated so it will offer investors a different exposure to the UK market than it has done in the past.”

Historically, the fund’s unique process has “offered something different to many of its peers” and helped it stand out in a crowded market, but a shift in style could remove some of its most appealing aspects, according to Hill.

“Though Sattar is an experienced UK equity fund manager in his own right, our conviction in him is lower than in Field and de Uphaugh,” he said.

“And the style Sattar’s fund will offer investors is one we feel we have well covered in our UK Growth fund selections on the Wealth Shortlist, where we have higher conviction in other managers.”

Since joining Liontrust from BlackRock in 2018, Sattar has managed three funds for the firm, including Liontrust UK Focus. He is sole manager of the much smaller (£17m) portfolio that has the same FTSE All Share benchmark and peer group as Liontrust UK Equity.

However, returns are down 4.3% in the five years since he took charge of the fund. Despite this period being a challenging one for those investing in the UK, its peers in the IA UK All Companies sector were up 5.3%.

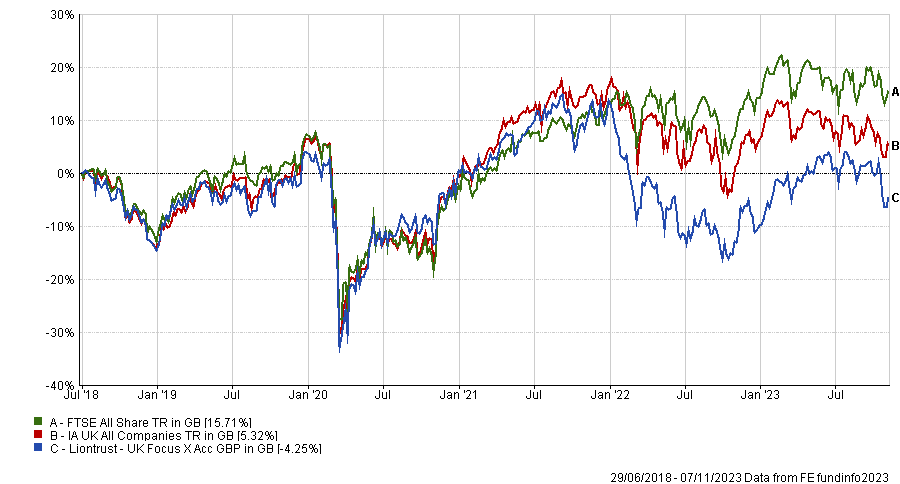

Total return of fund vs benchmark and sector under Sattar’s management

Source: FE Analytics

There are five UK growth funds remaining on the Wealth Shortlist after the removal of Liontrust UK Equity, including one portfolio managed by the same firm – Liontrust UK Growth.

This £1bn fund managed by Liontrust’s Smaller Companies team, which is headed up by Alpha Managers Anthony Cross and Julian Fosh, was up 90% over the past decade.

As the only remaining Liontrust fund investing in UK equities, analysts at Hargreaves said: “We think it could be a good option for the UK section of a broader global investment portfolio.

“A focus on high-quality companies means the fund could work well alongside other funds investing in unloved UK companies with recovery potential.”

Total return of fund vs benchmark and sector over 10yrs

Source: FE Analytics

Researchers at Square Mile also noted its 27% exposure to mid and small-cap companies, which could offer some appealing exposure to smaller companies if Liontrust UK Equity becomes more large-cap focussed as Hill anticipates.

They said: “The team’s ability to hunt out high quality and enduring companies is, in our eyes, one of the most compelling features of this strategy.

“It provides investors, especially those who are market cap conscious, the opportunity to access the Economic Advantage team and its formidable work, without having to take on significant exposure to the mid and smaller cap strategies that the managers are well known for.”