Investor fears of an artificial intelligence (AI) bubble are greatly exaggerated, according to fund managers, who are unconcerned by the sharp rise in tech over the past year.

Indeed, the release of ChatGPT at the end of 2022 generated strong enthusiasm for artificial intelligence (AI)-related stocks among investors last year.

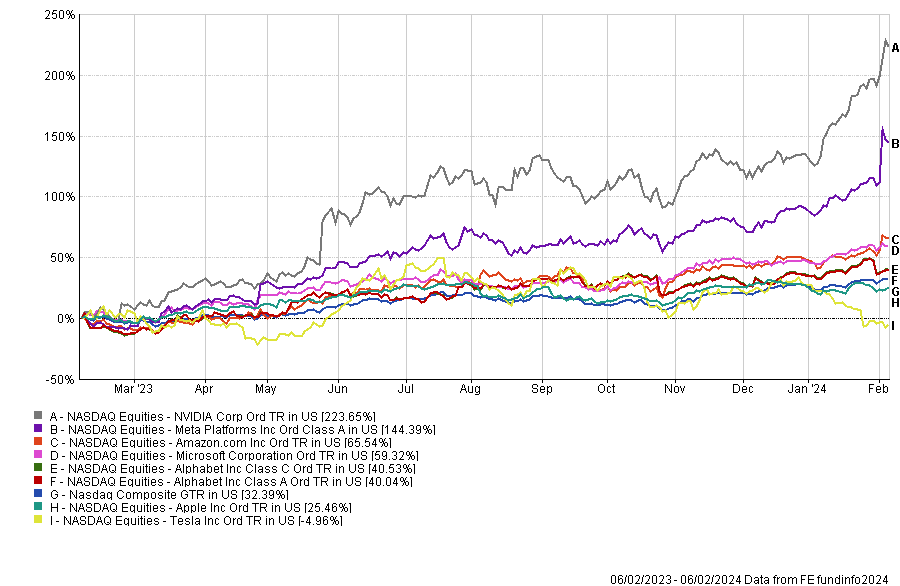

The technology-heavy Nasdaq Composite index returned almost 45% in US dollar terms in 2023, although most of this rally was driven by the ‘Magnificent Seven’ (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla).

Performance of stocks and index over 1yr

Source: FE Analytics

The narrowness of the market and the lofty valuations for AI-related stocks have led to fears we might be in an AI-bubble. As a result, comparisons have been drawn with the ‘Nifty Fifty’ from the 1960s and the dot-com bubble from the late 1990s.

Sajeer Ahmed, investment manager of equities at Aegon Asset Management, said: “Revolutionary new technologies often fuel the emergence of a bubble. In the 1840s, it was railways, and in the late 1990s, it was the internet. The emergence of generative AI over the last year begs the question: are tech stocks in a bubble?”

For FE fundinfo Alpha Manager David Eiswert, who runs the T. Rowe Price Global Focused Growth Equity strategy, the answer to this question is simply: no. Instead, he believes AI is in the initial stages of the infrastructure buildout and likened it to the previous expansion of optical fibre and the follow-on cycle of investment in wireless communications.

He added: “We believe this will continue to be driven by supply constraints and huge levels of demand from companies wishing to build AI applications.”

Georgina Cooper, global equity portfolio manager at Newton Investment Management, does not believe either we are in an AI-bubble. In fact, she sees the potential market size for AI as “significant” and said early signs suggest there are real benefits to businesses and individuals in its adoption.

She stressed, however, that investors need to sort the wheat from the chaff as there will be winners and losers in this space.

Cooper added: “We believe that those best positioned are those with dominant market positions, strong brand franchises and a loyal customer base where the transition to AI adoption is a natural evolution for the business model.”

This is also the view of Zehrid Osmani, manager of the Martin Currie Global Portfolio Trust. While he believes AI represents a “seismic shift” for economies, he warned that some of the AI-exposed names will struggle to monetise on the AI opportunity.

He identified ASML, Nvidia, BE Semiconductors and Microsoft as companies well positioned to be among the winners of this megatrend.

Yet concerns remain. Fuelling these is valuations. While they may look high, Ahmed noted that that the Nasdaq is now trading on a price-to-earnings (P/E) ratio of 27x and an enterprise value (EV) to earnings before interest, tax, depreciation and amortisation (EBITDA) ratio of 16, which is 20% lower than in 2021 for both of those valuation metrics.

He added: “The average three-year earnings per share (EPS) growth forecast for the Magnificent Seven stocks is around 20%. In recent earnings calls, companies have been upgrading their forecasts partly due to AI-related demand.

There has been significant demand growth for Nvidia’s graphics processing units, which power AI models, while Microsoft’s AI-powered Copilot could boost earnings growth if the product takes off, he added. “Therefore, while valuations have become somewhat lofty, they are not completely detached from reality.”

Ben Rogoff, portfolio manager of Polar Capital Technology Trust, highlighted that current valuations are also lower than they were at the time of the dot-com bubble.

He said: “The tech sector traded at nearly 2.3x the market multiple at the peak in 2000, while we’re currently at 1.4x. There's a lot of excitement and there are risks associated with it, but there's no bubble.”

Rogoff also stressed that the internet was not yet as easy to monetise and as broadly applicable in the late 1990s as AI is today.

Moreover, Rogoff believes investors’ interest in internet-related stocks in the late 1990s was not misplaced, but too early. He warned that a risk with AI is that the timeline may disappoint.

He said: “The risk is that we're too early, but the timelines look good so far. Microsoft’s feedback on its Copilot product is very strong. Productivity gains for these technologies look very significant. It’s not a 2% or 3% gain in productivity, but a 50% one when it comes to writing code. That's why we think companies will be able to monetise.”