Investors sometimes misunderstand the benefits of diversification and that can be costing them between 1.8 and 3 percentage points of performance per annum, a study by Orbis Investment counsellor Rob Perrone showed.

While some concepts of rebalancing are widely understood, other “very impactful practices” can sometimes be missed, for example understanding the impact that different investment styles can have on returns – and this is exactly where the most money can be made or lost.

The problem arises when diversification-seeking investors unknowingly blend funds with similar styles, which does “very little to reduce risk” and results in portfolios that are diversified only in name, explained Perrone.

This is especially true today, as the past decade was “extraordinarily favourable” for the growth style, resulting in investors being highly concentrated in growth within active funds.

But it gets even worse. Three-quarters of funds within the IA Mixed Investment 40-85% sector have a growth bias, and funds in that sector also tend to be highly correlated to the largest fund in that peer group, making it even easier to end up invested in the same thing, despite apparent diversification.

“That’s a big deal because size is a very good proxy for popularity among investors and advisors, and so it's completely plausible that someone's sitting down and thinking to be diversified, but actually their funds might be up to 95% correlated with one another,” Perrone said.

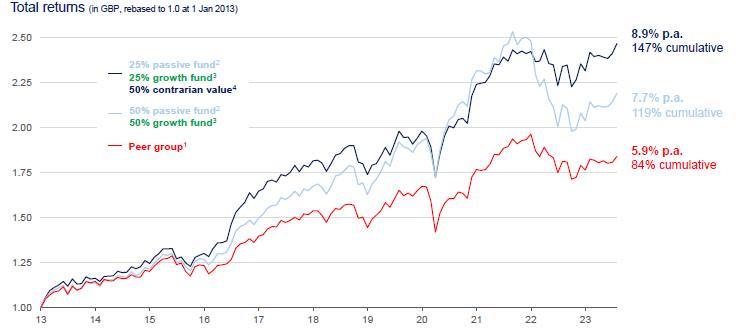

To prove how effective rebalancing between investment styles can be, Perrone looked at the historic return of an equally-weighted blend of the largest passive fund and the largest active fund in the IA Mixed Assets 40-85% sector against the return of a combination of passive (25%), growth (25%) and contrarian value (50%).

The result shows investors balancing with the contrarian fund spurred returns by 28 percentage points in the 10 years between 2013 and 2023, while the average fund in the sector is stuck on much lower figures, as shown in the chart below.

Blending funds with different styles enhanced returns

Source: Refinitiv, Orbis

“You might expect, given how well the growth style did over the past decade, that adding a value-focused vehicle would dilute your returns, but in fact it didn't, it actually enhanced long-term returns. The diversification benefit is really substantial,” said Perrone.

“Different styles come in or out of favour, and as you're rebalancing, you're taking advantage of that. Also, a significant part of an investment manager’s returns is driven by company-specific forces, it’s not just a case of tilting towards one factor or another. The combination of those two things means that blending value in with passive and growth actually enhances your returns.”

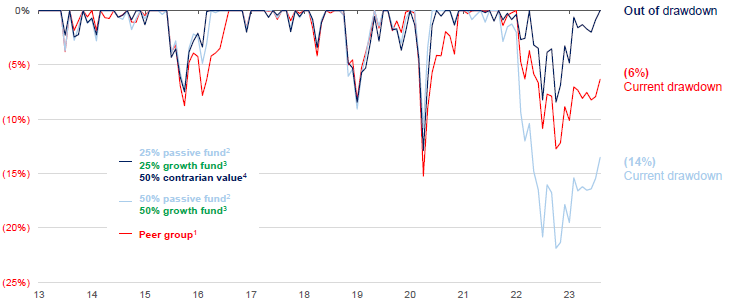

Not only that, it also reduces risk and maximum drawdowns, Perrone showed in the graph below.

Blending funds with different styles reduced risk

Source: Refinitiv, Orbis

Why now?

Rebalancing will be key in 2024, as the tech-heavy Nasdaq index, Latin America- and India-based investments returned 46.4%, 26.2% and 14% respectively last year, and most investors will understand that now it might be a good time to trim back on those exposures.

This is the most commonly understood side to rebalancing and what FundCalibre managing director Darius McDermott suggested to do in 2024. He said that now might be the right time to rebalance portfolios and take profit from the asset classes that have outperformed in the past 12 months, as “the winners in one year will often underperform in the subsequent period”.

Performance of indices in 2023

Source: FE Analytics

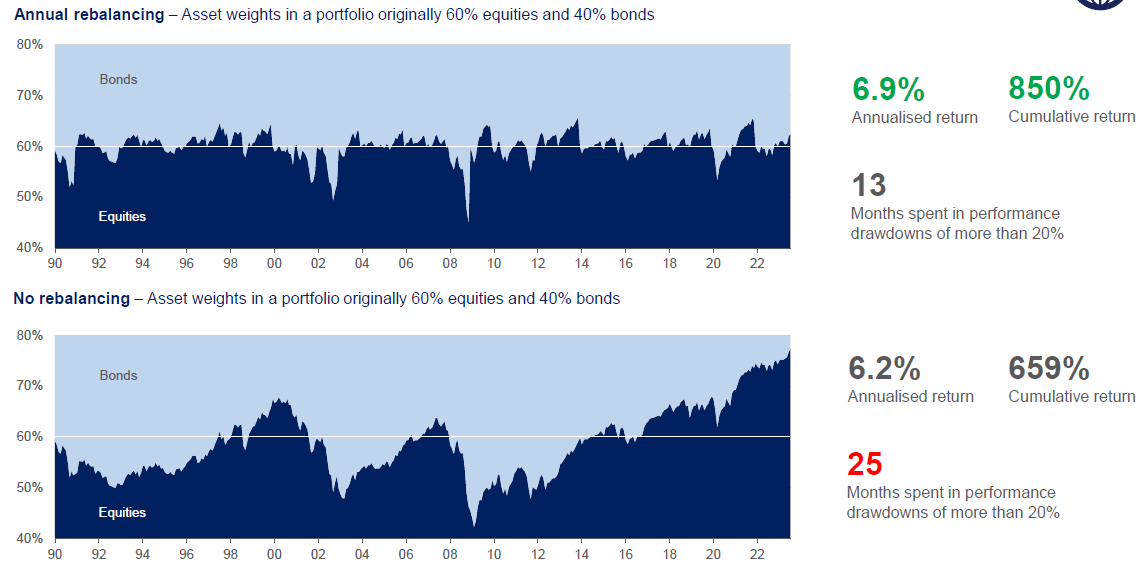

Rebalancing in this case allows people to sell assets as they become expensive and to buy back up into market declines, which is “usually a pretty good idea that enhances returns,” said Perrone.

“Investors who do not do this, will end up with underlying exposures and risk levels all over the place, and worse than that, it's not just variable over time, it's procyclical. And so they end up with their highest allocation at the top of market bubbles (the last time you want to be overweight) and their lowest allocation just after market crashes, which are very often pretty good buying opportunities.”

To illustrate this, he used the annualised return of the MSCI World Index as a proxy for equities and that of the JPMorgan Global Government Bond index as a proxy for bonds. Forgetting to rebalance cost investors 0.7 percentage points per year, as shown in the chart below.

Rebalancing between asset classes

Source: Refinitiv, Orbis

The solution

The key takeaways for Perrone were to diversify by getting active, getting away from the crowd by adding something different and looking at one’s portfolio through the following lens: if everything is working at the same time, diversification is lacking.

“It's healthier to have some things in your portfolio that aren’t working at the moment. Going through periods of looking stupid compared to the other things that you own is a sign that you have diversification,” he said.

“And so we would encourage investors to ask themselves not only 'how many different houses do I have represented?’, but also ‘are these bringing something fundamentally different to the portfolio?’, ‘are the underlying holdings meaningfully different?’ and 'Do the returns of the funds behave in a meaningfully different way?’,” he concluded.