The first Republican Party primary in Iowa has signalled the start of the race to the White House, something investors will be keeping a close eye on in the coming months.

Savers should be closely monitoring policy statements from Republican contenders, according to AJ Bell investment director Russ Mould, particularly with the prospect of a growing presidential rematch between Donald Trump and Joe Biden, a rare prospect not seen since 1956.

He said: "If opinion polls are accurate then America will get its first presidential rematch since 1956. Biden may well welcome that precedent, since that was when Dwight Eisenhower beat Adlai Stevenson for the second time to retain the presidency."

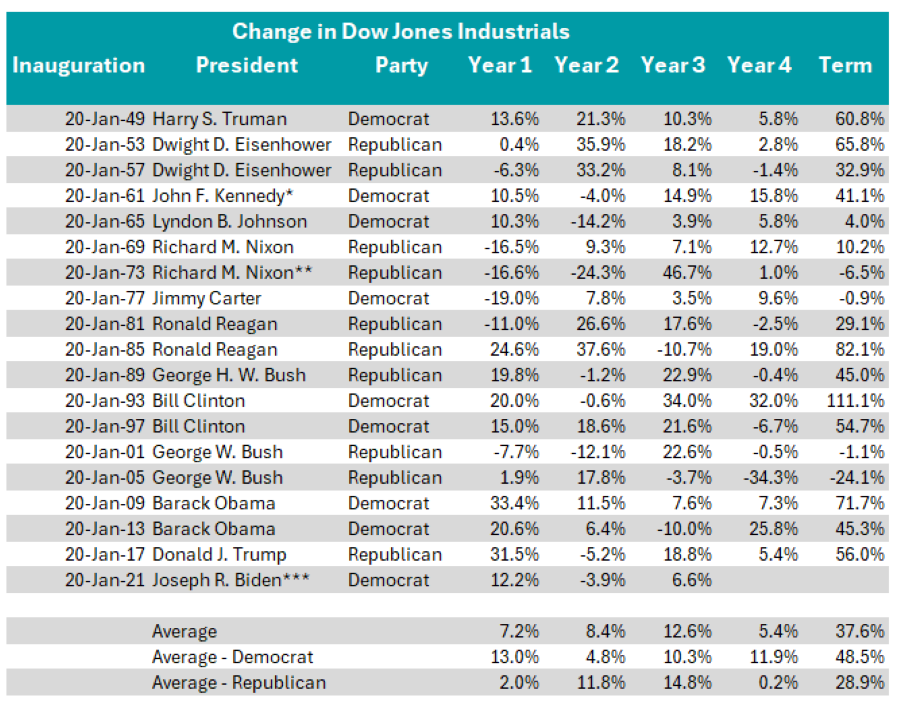

But how will investors fare in an election year? Historical data reveals a pattern in the US stock market experiencing mild turbulence in the final year of a presidency.

Performance of the Dow Jones Industrials index since 1949

Source: Refinitiv

However, the final year of a Democratic presidency historically yields a double-digit percentage capital return, while Republican numbers are impacted by events such as the 2008 financial crisis, which rather “punctured” the party’s figures, Mould said.

Below, he looks at other factors investors may wish to consider when looking at the outcome of the US election later this year.

Macroeconomics and markets

Past elections highlight the connection between macroeconomic conditions and stock market performance.

While the 1940s, 1950s, and early 1960s recessions did not severely impact stock markets, downturns during the Richard Nixon/Gerald Ford years and the 2001 and 2008-09 recessions under George W. Bush did.

Mould suggested that economic booms in the 1950s and 1980s, coupled with post-crisis recoveries, contributed to positive market performance.

He said: “The economic booms of the 1950s and 1980s and the recovery from the 2007-09 bust (helped by Fed largesse) meant the stock market did well under Harry Truman, Dwight Eisenhower, Barack Obama and Trump.”

“But investors must also account for equity valuations, and this may be an even bigger complication than the tattered state of America’s federal finances.

Starting valuations

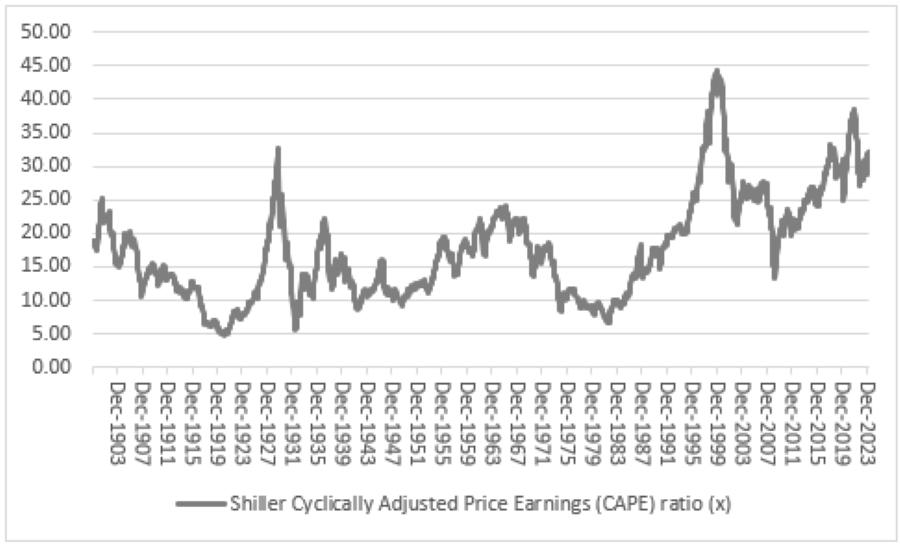

Equity valuations present a complex variable, potentially more challenging than the fiscal state of the US. Using the cyclically adjusted price/earnings (CAPE) ratio, current valuations are near historic highs, raising concerns about the market’s future trajectory.

Shiller cyclically adjusted price earnings ratio since 1903

Source: FRED – St. Louis Federal Reserve database and Congressional Budget Office

Previous instances of low valuations during Truman's, Eisenhower's, and Ronald Reagan's presidencies provided room for upside, unlike the high valuations during the Bush era.

Mould noted: "Bush came to power just as the tech bubble had driven valuations that made even the dizzying (and disastrous) heights of 1929 seem modest.

“In his case, almost the only way was down and, with the Shiller CAPE multiple back near historic highs, the next president and investors could be forgiven for wondering what may come next – especially if the US economy unexpectedly slows right down or even lurches into recession.”

Does it matter who wins this time around?

Working out the winners and losers based on presidential outcomes is rarely a good strategy. Despite initial apprehensions, markets viewed Trump's 2016 victory as an opportunity for growth, with US stocks advancing during his term, even amid challenges like the global pandemic.

Mould noted: “It may not pay to get too caught up in the identity of the winner of either the party races or indeed the presidential election, where the thought of an 81-year-old Biden grappling with the 78-year-old Trump for the second time is prompting independents to consider a run."

Regardless of who wins the upcoming US election there are some major question marks around Federal Reserve policy, and any potential interest rate cuts during 2024

Meanwhile, a $1.7trn budget deficit caused by spending to boost the US economy will also need to be addressed.