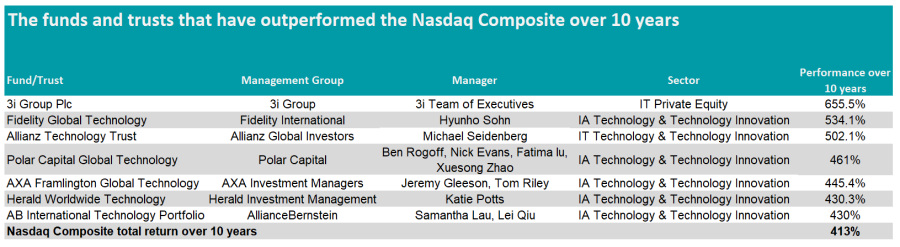

Beating the S&P 500 has been a tough challenge in the past 10 years, but outperforming the Nasdaq has proven an almost insurmountable task, with only seven actively managed funds (including investment trusts) and four trackers having achieved the feat.

The market has benefited from its weighting to the technology sector, which has driven the market in the past decade. Tech stocks make up 55% of the Nasdaq Composite, but only 28% of the S&P 500.

All the active funds that have beaten the Nasdaq Composite over 10 years are related to technology, with the exception of the largest outperformer 3i Group, the UK’s biggest investment trust with a market cap of £18.7bn.

One characteristic of the portfolio is the very high concentration (more than 50%) in a single business, Dutch discount retailer Action.

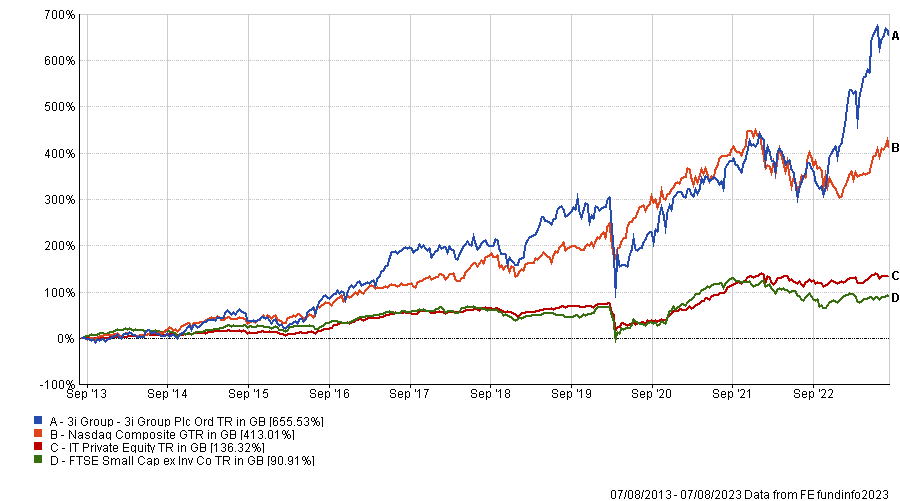

Performance of trust vs sector and indices over 10yrs

Source: FE Analytics

The other outperformers are all constituents of either the IA Technology & Technology Innovation sector or the Association of Investment Companies (AIC) equivalent.

Fidelity Global Technology, managed by FE fundinfo’s Alpha Manager Hyunho Sohn, has been the strongest tech fund, returning 576.2% over 10 years.

Gavin Haynes, co-founder of Fairview Investing, said: “Sohn is highly experienced with past specialisation in Asian technology and US semiconductor hardware stocks. The investment approach is based on the belief that understanding technology trends and new innovations is the key to identifying long-term winners.

“Whereas many investors in tech look for blue sky future growth potential or follow short-term momentum, the Fidelity fund has a strict valuation discipline. This results in quite a differentiated portfolio to the peer group.”

A feature of the fund is the mixture of mega-caps as well as mid-caps and smaller businesses. It also has the lowest concentration in the top 10 holdings compared to the other tech funds in this list.

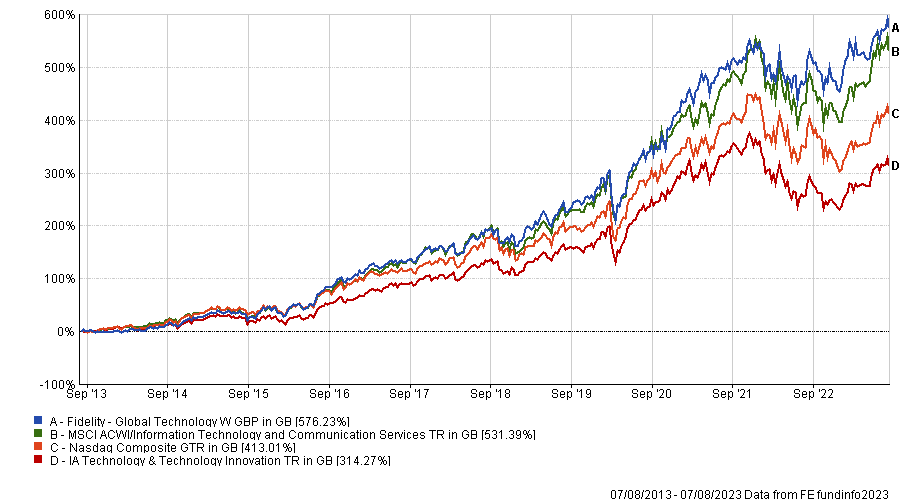

Performance of fund vs sector and indices over 10yrs

Source: FE Analytics

Allianz Trust is the only investment trust besides 3i Group to have outperformed the Nasdaq Composite over 10 years, returning 502.1%.

It has a mid-cap bias that has supported the long-term performance but caused it to lag behind the benchmark in the mid- and short-term. It has also been more volatile than its tech peers.

Gavin Trodd, associate, investment companies research at Numis, said: “The trust is fundamentally driven through a bottom-up stock picking approach, combined with undertaking detailed research to identify key macro and market themes.

“The focus is on identifying fast growing businesses at a reasonable valuation that can benefit from these themes and have the ability to deliver sustained growth over long periods from current or potential market leading positions.”

Performance of trust vs sector and index over 10yrs

Source: FE Analytics

Another fund that has beaten the Nasdaq Composite in the same period is Polar Capital Global Technology.

John Monaghan, research director at Square Mile Investment Consulting and Research, described it as an “attractive proposition” for investors seeking exposure to rapidly growing technology firms over the long term.

He added: “It is run by a small team of talented managers who are skilled in identifying changing industry trends and the businesses that are poised to benefit as a result. As technology is ever evolving, the firm’s team of sector specialists provides the managers with a distinct advantage in helping them stay informed of developments.

“In addition, the investment team boasts considerable market experience and has witnessed firsthand numerous seemingly promising businesses that have gone on to fall by the wayside as well as others that have succeeded in achieving sustained growth.”

Yet, Rob Morgan, chief analyst at Charles Stanley pointed out at the fund has a performance fee, whereby the managers receive a 10% share of any performance ahead of the fund’s benchmark in addition to the annual management charge.

Performance of trust vs sector and index over 10yrs

Source: FE Analytics

The fund also has a close-ended version, which has, however, failed to beat the Nasdaq Composite over 10 years.

While the investment trust is run by the same team, there are differences in holdings and concentration, leading to variations in performance between the two versions. While the open-ended version has done better over 10 years, the opposite is true over five years.

Herald Worldwide Technology is the smallest active fund (£75.4m in AUM) to have beaten the Nasdaq Composite over 10 years.

Morgan highlighted the fact it is not well known and often overlooked by investors seeking exposure to technology.

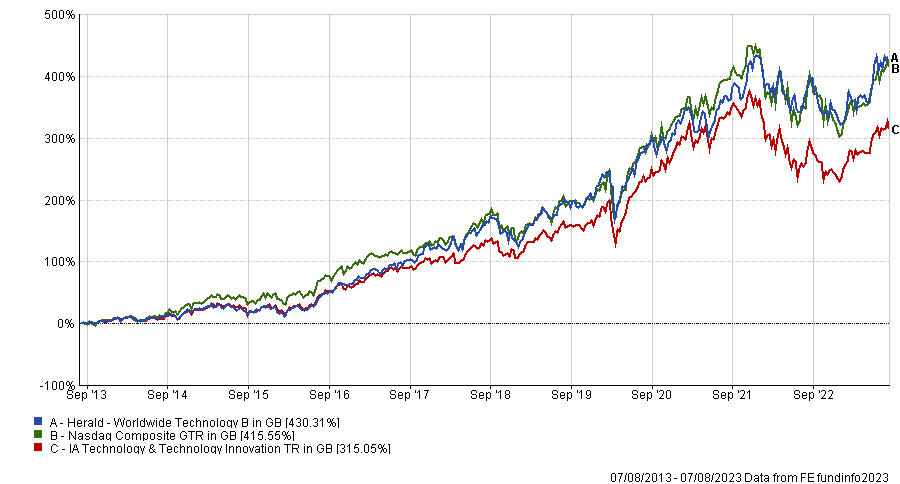

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

He said: “It has one of the most accomplished technology specialists at the helm, Katie Potts, whose experience is reflected in strong performance but not the size of the fund.

“It is still something of a minnow compared to others in the sector, but it’s well worth considering despite not being a big name.”

Haynes added that a key differentiator of the fund is that it has around half of its allocation into mid- and small-caps.

The other active funds that have outperformed the Nasdaq Composite over 10 years are AXA Framlington Global Technology and AB International Technology Portfolio.

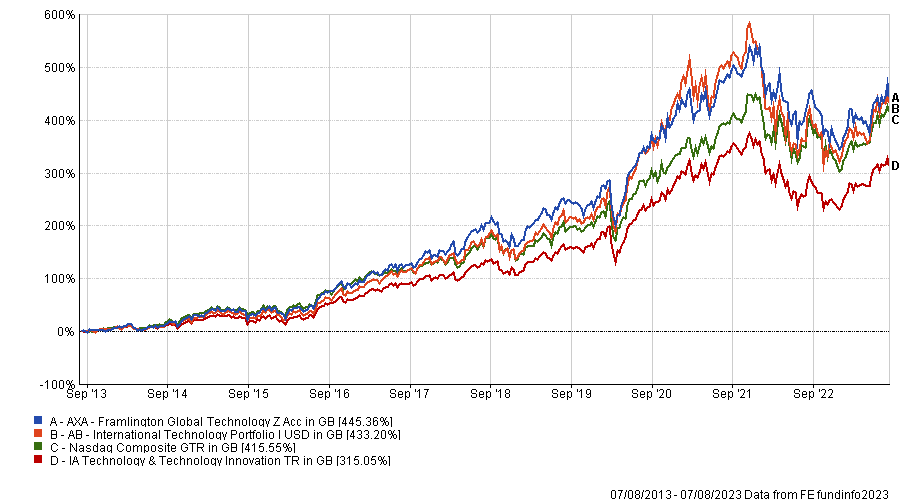

Performance of funds vs sector and indices over 10yrs

Source: FE Analytics

The AXA fund is managed by Jeremy Gleeson and takes an active, unconstrained approach mixing both bottom-up and top down themes.

Haynes said: “Gleeson will invest in stocks exposed to one or more key sub-themes that are expected to underpin the growth of the technology area over the coming years.

“From a stock picking perspective the fund is focused towards large-cap global leaders and invests based on the belief that companies that can produce above-average growth in earnings and cash returns on invested capital will outperform over time.”

As for the AllianceBernstein fund, it has beaten the Nasdaq Composite by the smallest margin (a difference of roughly 18 percentage points) and has also been the most volatile of the open-ended funds in the list.

Source: FE Analytics

Only four passive funds have beaten the Nasdaq Composite in the same period, with two of them, Invesco EQQQ Nasdaq 100 UCITS ETF and iShares NASDAQ 100 UCITS ETF, using it as their benchmark.

Yet, L&G Global Technology Index Trust, which tracks the FTSE World Technology Index, has been the best performer in that period.

SSGA SPDR MSCI World Technology UCITS ETF, which uses MSCI World Information Technology Capped 35/20 Index as a benchmark, is the other passive fund that has beaten the Nasdaq Composite over 10 years.