Leaving things to the last minute is human nature – and when it comes to tax returns hundreds of thousands of taxpayers take it down to the wire.

More than 800,000 taxpayers waited until the last minute to file their returns in 2023, with a staggering 36,000 doing so in the final hour.

Today marks the tax filing deadline. Below AJ Bell's pensions and savings expert Charlene Young gives some tips on getting that submission in before the midnight deadline.

Don't assume you're exempt

Even if you believe you owe nothing, filing a return is still essential. Failure to do so could result in penalties starting at £100, rising to £10 per day after three months.

Filing is mandatory for those earning over £100,000, the self-employed making more than £1,000, those paying Capital Gains Tax or the High Income Child Benefit Charge, and partners in business partnerships.

Young added: “But even if the above don’t apply to you, you might still have to file if you’ve received more than £10,000 from savings and investments in the 2022/23 tax year.”

Gather your paperwork

Ensure you have all necessary documents, including income statements from savings and investments, details of gains made on investments outside ISAs or pensions, and annual summaries from providers.

Young said: "Remember, cash and returns from investments inside ISAs or SIPPs do not need to be declared because growth and income is tax free."

Mind the interest

Tax is payable on interest exceeding the Personal Savings Allowance (£1,000 for basic-rate taxpayers, £500 for higher-rate) and additional rate taxpayers get no exemption, meaning they pay tax on all cash interest they receive.

Rising interest rates have brought more than 1.7 million people into paying tax on their non-ISA cash savings and savers should be prepared for HMRC to compare your declared amounts with information from banks and building societies.

Claim your investment allowances

The dividend tax-free allowance dropped to £1,000 in 2023/24, with tax rates of 8.75%, 33.75%, and 39.35% applying above the allowance depending on income.

Meanwhile, the capital gains allowance stands at £12,300, with CGT payable at 10% or 20% based on income (18% or 28% for residential property gains).

Maximise pension tax relief

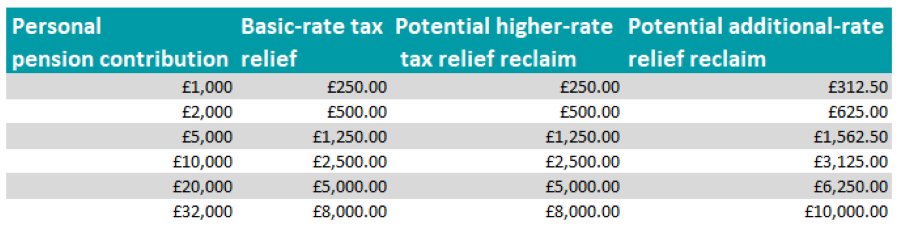

Higher and additional rate taxpayers can claim significant tax relief on pension contributions. Young said: "Anyone paying into a SIPP in the 2022/23 tax year would've received basic rate relief of 20% automatically."

A £2,000 contribution receives a £500 top-up for higher-rate payers and a 25% relief increase for additional-rate payers. With any increase in pension size, the incentive to claim back higher rate relief also rises.

Pension Contribution, tax relief and tax reclaim

Source: AJBELL

This benefit becomes more substantial with larger contributions or backdated claims. Remember, "net pay" schemes automatically receive relief, but those unsure should check if they claim the full amount due.

Beware the child benefit tax trap

This benefit is gradually withdrawn for anyone earning more than £50,000 and completely vanishes at £60,000. While claiming National Insurance credits for non-working partners, any overpaid benefit must be repaid via self-assessment, with potential penalties for non-compliance.

Ensure any outstanding tax is paid by midnight to avoid accruing daily interest and potential further penalties. "If you need to repay some or all of your child benefit payments, and your tax code hasn't been adjusted already to account for it, you'll need to repay via self-assessment, “ Young said.

"Eventually, the taxman will catch up with those who fail to do so, and they may incur an extra penalty as a result.”

Pay your tax

It sounds obvious, but Young's last point can be overlooked, as many feel that simply filing your tax is enough, but you must pay all tax owed by 31 January. Currently, the annual interest rate charged by the HMRC for late tax payments is at 7.75%, the highest since 2008.

Young added: "Any tax for 2022/23 still left unpaid by March could then face an extra 5% penalty charge on top. If you're having difficulty paying, you might be able to agree a payment plan online with HMRC if you owe less than £30,000."