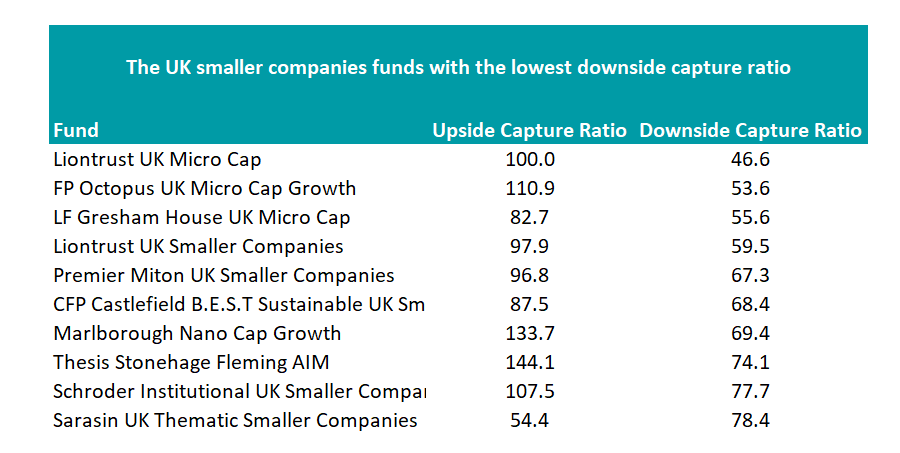

Smaller companies tend to be for the more risk-on investor, but there are some that have managed to protect against stock market crashes all the same, according to the latest study from Trustnet.

Liontrust UK Micro Cap has the best downside capture ratio in the sector when compared with an appropriate benchmark. When the Numis Smaller Companies excluding Investment Companies index has fallen, the fund has lost less than half as much (see full methodology below). If the index were down 10%, its 45.6% capture score means it would have lost just 4.6%.

It has also performed well when the market has risen, increasing by roughly the same amount as the index over the past five years during the good times.

The portfolio is managed by FE fundinfo Alpha Managers Anthony Cross and Julian Fosh, alongside co-managers Matthew Tonge and Victoria Stevens.

The team uses its “Economic Advantage” process to find profitable companies that have an edge on their rivals, and will only invest in stocks where the senior management of the business has a minimum 3% equity ownership.

It is predominantly invested in AIM, with almost 80% of the portfolio in companies quoted on the junior market, and currently holds more than 9% of its £206m under management in cash.

In 2018, when the index and average IA UK Smaller Companies sector peer made double-digit losses, the fund made a 3% gain, the best in its sector, while last year it was able to withstand the worst of the market falls, eventually making a 12% gain, the 10th-best figure among its sector rivals.

Over five years, the fund has made 165.3%, the second-best figure in the sector. This is almost double its average peer and 100 percentage points more than the benchmark index.

Source: FinXL

The larger £1.8bn Liontrust UK Smaller Companies fund also made the list, with a downside capture ratio of 59.5%, although it has slightly underperformed the Numis index during market upturns.

However, the main reason investors dabble in smaller companies is for the upside potential, so just protecting on the downside is of limited use.

Although the £120m Sarasin UK Thematic Smaller Companies fund has one of the lowest downside capture ratios (78%), it also has one of the worst upside capture ratios, and over the past five years has been the worst performer in the sector. All others on the list have either made top-quartile or second-quartile returns.

The best fund in the sector over five years has been Thesis Stonehage Fleming AIM, which appears on both lists.

The £143m portfolio, managed by Paul Mumford and Nick Burchett, has made 170% over this time, three times more than both the Numis Smaller Companies ex ITs index and the FTSE AIM All Share.

Formerly known as TM Cavendish AIM, it has been a top-quartile performer in each of the past five calendar years and is on course for a top-10 finish in 2021: it is currently sixth in the 50-strong sector, with a gain of 30.9% year-to-date.

For aggressive investors, the £259m Jupiter UK Smaller Companies Focus fund has the highest upside capture ratio.

Source: FinXL

The fund, managed by Matthew Cable, has a high weighting to industrials and financials, two sectors that have been boosted by the value rally in 2021.

It has an upside capture ratio of 152.7%, the best in the sector, although its downside capture is higher at 93%. It has failed to crack into the top quartile over five years as the rocky times, such as March 2020 and 2018, have affected performance.

From the list of funds with the best upside capture ratios, three others also failed to make top-quartile returns relative to their peers. Aegon UK Smaller Companies and Janus Henderson UK Smaller Companies made below-average returns, while Threadneedle UK Smaller Companies joined Jupiter UK Smaller Companies Focus in the second quartile of the sector.

Methodology

In this series, we looked at upside and downside capture ratios, which measure how much a fund has risen or fallen relative to a benchmark index over the past five years. For smaller companies funds, we used the Numis Smaller Companies ex ITs index.

If a fund has a downside capture ratio of 100, the fund has lost the same amount as the benchmark. A ratio of 50 shows that if the market were down 10%, the fund would be down 5%.

Similarly, 150 would imply a 15% drop if the market fell 10%. The opposite is true for upside – a score of 150 would imply a 15% rise if the market were up 10%.

Previously we have studied the IA UK All Companies and IA UK Equity Income sectors.