Rolls Royce had a tremendous year in 2023 and was one of the best performing stocks in the FTSE 100 alongside Marks & Spencer and 3i Group.

The British aerospace and defence company also made a good start to 2024. Its results last month revealed that its return on capital more than doubled in 2023 to 11.3%, reflecting improved operating profit and disciplined capital allocation.

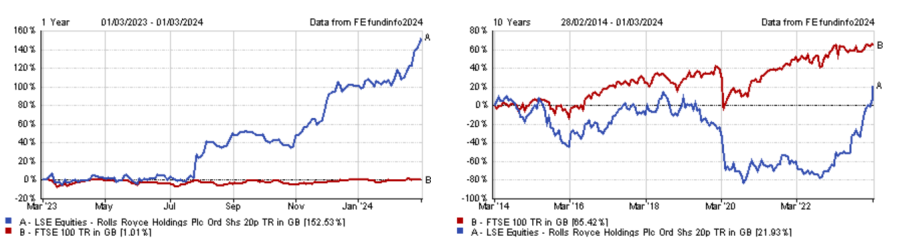

While this outperformance certainly pleased investors, long-term shareholders have had their patience tested during the past 10 years.

In fact, investors who bought their shares in March 2014 were sitting on a loss until last year’s recovery. At the nadir of September 2020, their shares were down 83%.

Performance of stock over 1yr and 10yrs vs FTSE All-Share

Source: FE Analytics

Why did Rolls Royce tank before 2023?

The reasons why Rolls Royce struggled until last year were due to continued evidence of inefficiencies, unnecessary layers of costs and a level of profitability that looked to be far below the firm’s potential, according to Steve Woolley, portfolio manager of Ninety One UK Special Situations.

“This underperformance was then exacerbated by the Covid downturn, which saw flights grounded globally, and hence the main source of the firm’s cashflows drying up,” he explained.

“Peak pessimism towards the stock occurred towards the end of 2020, when the firm was forced to raise equity to strengthening its balance sheet. The shares initially recovered strongly when news of successful Covid vaccines broke a few weeks later, but then gave back most of this recovery over the subsequent two years.”

James Henderson, co-manager of the Henderson Opportunities Trust, Lowland and Law Debenture, also highlighted some issues with the company’s charging model.

“The advantage of selling your engines as cheaply as you can and then making the profits on the servicing is that you hopefully sell a lot more engines, and you build yourself a nice recurring income,” he said.

“But it pushes payback further into the future, and that left Rolls with very low margins, struggling to pay off its debts. The former management were very good at focusing on developing new technology. They were not so sharp on costs.”

What has changed?

A significant catalyst has been the appointment of Tufan Erginbilgic as chief executive officer on 1 January 2023.

After describing Rolls Royce as a “burning platform”, he embarked on a series of aggressive cost-cutting and profit-maximisation initiatives, including scaling back and disposing of non-core businesses, as well as exiting or restructuring low margin and loss-making contracts.

Woolley added: “These efforts were also backed up by markedly increased profitability, both delivered and targeted in the medium term, which led the market to rapidly reappraise the firm’s prospects.”

While Erginbilgic played a significant role in this turnaround story, there were other factors at play.

Richard Hallett, manager of the Marlborough Multi-Cap Growth fund, explained that the post-pandemic recovery has provided a better backdrop for the aerospace industry, which happens to be Rolls Royce’s largest division in terms of earnings.

“More widebody flight hours led to increased revenues, as Rolls bills largely on engine flight hours. The business also saw orders for new engines take off again as airlines ordered new aircraft. Rolls is geared into Airbus and the A350 programme, which is taking share from the Boeing 787,” he explained.

The performance of the defence division has also improved, as Russia’s invasion of Ukraine sadly created a more supportive demand environment for the sector, with several European countries ramping up their defence spending.

However, it should be noted that Rolls Royce does not manufacture weapons, but builds engines for submarine and military aircraft.

Finally, Hallett also pointed to the ‘power systems’ division, which includes “interesting” power generation technology that could be useful in the transition to a low-carbon world.

Can Rolls Royce fly higher?

Hallett is optimistic on the company’s prospects, seeing at least another year of improvement ahead.

He stressed that the management re-organisation is only part way through and there is still room to improve the company’s margin from 11% currently to more than 15% in the next couple of years.

Hallett added: “That should lead to further earnings upgrades, improved credit ratings and, perhaps, the restoration of dividend payments later this year. The key upside is its ability to structurally improve its gross margin in the civil aerospace division.”

Ed Legget, co-manager Artemis UK Select, agrees, saying that Rolls Royce will do well if the management keeps delivering on its targets.

He added: “In our experience, restructuring stories against a backdrop of a strongly growing top line often surprise on the upside. The company’s cash generation means that over the next 12-24 months it will start to look overcapitalised – providing another leg to the story.”

Legget sees a further tailwind in the UK Government’s push to create more energy supply, as it may provide additional funding for Rolls Royce’s small modular reactor.

Henderson hasn’t taken any profits yet and still hold Rolls Royce in Law Debenture and the Henderson Opportunities Trust, as he also believes there is more to come.

He said: “The defence side of the business is material to earnings and with the world becoming a more dangerous place that could be of increasing importance.”

Woolley also still holds Rolls Royce, highlighting that the aircraft engines subsector in which the company operates is effectively a duopoly. Yet, he does not believe the market has yet fully recognised these characteristics.

“Rolls Royce is unique in the UK market in terms of its exposure to, and strength in, the aircraft engine subsector. It’s worth adding that, while our global strategies have the flexibility to invest in a wider range of aerospace names, Rolls Royce is the name in the sector we hold in that strategy too, given its superior profit growth potential and attractive valuation.”

What could cut this recovery story short?

While the managers are confident that Rolls Royce can deliver more, some issues remain that could clip its wings.

Henderson highlighted, for instance, that the easy cost savings have been made. Moreover, the company will need to produce the next-generation aeroengine, which will be capital intensive.

“Planes of the future may be totally revolutionary and the alternative engine fuels at the moment do not seem capable of producing the thrust needed. But the pressure on the industry to reduce carbon emissions is enormous. So this is a big question for the longer term,” he said.

Legget also noted the lack of breadth in the company’s portfolio, saying that the civil business is reliant on a couple of engine programmes such as Trent XWB for the Airbus A350 and Trent 700 for the Airbus A300 Classic.

“If these engines develop an issue then there is not much diversification,” he said.