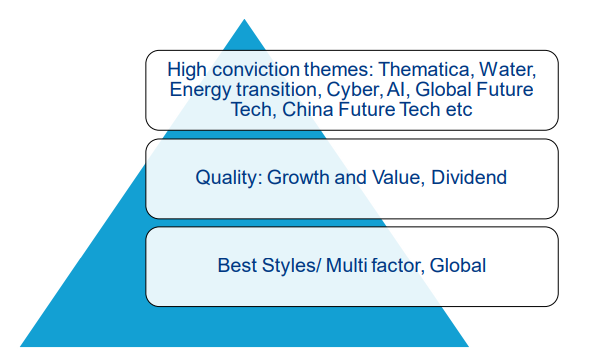

Equity markets have been swarming with “zombie” companies that are hiding in investors’ portfolios, but now that the “death of the zombies” is incoming, Allianz Global Investors equity global chief investment officer (CIO) Virginie Maisonneuve said a pyramid-shaped portfolio works best to avoid any potential pitfalls.

“At the bottom of the pyramid should be a stable strategy, such as a multifactor, global strategy, to anchor the portfolios. Then the next level is quality,” she explained.

“When you have interest rate movements, value tends to benefit, but not any kind of value. I'm not interested in value with dirty coal or dirty oil and similar, but rather only quality value, and then quality growth and quality income.”

Then, at the summit of the pyramid are themed investments, where Maisonneuve particularly mentioned cybersecurity, the energy transition and conviction plays around the global future.

Opportunity pyramid for the next 12 month

Source: AllianzGI

“Cybercrime committed through the use of AI [artificial intelligence] tools makes it much more impactful. The cost to the planet on cyber is in the trillions now, so this is really an area where there's pricing power,” she said.

“Then there’s the climate transition as well as opportunities in China and also what we call China plus, which includes India, Vietnam, Indonesia and Mexico for the near-shoring trend. We think about these markets as a thematic map rather than emerging versus developed markets or in GDP-per-capita terms.”

However, investors need to take a highly selective approach – something that is especially true in times of increased volatility such as these – and that portfolio construction should be even more thorough than usual.

“Volatility is not bad for stock pickers because it gives opportunities to buy companies at more favourable valuations, but portfolio construction in this kind of volatility has to be very carefully followed,” she said.

Within the structure of the pyramid, Maisonneuve stressed the importance of price points and how “essential” the use of sustainability, earnings-per-share and risk data is.

Another key is to look at all angles. For example, inflation has two sides: one that impacts economic growth and borrowing and another that impacts demand.

“You want companies across the board that have a very strong balance sheet and are in sectors where demand is strong, because in the next two to three years, we are going to see the death of the zombies,” she said.

“A lot of weaker companies with low margins and that frankly should not be in business, will die. That’s a good thing. But for now, it’s all about high pricing power, strong balance sheet, and the ability to survive in terms of debt until rates go down.”

As a good barometer of what might come next, Franck Dixmier, Allianz Global Investors global chief investment officer for fixed income, suggested looking at core inflation.

“Core inflation is not a big deal in the US anymore, which is why we are convinced that the Fed is done,” he said. “We find that the first cut is priced in by the market for mid-2024 and we’re fine with that.”