BlackRock went overweight US stocks on a tactical horizon of six to 12 months earlier this year and is sticking to its position despite the market hitting all-time highs.

The asset management giant, which is the largest in the world, is confident that artificial intelligence (AI) advances will continue to bolster returns in the technology sector but believes that gains will broaden out into other sectors such as industrials, commodities, healthcare and energy.

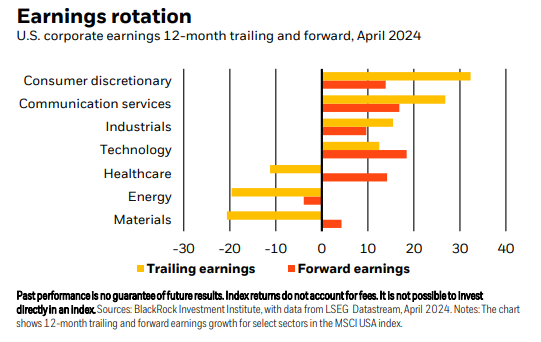

A sector rotation is underway. Although the consumer goods and tech sectors have driven earnings growth for the past 12 months, going forward, consumers are starting to show signs of fatigue as their pandemic savings run dry, while demand is improving in other sectors, the firm said.

Carrie King, chief investment officer of US and developed markets, fundamental equities at BlackRock, said: “Earnings for energy and commodity producers are picking up after a rough two years. We think higher commodity prices can persist and boost both, with the FTSE/CoreCommodity CRB index up 14% this year and near a decade high.

“Prices of metals key to the low-carbon transition, such as copper, have rebounded and could rise further. We see AI advances stoking the buildout of data centres, resulting in major commodity demand. Companies bringing production closer to home can boost industrials.”

Nonetheless, there are risks on the horizon, including tensions in the Middle East and the potential for inflation and interest rates to stay higher for longer. Against that backdrop, BlackRock views energy stocks as a potential portfolio buffer against geopolitical risk.

“The March acceleration in core services inflation, excluding housing, suggests overall core inflation could rise again sooner than we had expected. The tensions in the Middle East look contained for now but we see risks of further escalation. We could face elevated oil and commodity prices for longer, reinforcing the new regime of higher inflation – and our long-held view that we are in a higher-for-longer interest rate environment,” King warned.

“The question for stocks: will economic and earnings growth stay strong enough to offset that inflation and policy rate outlook?”

So far, solid job gains have supported US economic growth, helping companies to maintain profit margins. “We think market sentiment can stay upbeat if falling goods prices keep dragging down inflation – allowing the Federal Reserve to deliver one or two rate cuts,” King said.

“Nonetheless, after such strong recent performance, the onus will be on US companies to meet already-high expectations this earnings season.”

Analysts are forecasting 2024 earnings growth of 11%, which is well above the 7% historical average, according to data from LSEG.

Felix Wintle, manager of the VT Tyndall North American fund, agrees with BlackRock that stock market leadership is spreading to other sectors. Since the market rally began at the start of November, “mid-caps are working, small-caps are working, there’s been a broadening out of participation,” he said. “We’re actually really bullish.”

This is in stark contrast to last year when “everyone wanted to play defence” but “your traditional defensive sectors were a no go” because utilities, real estate investment trusts and pharmaceuticals were all hit hard by successive rate hikes.

“People just piled into Apple and Microsoft [thinking] ‘I know these stocks aren’t going to blow me up’,” Wintle said. In his 20-year investment career, he doesn’t remember a market being that narrow.

To find the next stock market leaders, Wintle is leaning into the themes of US federal spending on infrastructure, reshoring the semiconductor industry and building out data centres – trends that BlackRock is also monitoring closely.

The VT Tyndall North American fund’s biggest winner this year is Super Micro Computer; it provides the hardware to retrofit and upgrade servers to make them compatible with AI, which uses more computer power than traditional data centres can handle. Since Wintle bought the stock in January it has risen 300% so he is trimming the position.

Share price performance of Super Micro Computer year-to-date in US dollars

Source: Google Finance

Wintle’s high conviction holdings in other sectors include Celsius, which makes a healthy energy drink, and online sports betting company DraftKings.