The past 10 years have proven to be challenging for the UK market as domestic equities have delivered very modest returns.

For instance, the FTSE All Share has grown 69.9% in that period, which pales in comparison to the S&P 500 and MSCI World, which have made 285.4% and 192.3% respectively.

With UK equities performing so poorly, there were arguably more incentives for investors to try to beat the market by using the services of a fund manager.

Performance of indices over 10yrs

Source: FE Analytics

Yet, some managers charge more than others for their stock selection and investors have to make sure that they are worth the money.

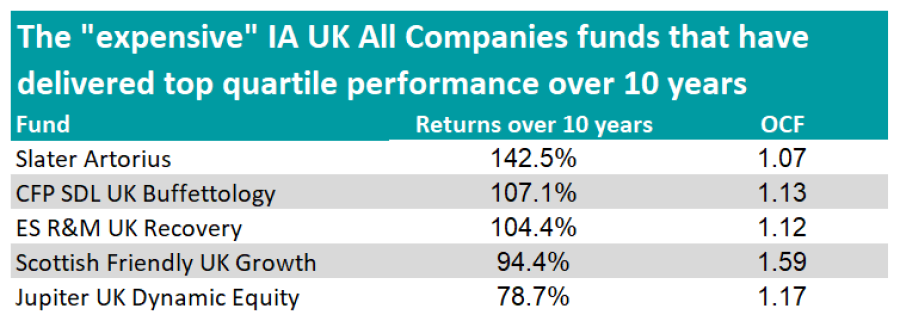

Therefore, Trustnet has researched the funds with an ongoing charge figure (OCF) of more than 1% that have made top-quartile performance over 10 years. All OCFs are based on the fund’s main share class as determined by FE Analytics.

There were five funds meeting these criteria in the IA UK All Companies sector, with many of them having a bias toward mid- and small-caps.

This is the case of CFP SDL UK Buffettology, managed by FE fundinfo Alpha Manager Keith Ashworth-Lord, for instance. As the name suggests, the fund aims to follow Warren Buffett’s ‘Business Perspective Investing’, which involves looking for businesses with an economic moat and a strong position in their industry, limiting the risk posed by competitors.

The "expensive" global funds that have delivered top quartile performance over 10 years

Source: FE Analytics

Analysts at FE Investments recommend the fund despite its fees, noting that “Ashworth-Lord’s disciplined approach, extensive experience, strong ties with management teams and alignment of interests with investors through significant personal investments in this fund” had “impressed” them.

“We expect the fund to maintain its high level of differentiation and therefore to potentially perform very differently to its peers. Due to the manager’s aversion to banking, energy and commodity-related companies, the fund may underperform when these sectors perform well and vice versa. The high exposure to industrial and consumer discretionary businesses would still add a certain level of cyclicality,” they said.

Another example is ES R&M UK Recovery, with manager Hugh Sergeant looking for undervalued UK businesses that have the potential to improve or recover from rough times.

It is recommended by analysts at Square Mile Investment Consulting & Research, who gave it an ‘AA’ rating.

“This is a high risk, high return strategy that really needs to be considered over the very long term as recovery type stocks tend to offer considerable share price upside potential but are extremely volatile and can be particularly vulnerable during market downturns,” they said.

“However, in our view," the experience of the manager and the underlying philosophy and portfolio biases, as well as the investment approach and supporting resources of the firm, are of a pedigree that should enable the fund to meet its performance objectives over time.”

Other expensive UK All Companies funds achieving top-quartile performance over the past decade include Slater Artorius, Jupiter UK Dynamic Equity and Scottish Friendly UK Growth.

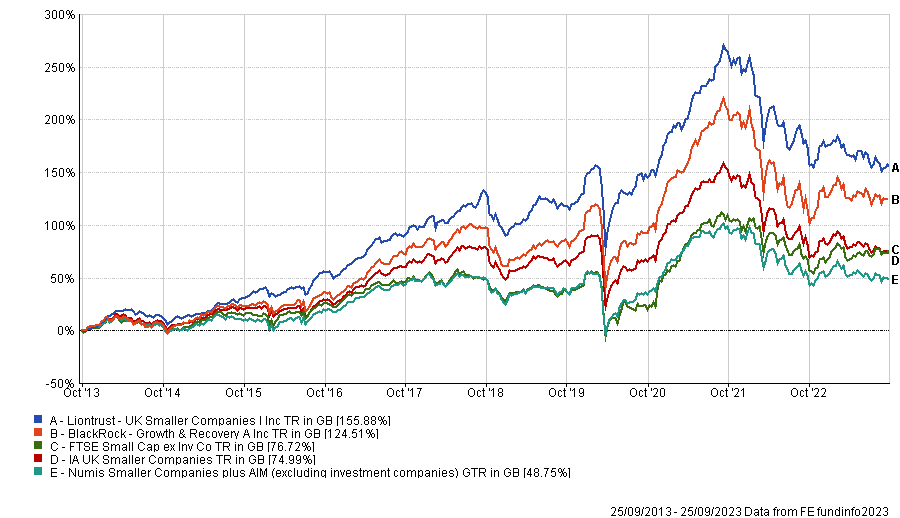

Moving on to the IA UK Smaller Companies sector, higher fees are easier to justify as smaller companies are more expensive to research and trade. Yet, only two funds in the sector with an OCF above 1% have made top-quartile performance in the past 10 years.

Performance of funds over 10yrs vs sector and indices

Source: FE Analytics

The first one is Liontrust UK Smaller Companies, managed by FE fundinfo Alpha Managers Anthony Cross and Julian Fosh as well as Matthew Tonge, Victoria Stevens and Alex Wedge.

The fund has a quality-growth tilt with the managers looking for stocks that can sustain a level of profitability above the average. They also require the management of their investee companies to have a minimum 3% stake in the business.

The fund has struggled in recent times, delivering negative returns over one year, but has made 161.3% over the past decade.

In the same period, BlackRock Growth & Recovery has returned 131.5%, with notable overweights in industrials, consumer discretionary and technology.

Finally, it should be noted that no fund with an OCF above 1% in the IA UK Equity Income sector has achieved top quartile performance over 10 years.