Performance fees are perhaps one of the most polarising charges in all of investing. Supporters argue that it aligns management with the returns for shareholders, giving extra incentive to perform well. Detractors counter that it is an additional charge for performance that has already been paid for.

After all, investors pay an annual charge, known as the ongoing charges figure, which encompasses the costs associated with the running of a fund. On top of this, transaction fees – the cost of buying and selling stocks – are incurred when the manager makes changes to a portfolio. But it does not end there. Platform fees charged by the platforms that investors use also add up.

As such, adding an additional fee based on the performance of a fund may seem galling to some investors, who could already be paying a hefty price.

And data from RBC Brewin Dolphin suggests the returns are not worth the extra cost. Indeed, equity funds with performance fees have generally underperformed those without them.

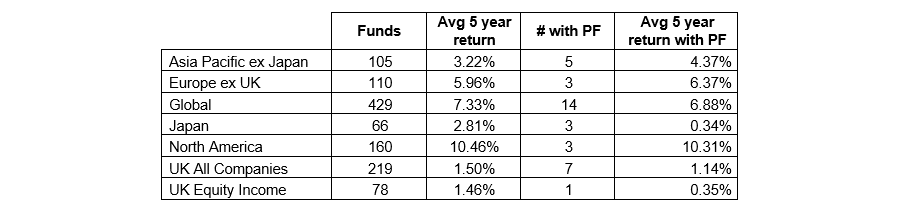

According to the research, average yearly returns from global, Japan, North America, UK all companies and UK equity income funds with performance fees failed to keep pace with their peers.

Japan funds had the biggest discrepancy, as the table below shows, with performance-fee charging portfolios making average annual returns of just 0.34% compared with 2.81% for the average Japan fund.

Average annualised returns over five years from long-only funds

Source: RBC Brewin Dolphin, Datastream

However, there are some regions where it has paid off, such as Europe and Asia, where the returns net of fees have been higher in performance-fee charging portfolios.

Rob Burgeman, senior investment manager at RBC Brewin Dolphin, said: “A bit like with active management, there are certain regions where it is worthwhile considering funds with a performance fee and others where it is not.

“In markets like North America it is notoriously difficult to consistently outperform the benchmark indices, which is one of the reasons why there are so few bothering to attach a fee.”

As such, investors need to look at the risk-reward of active versus passive funds first, before considering any additional charges incurred.

Burgeman said there needed to be a high hurdle rate that the fund must hit, with any underperformance earned back first before a performance fee is charged.

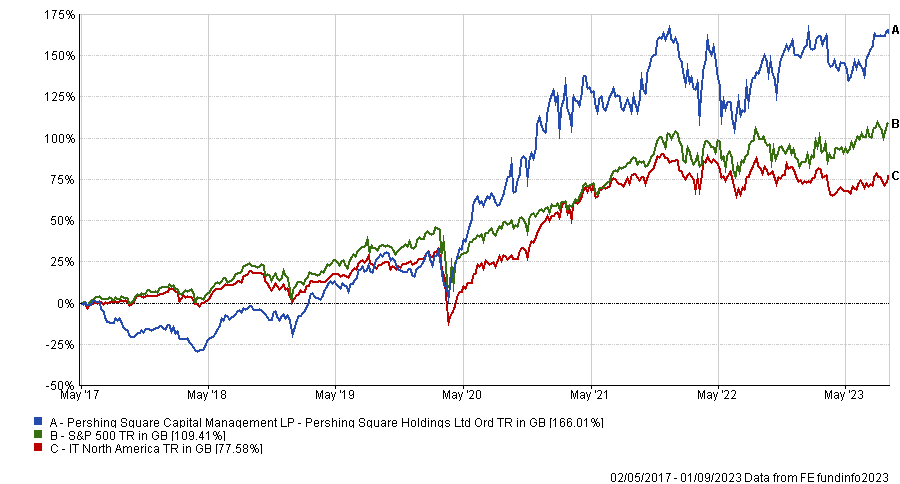

Total return of trust vs sector and benchmark over 10yrs

Source: FE Analytics

“A good example is Pershing Square, which comes with a 10% performance fee, but it has delivered a return of more than 100% over five years, which is a lot more than a comparable passive,” he said.

“Pershing Square is constantly mentioned for its charging structure, which on the face of it looks expensive. But, in the past five years it has delivered annualised returns of around double the historic annualised average for the S&P 500.

“On its current discount to net asset value (NAV), you are paying 64p for £1 of assets – a 36% discount. It looks a compelling proposition, even if you are paying for performance.”

One of the main reasons investors may want to consider paying a performance fee is if the portfolio is offering something that they cannot get elsewhere – such as being in an asset class where there are few options to choose from.

“It should really only be considered where there are specific strategies or the fund offers exposure to specialist areas. In those instances, it might even be a good thing and align managers’ and investors’ interests,” said Burgeman.

However, it can also encourage managers to take excessive risk, particularly towards the end of the reporting year if the portfolio is lagging behind its benchmark index.

An example of a trust that is worth a look despite coming with a performance fee attached is Odyssean Investment Trust.

“Its approach is quite different to what you get elsewhere, owing in part to its managers’ backgrounds in private equity. The trust holds a relatively concentrated portfolio of stocks that are bought at what the managers feel is a cheap price and then sold for more at a later date,” said Burgeman.

“The Odyssean team takes all its performance fees in shares, giving the managers significant skin in the game and aligning their own interests with other shareholders.”

Total return of trust vs sector since launch

Source: FE Analytics

Overall, the RBC Brewin Dolphin senior investment manager said costs should only be part of the consideration. By rejecting portfolios with an above average cost, investors might be giving up an opportunity for significantly higher gains.

“The trick is to not be frightened by high charges, but don’t be ignorant of them either,” he said.