The market has been “quite fixated” with Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla – the so-called ‘Magnificent Seven’ stocks that lately have been leading the market on the back of enthusiasm around artificial intelligence (AI).

But of the lot, Alphabet is the one that convinces FE fundinfo Alpha Manager Richard Saldanha and Francois De Bruin the most, making up 6.8% of the £451m Aviva Global Endurance portfolio that they run jointly.

Below, they unpack why and argue that the market has been “fixated” on AI, possibly ignoring other interesting areas. They also describe how they have given Warren Buffet’s idea of a moat a re-vamp.

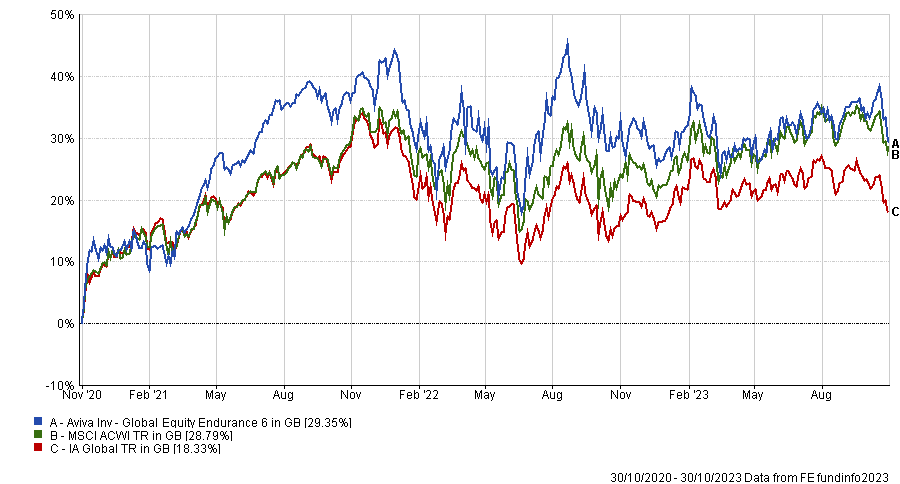

Performance of fund vs sector and index over 1yr

Source: FE Analytics

What are your investment philosophy and process?

Saldanha: The portfolio is all about durability. It's a long-term focused, highly concentrated fund, with 30 holdings. The biggest, Alphabet, is at 6.8%.

We look for companies that have durability in terms of strong competitive advantage, earnings and cash flow durability, and strong moats.

Why should investors pick your fund?

De Bruin: There are two reasons why we think it makes sense to take more defensive stances.

Firstly, if you lose 50% of your investment, in order to regain your capital you need to make 100% just to break even. This asymmetry around resilience and defence is why it makes sense to try not to lose money in the first place.

The second thing has to do with how we value assets. We mostly look at discounted cash flows (DCF), and you stare at them long enough as we do, you’ll know that 70% of the value lies in the cash flows that are generated 10 years from now and beyond. That's why we obsess about the longevity, durability and resilience of cash flows. What we call a ‘modern’ moat.

What’s a ‘modern’ moat?

Saldanha: The Warren Buffets of this world talked about moats in terms of having strong brands and economies of scale. What we look for are ‘modern’ moats, or companies with what we call ‘network effects’ which are at the basis of real sustained long-term value creation.

De Bruin: Alphabet’s search engine is a fantastic example of network effects in action. The more users it attracts, the more it encourages companies to market their goods and services on Google, and the more useful it is to consumers. What you have is a self-fulfilling prophecy where strength begets more strength that enforces both the growth and the durability.

An extremely well-resourced company with highly talented individuals such as Microsoft has not been able to make a dent in the search market because network effects are so difficult to disrupt.

Alphabet is the only Magnificent Seven company that you own. Why?

Saldanha: The big driver of this market have been these Magnificent Seven technology companies and they’re great companies, but we are in a world where valuations do matter.

The beauty of Google compared to some of the other Magnificent Seven is that it still only trades on 20x earnings and it has close to a 5% free cash flow yield. So it's generating a lot of free cash flow, it has pristine balance sheets, and we can see the runway for growth.

Also, the market has been quite fixated with AI, but there are many other opportunity sets for resilient, defensive companies at good prices, for example in sectors such as health insurance and insurance broking, which are really attractive right now.

What were the best and worst calls over the past year?

Saldanha: Our best and worst calls this year have been on the opposite sides of the generative AI wave.

On the positive side, Alphabet was particularly well placed to benefit from it. We added to our position when Microsoft’s Satya Nadella teased Google to “come out and dance”, and we are certainly pleased. Evidently, they did come out and dance, with shares rising almost 50% to the end of September.

On the other hand, Teleperformance, the global outsourced business services provider, had fallen sharply as the emergence of large language models could prompt companies to bring much of that activity in-house.

Shares had fallen 29% over the year to date when we exited our position, leading to an attractive free cash flow yield, but we had lost confidence in the long-term competitive position of the company. Shares have continued to struggle and are down a further 35% since then.

What do you do outside of fund management?

De Bruin: We are both passionate sports fans. There are certainly some interesting parallels with fund management whether it be making sure our starting XI (portfolio) is a strong as it can be but also making sure the substitutes on the bench (new ideas) are ready and primed to come on if required.

Saldanha: We have a fantasy football league running in the office and Francois has more bragging rights there than me right now but it’s a long season ahead – he also happens to be an Arsenal fan whilst I support Chelsea but luckily we don’t let that get in the way of our working relationship.