Short sellers redeemed their holdings in Naked Wines in October after disappointing annual results hammered its share price.

The wine retailer spent several months among the UK’s most shorted companies – a process in which traders buy a stock they expect to fail, loan it out and make a profit by reclaiming it at a cheaper price – until firms dropped their positions en masse.

It had 3.6% of its stocks held in short positions at the beginning of October but that dropped to 0.6% throughout the month as two firms cashed in their holdings. Jupiter is the only firm that retained its shorted stocks in the company.

The mass sell-off came after Naked Wines reported a £15m loss in its annual statement, down a sizable 617% from the £2.9m profit made in 2022.

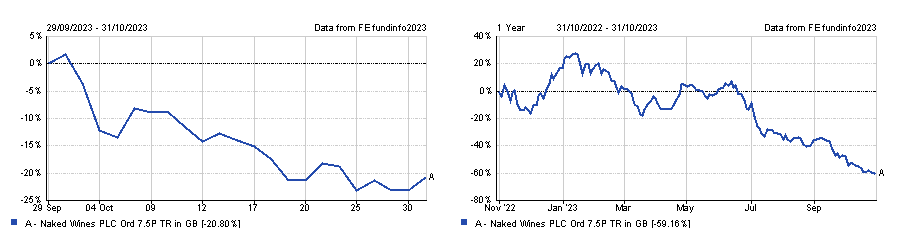

Shares in Naked Wines dropped 6.8% on the day of the announcement, with its price falling 20.8% in total throughout October.

In the annual report, founder Rowan Gormley apologised to shareholders who were undoubtedly disappointed with the 59.2% drop in value their stocks underwent over the past year.

Share price of Naked Wines in October and over the past year

Source: FE Analytics

He said: “The whole board of Naked Wines regret that your support and patience as shareholders, winemakers, angels and employees has not been rewarded. We are all determined to remedy that.”

Naked Wines CEO Nick Devlin highlighted inflation as one of the main headwinds facing the £33.4m company, but also noted that changes to Apple’s privacy policy has made it marketing more challenging.

However, Devlin said the company is on a mission to return profitability by resetting its cost base, increasing marketing efficiency and adopting new ways to drive traffic.

“We recognise that the environment is likely to remain tough and are configuring the business to be profitable and cash generative despite challenging conditions,” he said.

“A leaner and more focussed Naked will be best placed to deliver for our customers and winemakers. I believe we can emerge from these challenges a stronger business.”

With Naked Wines exiting the UK’s top 10 most shorted stocks, it was replaced by manufacturing company Melrose Industries.

The £6.5bn business edged its way onto the list after the amount of shorted stocks increased by 0.3 percentage points throughout the month to 3.7%.

Three shorting firms – Millennium International Management, Marshall Wace and P. Schoenfeld Asset Management – have bets against the company, with the former taking the largest position with a 2.2% holding.

Source: Financial Conduct Authority

Melrose Industries specialises in acquiring, developing and selling engineering companies, with one of its most notable purchases in recent years – GKN Automotive – joining its portfolio in 2018.

Over the past year, it spun off the automotive branch of this acquisition into its own company – Dowlais – and retained the aerospace part of the business, which generated a £175m profit over the past six months (up 161.2% from the £67m reported this the same time last year).

Overall revenue was up higher than anticipated in its six-month report, climbing to £1.6bn from last year’s £1.4bn, leading the company to upgraded its full-year guidance, increase its dividend and launch a share buyback programme.

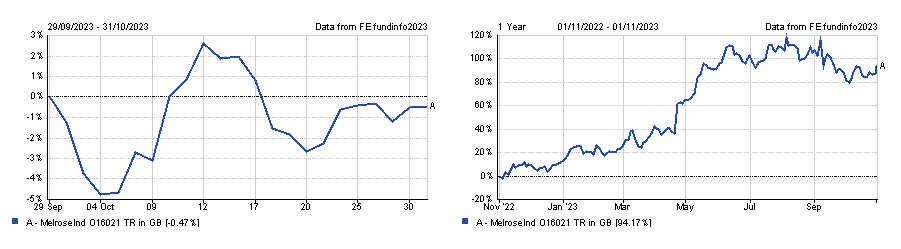

Shares in Melrose Industries were down 0.5% in October, but are up 94.2% in total over the past 12 months.

Share price of Melrose Industries in October and over the past year

Source: FE Analytics

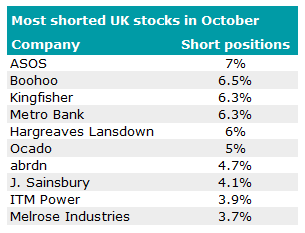

Sharing the top spot of the UK’s most shorted companies yet again was online fashion retailers ASOS and Boohoo.

Short positions in ASOS were down 0.7 percentage points to 7% throughout October, but those in a Boohoo leapt 1.5 percentage points to 6.5% as one new firm – GSA Capital Partners – joined the five others already betting against the company.

Both business have struggled to match the same levels of demand they had during the pandemic when savings were high and shopping options were limited.