Passive funds investing in small-cap and income stocks in emerging markets have performed strongly against their peers in recent years, although it is an active fund managed by Artemis that has outpaced the rest on a wide range of risk and return metrics, Trustnet research shows.

In this annual series, we examine the major Investment Association sectors to see which funds have consistently delivered for investors for performance, volatility and other key measures over the past three years. This week, the IA Global Emerging Markets sector goes under the microscope.

In this research, we have worked out the percentile rankings of each fund for: cumulative three-year returns to the end of 2023 as well as the individual returns of 2021, 2022 and 2023 (to ensure performance isn’t down to one standout year), annualised volatility, alpha generation, Sharpe ratio, maximum drawdown, and upside and downside capture relative to the sector average.

The 10 percentile rankings for these metrics are then collated into an average percentile score for each fund; the lower the score, the stronger a fund has been across the board over the past three years.

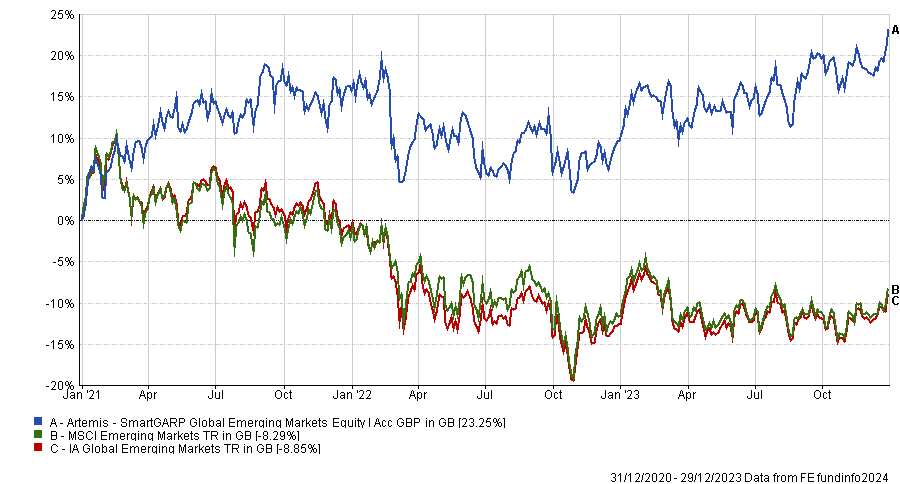

3yr performance of Artemis SmartGARP Global Emerging Markets Equity vs sector and index to end of 2023

Source: FE Analytics

The chart above shows the IA Global Emerging Markets fund that took first place in this research. Artemis SmartGARP Global Emerging Markets Equity has an average percentile score of just 8.7, on the back of a 23.3% three-year return (seventh highest, out of over 150 funds) with strong risk-adjusted performance and a relatively low maximum drawdown.

The £696m fund uses Artemis’ quant-based SmartGARP process, which aims to find cheap stocks that are growing faster than the market (‘GARP’ stands for ‘growth at a reasonable price’). The SmartGARP process highlights the best ideas in the market based on eight factors (growth, value, earnings estimate revisions, momentum, accruals, ESG, investor sentiment and macroeconomic forecasts), which are then reviewed by the managers for inclusion in the portfolio.

It is managed by Peter Saacke and Raheel Altaf, although the former is to retire from the fund management industry in June to return to teaching.

Analysts at FE Investments, which has the fund on its Approved List, said: “The fact that the fund does not only look at deep value or distressed stocks and that the model incorporates a variety of factors beyond value implies that it could be used as a core emerging-market allocation.”

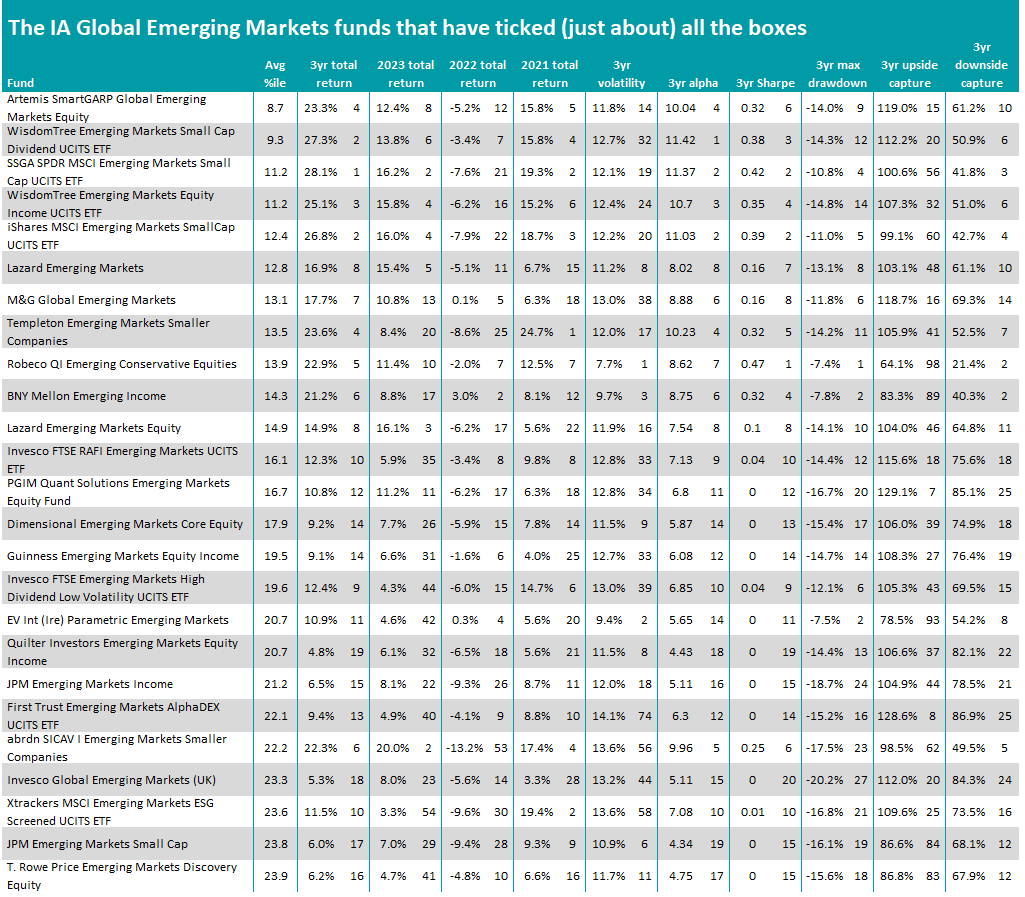

The IA Global Emerging Markets funds joining Artemis SmartGARP Global Emerging Markets Equity among the top 25 in this research can be found in the table below.

Source: FE Analytics

The next four are all exchange-traded funds (ETFs) and, as their names make clear, fit into two trends – investing in smaller companies or equity income stocks. In the case of WisdomTree Emerging Markets Small Cap Dividend UCITS ETF – the second-best performing fund in this research – both trends are combined.

A look at the performance of the various emerging market equity indices over the past three calendar years shows just how strongly these two themes have been, especially as the broad MSCI Emerging Markets index made an 8.3% loss (in sterling terms).

The MSCI Emerging Markets Small Cap index, however, made a 29.4% total return and the MSCI Emerging Markets High Dividend Yield gained 12.4%. Contrast this with the returns of their opposing indices: MSCI Emerging Markets Large Cap fell 11.4% and MSCI Emerging Markets Growth dropped 21%.

Indeed, these two themes are also present in several of the active funds in the above table.

Templeton Emerging Markets Smaller Companies, abrdn SICAV I Emerging Markets Smaller Companies and JPM Emerging Markets Small Cap all focus on small-caps while BNY Mellon Emerging Income, Guinness Emerging Markets Equity Income and JPM Emerging Markets Income are seeking dividend-paying companies.

That Artemis SmartGARP Global Emerging Markets Equity doesn’t fit into either of these trends, as it has a bias towards large-cap value stocks.

This has worked for other IA Global Emerging Markets funds over the past three years, with the likes of Lazard Emerging Markets, M&G Global Emerging Markets, Robeco QI Emerging Conservative Equities and Invesco Global Emerging Markets outperforming their peers with this kind of portfolio.

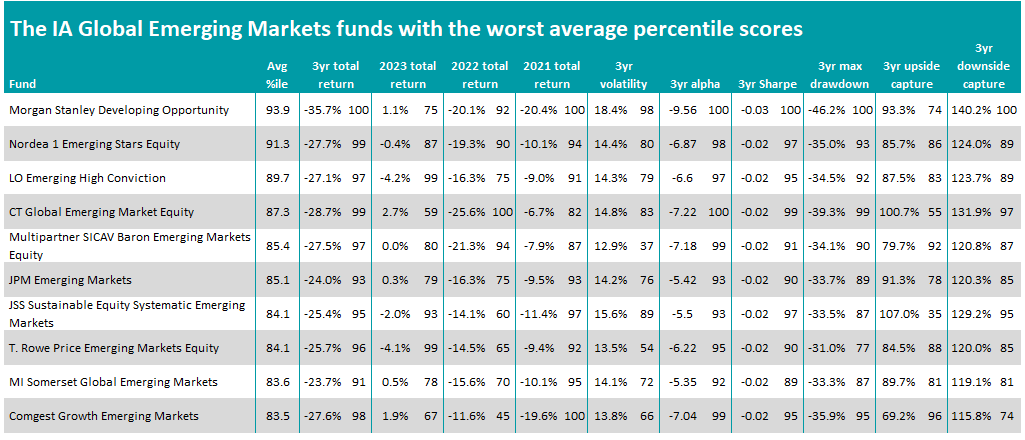

Source: FE Analytics

In contrast – and in keeping with what we have seen in other sectors – the funds with the worst average percentile scores for the past three years are those that follow a growth investing approach, which has suffered as interest rates were hiked to combat soaring inflation.