The UK could be “superbly positioned” to take advantage market changes but people have yet to wake up to the opportunities, said Gervais Williams, manager of Premier Miton’s Diverse Income Trust and UK MicroCap Trust.

Catalysts for future returns could be very different to those of the past decade, when low interest rates meant companies could borrow cheaply, while anaemic economic growth caused investors to pay more for stocks that were able to improve their earnings.

US stocks surged while the more value-centric UK market was left behind, but this has reversed in recent years, leading Williams to suggest that the domestic market is “sitting on a gold mine and we just don’t know it”.

“People have very low expectations for the UK, but my assumption is that it will be the best-performing market in the next 10 or 20 years,” he said.

This might sound counterintuitive to UK investors, who keep hearing that the domestic market is dying – with fewer companies deciding to list on the London Stock Exchange and fund managers cutting back on their regional allocations to invest globally instead.

But that’s not the only controversial view Williams holds. It will sound even stranger to hear that he thinks the US market will flatline in the next 20 years due to obsolescence risk.

“Obsolescence risk is key to today’s market. Just look at what happened to Nokia and Vodafone in the dotcom bubble and what is happening today,” he said.

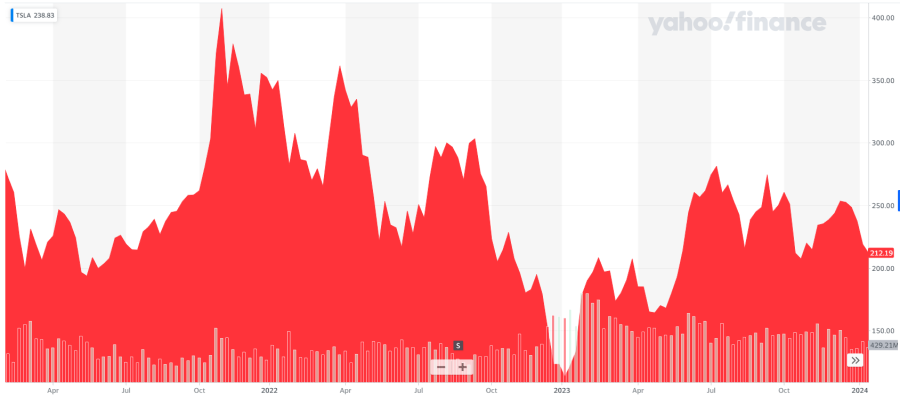

“Today, Apple is facing risks from Chinese competitors, we don’t know if it’s going to be Nvidia or another company that will deliver the chips of the future, and we have already started to see the cracks in Tesla, whose share price has more than halved since its peak in 2021.”

Performance of stock since 2021

Source: Yahoo! Finance

If markets flatline, as the FTSE 100 did for 50 years during the World Wars, indices won’t be our friends anymore going forward, so that’s another thing investors should reconsider, according to the manager, together with correlation risks.

“Thanks to globalisation, we’ve had 20 to 30 years of uncorrelated bonds and equities, which has meant that risk has been relatively benign. In the future, there is going to be much more risk both in terms of total return and correlation,” he predicted.

And here is where the UK comes in.

“The way to resolve these problems is to go back to some old-fashioned strategies such as cash compounding, where the advantage is that it can make money in absolute terms even when the markets aren’t growing,” Williams said.

“Capital-intensive businesses will also come forth, for which the UK is superbly positioned. Insurance, financials, manufacturing, defence and of course the commodity sector, will be exciting again.”

This is because, if inflation persists at a high level due to reshoring, energy costs and higher salaries, companies in these sectors will be able to pass higher costs on to customers through price increases.

Finally, Williams was particularly bullish on small-caps, not just because the age of large-caps is coming to an end, but because fund managers will start realising the opportunities they are missing out on just for technical reasons.

“Some outstanding UK companies are literally too cheap for some managers to just look at them. That shouldn’t be happening. We need to be more open-minded as managers and not restrict ourselves by silly considerations,” said Williams.

“People got lazy. We just need to get out and do the work. There are some excellent managers in the city, who dedicated their lives to their businesses and they are having to give away equity at ridiculously low levels.”